It is easy to forget – because the case rumbles on in foreign courtrooms – the danger posed to the Federal Government of Nigeria (FGN) by the award against it of US$6.6bn in favour of the engineering firm Process & Industrial Developments (P&ID). With accrued interest the award has ballooned to some US$10.0bn and, if enforced internationally, could lead to the freezing of FGN assets. Fortunately, Nigeria won the right to present new evidence in an unusual judgement in the High Court in London last week. See details below…

FX

In the parallel market last week the Naira appreciated against the US dollar as the Central Bank of Nigeria (CBN) resumed sales of FX to Bureaux de Change (BDC) operators. FX rates in the parallel market rate opened the week at N477/US$1 and closed at N440/US$1. The extent of Naira appreciation depends on how many US dollars the CBN is willing to sell and how well it can monitor the BDC’s own rates to prevent arbitrage, in our view. While the sales of FX to the parallel market is alleviating the pressure in the FX market, the statistics from trade balances for Q2 2020 paints a different story. Nigeria reported a trade deficit of 1.8tn (US$4.74bn) in Q2 2020, the worst in a decade, primarily due to weak oil production and prices. We think the renewed supply of FX to BDCs may fail to catalyze a full reversion to exchange rate unification across the various windows.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 10 basis points (bps) to 8.90%, and at 3 years increased by 20bps to 5.49%. The annualised yield on 356-day T-bill decreased by 9bps to 3.09% while the yield of a CBN Open Market Operation (OMO) bill with similar tenure decreased by 55bps to 3.19%. At the OMO auction last week, the CBN offered bills worth N100.00bn (US263.2m), across different maturities: N10.00bn of the 82-day; N10.00bn of the 180-day and N80.00bn of the 355-day. We expect market activity to shift to the T-bill segment this week as the Debt Management Office (DMO) will be offering N128.06bn (US$128.0m) worth of instrument. We expect continued strength in demand.

Oil

The price of Brent crude decreased by 5.31% last week to US$42.66/bbl. The average price, year-to-date, is US$42.65/bbl, 33.55% lower than the average of US$64.20/bbl in 2019. Last week, oil prices declined after Saudi Arabia made the deepest monthly price cuts for its Arab Light crude, for sales to Asia in the month of October, by US$1.40/bbl. Optimism about global demand recovery has cooled amid coronavirus outbreaks. We see US$40.00/bbl as a support level and oil to be range-bound between there and US$46.oo/bbl for several weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) gained 1.17% last week. The year-to-date return is negative 4.61%. Last week Mobil (+10.00%), Nigerian Breweries (+8.11%), Fidelity Bank (+5.68%), Stanbic IBTC (+5.41%) and GT Bank (+4.53%) closed positive, while Oando (-4.26%), PZ Cussons (-2.38%), International Breweries (-1.35%), and Dangote Cement (-0.15%) closed negative. See Model Equity Portfolio below.

Progress for Nigeria in the P&ID case

Last week a judge in the High Court in London allowed Nigeria time in which to substantiate its case against Process & Industrial Developments (P&ID). P&ID had earlier (January 2017) won an arbitral award against Nigeria for US$6.6bn. Prior to last week, P&ID’s case had been upheld several times, on issues such as place of jurisdiction and enforceability. And, with interest accruing, the sum had grown to around US$10.0bn. The case relates to a gas supply contract (GSPA) between P&ID and the Ministry of Petroleum Resources signed in 2010.

This is a very different judgement to what has gone before. It involves examining the actual liability of Nigeria, i.e. whether the Federal Republic of Nigeria is at fault or not. Unlike previous court cases, the judge delved into what had taken place in Nigeria, for example: how the contract was awarded; P&ID’s ability to finance the project; the way in which counsel for Nigeria later recommended that Nigeria should settle rather than contest P&ID’s case. The judge stated (paragraph 196 of the judgement): “In my view, there is a strong prima facie case that the GSPA was procured by bribery.”

P&ID has argued that an unreasonable length of time has elapsed between the arbitral award in 2017 (also in London) and that for arbitral awards to be meaningful they must be enforced in good time. P&ID also argued that Nigeria had missed several opportunities to present evidence in court, which nullified its right to present evidence of misconduct at a later date. Against this, the judge ruled that during previous arbitration Nigeria “did not know and could not with reasonable diligence have discovered the grounds it now advances” (paragraph 223). In other words, the judge thinks that Nigeria was poorly advised but now has new evidence to present.

