The past three weeks have seen an unusual number of macroeconomic changes. The Central Bank of Nigeria (CBN) announced plans to clear the backlog of foreign currency demands and began supplying US dollars to the Bureaux de Change (BDC). Nigeria won an important High Court case in London. And oil prices fell. However, we don’t believe that Nigeria’s policy mix (low-interest rates combined withholding the currency) will change any time soon. Read below for the reasons why.

FX

The Naira weakened against the US dollar last week in the parallel market, closing at N455/US$1 from N440/US$1 a week earlier. The effect of sales of FX to Bureaux de Change (BDC) operators by the CBN appears to be short-lived. Although the CBN determines the sales price for the US dollar to BDC operators and the margin they are allowed to sell, other factors are at play, notably: the trade deficit, the backlog of US dollar demand and oil prices play. In the NAFEX market, the Naira remained stable around N386/US$1.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity increased by 10 basis points (bps) to 9.00%, and at 3 years decreased by 163bps to 3.86%. The annualised yield on 356-day T-bill decreased by 53bps to 2.56% while the yield of a CBN Open Market Operation (OMO) bill with similar tenure decreased by 28bps to 2.91%. At the T-bill auction last week, the Debt Management Office (DMO) offered bills worth N128.06bn (US$128.0m), across different maturities: N4.41bn of the 91-day; N14.00bn of the 182-day and N109.65bn of the 364-day T-bills. This week, we expect market activities to be influenced by strong market liquidity as a total of N658.40bn (US$1.73bn) is due to come into the system: N350bn from OMO maturities and N308.40bn from T-bill maturities.

Oil

The price of Brent crude decreased by 6.63% last week to US$39.83/bbl. The average price, year-to-date, is US$42.60/bbl, 33.65% lower than the average of US$64.20/bbl in 2019. Last week, oil prices slipped below US$40/bbl for the first time since mid-June. The unprecedented decline is coming barely a month after Organisation of Petroleum Exporting Countries (OPEC) tapered production cuts from 9.7mbpd to 7.7mbpd, while it appears that global demand for oil is still weak and may not return to pre-COVID-19 era until the end of the year.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 0.05% last week. The year-to-date return is negative 4.66%. Last week Lafarge Africa (+6.67%), Oando (+6.67%), Stanbic IBTC (+5.26%), Access Bank (+4.65%) and PZ Cussons (+3.66%) closed positive, while Ardova Oil (-9.92%), Guinness Nigeria (-6.57%), GT Bank (-5.84%), Fidelity Bank (-5.38%) and International Breweries (-4.11%) closed negative. See Model Equity Portfolio below.

The policy mix and the markets

A few weeks ago the Central Bank of Nigeria (CBN) announced that it would sell US dollars to the country’s Bureaux de Change (BDC). This looked like a generous move by the CBN, and the parallel market duly reacted by taking its offer price for US dollars down from N477/US$1 to N435/US$1 in a matter of days (it has since moved back up to N455/US$1).

At the same time, the CBN announced that it would clear a backlog of demand in the foreign exchange markets, where individuals and companies bid for US dollars at around N389.6/US$1 in the NAFEX market (also known as the I&E Window, and the rate quoted by Bloomberg). Our interpretation of CBN policy is that it is attempting to unify the NAFEX and the parallel rates by lowering the parallel rate (rather than by devaluing), and it is pacifying foreign portfolio investors in Nigeria.

Then two things happened, one good, one bad. As we wrote last week, the High Court in London granted Nigeria more time to prepare its case in its ongoing legal battle with the British Virgin Islands-registered engineering company Process & Industrial Developments (P&ID). If this judgement holds then it could mark a change in fortunes for the Federal Government of Nigeria in its battle over this approximately US$10.0bn claim.

And oil prices fell. The price of Brent, which had been trending in a narrow range between US$40.00/bbl and US$46.0/bbl, fell from US$45.28/bbl at the end of August to US$39.83/bbl last Friday. We must remember that this is only a short-term move (likely due to the tapering of OPEC production cuts) and could be reversed. However, it makes the prospect of oil prices over US$50.00/bbl appear more remote than before. Our long-held view is that Nigeria’s public finances work best when oil prices are above US$50.00/bbl.

Does this herald a change in the policy mix? We doubt it. Neither of the CBN’s recent initiatives point to a change in foreign exchange policy: in fact, they reinforce it. The drop in oil prices might disappoint the CBN but it does not change its strategy. It wants low market interest rates to stimulate the economy (which also lowers the cost of issuing FGN T-bills and bonds). And it wants to hold the currency where it is.

Model Equity Portfolio

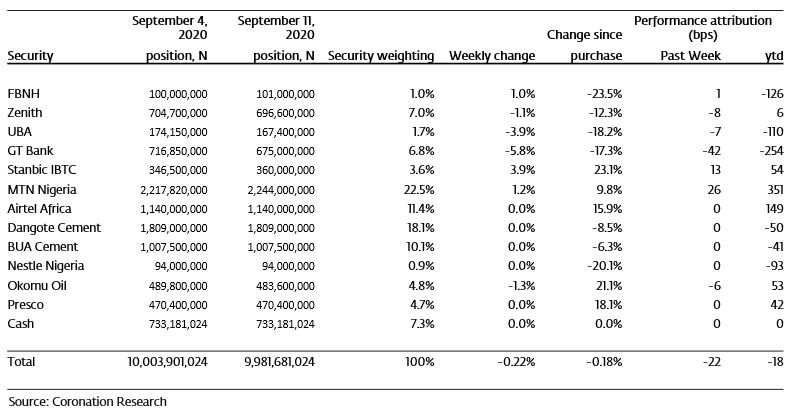

Last week the Model Equity Portfolio declined by 0.22%, compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.05%, therefore underperforming it by 17 basis points. Year-to-date it has lost 0.18%, against a loss of 4.66% in the NSE-ASI, outperforming it by 447bps.

Our underperformance was caused by our increased notional holdings of bank stocks (19.4% of the portfolio). We increased our holdings last month to position the portfolio for potential upside when their H1 2020 results are released. While we were aware that the results may be far from impressive because of reduced business activities during the period, we thought a selected few will report some good numbers and declare dividend.

Model Equity Portfolio for the week ending 11 September 2020

Although this was the case, the stocks sold off rather quickly as investors took profits. We are not worried about the banking stocks as we think the stocks may rally as it approaches ex-dividend date.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.