Nigeria’s public finances work well when oil prices are above US$50.00/bbl (better still, above US$60.00/bbl). Though prices are trending in that direction the prospect the Democratic Party winning November’s presidential election puts a question mark over the trend next year. And the Organization of the Petroleum Exporting Countries (OPEC) insists on Nigeria cutting its production as prices rise. Nigeria’s reliance on oil is under the spotlight again. See details below…

FX

Last week the FX reserves of the Central Bank of Nigeria (CBN) increased by 0.2% week-on-week to close at US$35.66bn, the first accretion since May. On the other hand, the overall trend in the CBN’s reserves has been a gentle downwards slope from US$36.67bn reached the beginning of June. This is consistent with a policy of maintaining reserves, as much as possible, while not supplying as many US dollars to the NAFEX market (where the Naira closed at N385.76/US$1 last week) as it did before March. The CBN announced that it will resume selling US dollar to Bureaux de Change (BDC) on 31 August at the official rate in an attempt to influence the parallel market exchange rate, which closed at N477/US$1 last week. In our view, the success of this move will depend on how many US dollars the CBN is willing to sell and how well it can monitor the BDC’s own rates to prevent arbitrage.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity increased by 24 basis points (bps) to 9.00%, and at 3 years decreased by 34bps to 5.29%. The annualised yield on 363-day T-bill increased by 84bps to 3.18% while the yield of a CBN Open Market Operation (OMO) bill with similar tenure decreased by 47bps to 3.74%. At the primary market auction last week, the Debt Management Office (DMO) rolled over maturing T-bill worth N197.60bn (US$513.2m) across different maturities – N20.37 billion for the 91-day, N55.85 billion for the 182-day and N121.38 billion for the 365-day T-bills. Despite the rises in rates last week, our sense is that high inflows of liquidity due in September will keep market interest rates trending downwards.

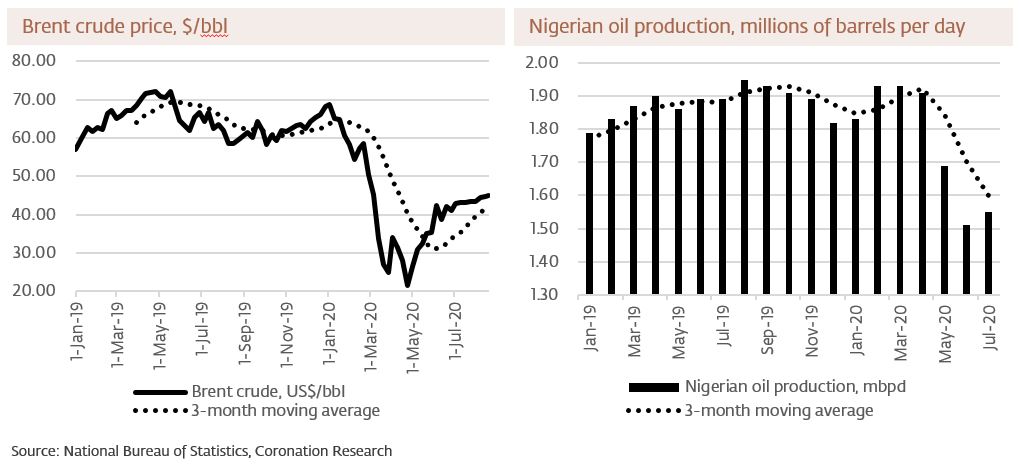

Oil

The price of Brent crude increase by 1.58% last week to US$45.05/bbl. The average price, year-to-date, is US$42.60/bbl, 33.63% lower than the average of US$64.20/bbl in 2019. Last week, the increase in oil prices was caused by a mix of factors: first, a reduction in oil supply due to hurricane Laura which caused US oil producers to shut down some of their facilities; second, demand for crude oil as more COVID-19 restrictions are lifted around the world. We see oil prices trending gently upwards from here.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) gained 0.35% last week. The year-to-date return is negative 5.71%. Last week PZ Cussons (+9.09%), Unilever Nigeria (+7.53%), FCMB Group (+5.91%), Stanbic IBTC (+4.49%) and International Breweries (+2.78%) closed positive, while Guinness Nigeria (-6.91%), Presco (-3.92%), UBA (-3.79%), Fidelity Bank(-3.22%) and Access Bank (-1.54%) closed negative. See Model Equity Portfolio below.

Nigeria’s oil revenue paradox

The presidency of Donald Trump has seen US oil production rise from 8.8 million barrels per day (mbpd) in January 2017 to a peak of 13.1mbpd in March of this year, before slumping to 10.8mbpd in August. If Joe Biden becomes President of the United States in January 2021 America’s policy towards oil is likely to change. Mr. Biden wishes to become a green president, and intends to re-sign America to the Paris Climate Agreement and to put her on track to be carbon emissions net-zero by 2050.