In March 2019 it was reported (by Bloomberg) that a subsidiary of VR Capital Group had bought 25% of P&ID, thereby taking a stake in its claim against Nigeria. VR Capital Group is a hedge fund which specialises in distressed sovereign debt and has recorded successes in Russia (1998), Argentina (2001) and Ukraine (2004), among other instances. We reported on this investment in Coronation Research, P&ID’s risk to Nigeria, 14 March 2019, and argued that the involvement of VR Capital Group would add resources to its legal case, given the hedge fund’s track record. Clearly, last week’s judgement represents a setback.

And it represents progress for Nigeria’s Attorney General and Minister of Justice Abubakar Malami who decided to contest the case, despite the significant period of time that had elapsed since the award. However, it does not represent victory. Although last week’s judgement contains many opinions that are helpful to Nigeria’s cause, the judgement itself is about whether Nigeria may be allowed more time to present its case, the final paragraph (274) concluding with the words: “For the reasons given, I grant Nigeria’s application for an extension of time and relief from sanctions.” There will be many legal battles to come.

Model Equity Portfolio

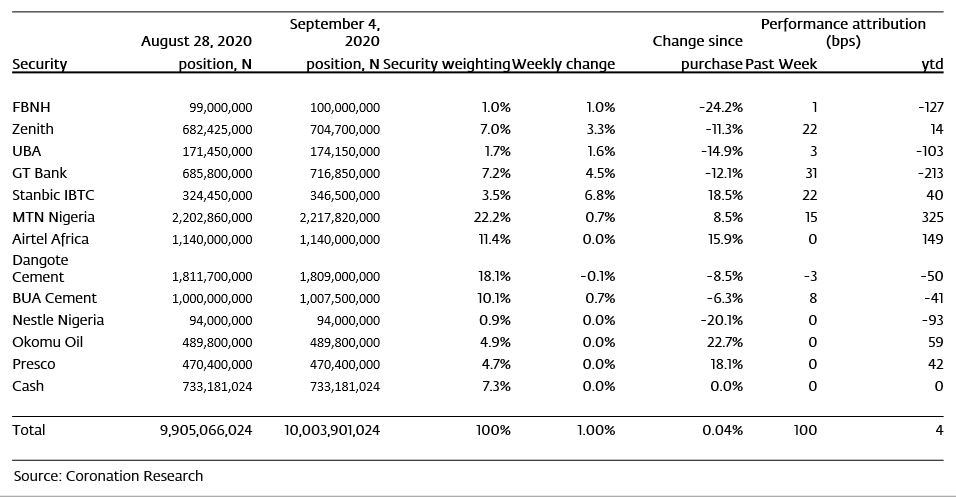

Last week the Model Equity Portfolio rose by 1.00%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.17%, therefore underperforming it by 17 basis points. Year-to-date it has gained 0.04%, against a loss of 4.61% in the NSE-ASI, outperforming it by 465bps.

Last week we wrote: “We do not set ourselves the task of predicting which way the market will go from month to month, still less from week to week.” This is just as well, as we were nervous about the market last week and if we had taken notional positions off the table then we would have underperformed by a bigger margin than we did. As it was, we sneaked into the first positive year-to-date return of the year – up 0.04%.

What has happened, in our view, is that market has stabilised and is reacting to normal occurrences, such as the good bank earnings that were reported last week, as opposed to exceptional occurrences such as the COVID-19-related lockdown and wild swings in commodity prices. We are no longer inclined to scale down our notional exposure to equities.

Model Equity Portfolio for the week ending 4 September 2020

For the fourth week in a row, we had a consumer-related stock, in this case, Nigerian Breweries, rallying a lot when we are position is to have very few of these stocks. As we have stated before, we are not minded to chase such rallies.

Also last week, we wrote that: “We are casting around for new themes to carry us into September and will report back.” We have not done that yet. One point worth making is that our position in banks does not really reflect how much we like them. For example, Stanbic IBTC is one of the few banks in which we have a notional position, but it is only close to its weight in the index. So we are not really benefitting enough from it. On the other hand, we only have 7.3% in notional cash, so we must find some way of streamlining the portfolio and concentrating on the stocks we really like.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.