Although none of these policies would have an immediate impact on oil prices Mr. Biden also intends to sign a nuclear deal with Iran, which could enable the country to vastly increase its oil exports. Under the US sanctions Iranian oil production has fallen from an average 3.8mbpd in 2017 to 2.0mbpd so far in 2020. A change of 1.8mbpd is significant in the scheme of global production and supply (which was roughly 100.0mbpd at the beginning of this year). So, a Biden presidency could bring about downward pressure on oil prices next year.

What about the near-term, i.e. from now until the end of the year? It was clear, in early March, that OPEC and Russia (known as OPEC+) wanted to crash oil prices in order to drive out of business part of US shale production. However, by mid-April, OPEC+ had agreed to production cuts in order to stop oil prices becoming too low for their liking. Nigeria, as an OPEC member, was due to take its share of the cuts, too.

At the end of July Nigeria’s quota was set at 1.4mbpd, compared with production that had recently peaked at 1.9mbpd. In other words, Nigeria is being asked to forgo up to 26% of its production, significant for an economy in which (in good times) oil supplies 90% of its exports and around 60% of government revenues. This brings a fresh perspective to recent gains in oil prices. Although prices (Brent) are sharply up from the low level (of US$19.33/bbl) reached in April, the rate of the climb since the end of June (when it closed at US$41.15/bbl) has been slow, reaching US$45.05/bbl at the end of last week.

We would not argue with a forecast that puts oil trading at around US$50.00/bbl by the middle of Q4 2020. In the past, we have seen how this price level positively affects international investors’ appetite for Nigerian assets, by which we mean Eurobonds, the open market operation (OMO) bills of the CBN and Naira-denominated bills and bonds issued by the Federal Government as well as by the private sector. However, Nigeria needs both a firm oil price and high levels of production, and this combination may remain elusive for a while.

Model Equity Portfolio

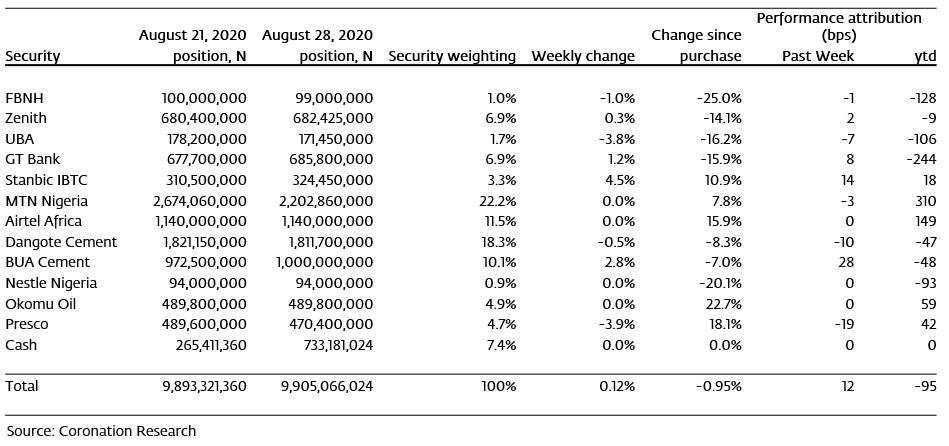

Last week the Model Equity Portfolio rose by 0.12%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.35%, therefore underperforming it by 23 basis points. Year-to-date it has lost 0.95%, against a loss of 5.71% in the NSE-ASI, outperforming it by 476bps.

For the third week in a row, we have found consumer-facing industrials and brewers rallying: we do not like these stocks and do not hold them. Some of these are not very liquid, so a little buying can make their prices move a lot. Last week (as featured on page 1) it was the turn of PZ Cussons Nigeria, Unilever Nigeria and International Breweries to rally. We are not tempted to chase them.

On the other hand, it does make us think again about the direction of the market. If investors are focusing on the stocks with low index weights, then this implies relatively less interest in the large stocks in which – for the most part – the Model Equity Portfolio is concentrated. Our concern is that, once investors are done with the stocks with low index weights, they may want to take profits from the market as a whole. And our model portfolio is highly exposed to the market as a whole.

Model Equity Portfolio for the week ending 28 August 2020

We do not set ourselves the task of predicting which way the market will go from month to month, still less from week to week. We make notional purchases of stocks which we like, and we time these purchases when valuations are below their long-term historical averages. We also buy themes such as currency depreciation (hence our positions in Okomu Oil and Presco which produce commodities with US dollar-related prices). And we aim to outperform the market over time.

Our point is that, overall, our strategy is working out, and therefore it is important not to change it, even when we see stocks which we do not like rallying. We need to be patient, but not stubborn. If the market show signs of cracking then we are prepared to take bets off the table (and, as ever, we will warn our readers in advance of making notional trades). We are casting around for new themes to carry us into September and will report back.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.