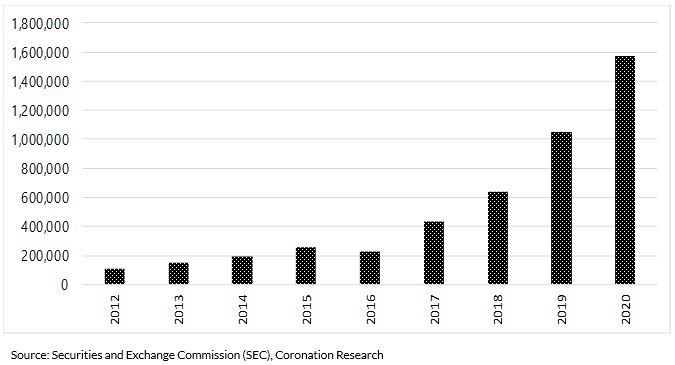

Tomorrow we publish our report on the Mutual Fund (Collective Investment Scheme) industry. The total assets under management (AUM) of Nigeria’s Mutual Funds grew by 50% last year to N1.6 trillion. Yet we have found that it is difficult, not to say impossible, to get comparable performance data for the unit prices (UP) of Fixed Income Funds. Surely, this needs to be resolved? Read below for details and read our report tomorrow for the full story.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.08% to close at N410.33/US$1. In the parallel (or street) market, the Naira strengthened by 0.41% to close at N483.00/US$1. The Central Bank of Nigeria’s (CBN) FX reserves fell to US$34.73bn, a loss of 0.42% on the week. In line with our stated expectation, the CBN, on Wednesday, extended its Naira 4 Dollar scheme indefinitely. The CBN did not give reasons for the extension and has not released new data on remittance flows. However, we believe the policy may have started to bear fruit. Nonetheless, persisting FX illiquidity in the NAFEX and I&E Windows, and the parallel market rate’s weakness still suggest that pressure on the I&E rate is likely to continue, in our view.

Bonds & T-bills

Last week, bearish sentiment persisted in the bond market as the secondary market yield for an FGN Naira-denominated bond with 10 years to maturity rose by 65bps to 13.31%, the yield on the 7-year bond rose by 67bps to 13.10%, while the yield on a 3-year bond rose by 110bps to 12.06%.

The annualized yield on a 328-day T-bill in the secondary market fell by 1bp to 8.04%, while the yield on a 312-day OMO bill fell by 28bps to 9.90%. At the close of the week, the average benchmark yield for T-bills rose by 12bps to close at 4.86%, while OMO bill yields rose by 48bps week-on-week, on average, to close at 8.39%. The Treasury Bills market remained bearish due to persisting tight system liquidity.

We expect the CBN to hold an open market operation (OMO) auction given the OMO maturity of ₦90bn (US$220m) this week. The Debt Management Office (DMO) is scheduled to offer ₦117.6 billion at the Treasury Bill (T-bill) primary market auction (PMA) this week. Amidst tight system liquidity, we expect yields to close higher than two weeks ago, with the annualised yield for 364-day paper likely to surpass 11.00% (it was 10.80% at the last PMA on 28 April, with a stop rate of 9.75%).

Oil

The price of Brent crude rose by 1.53% last week, closing at US$68.28/bbl, meaning a 31.81% increase year-to-date. The average price year-to-date is US$62.67/bbl, 45.00% higher than the average of US$43.22/bbl in 2020. Oil prices rose after a cyber attack shut down a US pipeline operator that supplies oil to the east coast of the US. The disruption comes as the accelerating COVID-19 vaccine rollout improves the demand outlook. However, we note that fresh outbreaks of the virus have led to extensions of restrictive measures in some countries. India, in particular, continues to deal with a deadly second wave of the virus, which has led to lockdowns in its major cities and led to a US$39.5bn reduction in oil imports in April.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 1.60% last week, bringing the year-to-date loss to -2.66%. Access Bank +11.64%, Seplat +8.77%, Cadbury Nigeria +7.69%, and BUA Cement +7.15% closed positive last week, while MTN Nigeria -7.38%, Lafarge Africa -7.22%, and Stanbic IBTC -6.00% closed negative. Across sectors, performance was mixed as the NSE Oil and Gas index led the gainers for the week with +5.98%, followed by the NSE Consumer Goods +0.62% and NSE Banking +0.62% indices, while the NSE Insurance -2.20%, NSE-30 -1.94%, and NSE-Industrial Goods -1.60% indices closed negative.

It is worthy of note that 11 Plc (formerly Mobil Plc) has been voluntarily delisted from the NSE and is now listed on the National Association of Securities Dealers (NASD) OTC market where its shares will still be tradable. Following the end of the Q1 2021 earnings season, we expect market activity to remain quiet in the absence of catalysts. Investors are expected to continue to watch yield movements in the fixed income space and this is likely to affect their appetite for equities, in our view.

Comparing Mutual Funds: Apples and Oranges

The Mutual Fund industry in Nigeria is growing fast. The total assets of the Mutual Fund industry in Nigeria grew by 50% in 2020, to Naira 1.6 trillion. Yet this is only 14% of the size of the much larger Pension Fund industry. So, it needs to keep growing to become a financial force. What is the experience of an ordinary investor trying to buy into a Mutual Fund?

We went through the experience of an ordinary investor looking to buy units in a Fixed Income fund. We compared the reported Unit Price (UP) performance of 17 different Fixed Income funds operating throughout 2020, even though past performance is not necessarily a guide to future performance. We found that the Unit Price data, which is supplied by the Funds/Fund Managers themselves, is not comparable. Differences in reported performance are too large to be explained by differences in underlying performance in 2020 (2020 was a very good year for FGN bond prices). Instead, the differences come from the fact that funds report Unit Prices in different ways.

We gathered fund factsheets, held phone calls with sales staff, visited offices, and then examined how funds report their investments from their factsheets and from prospectuses (where these were supplied). We found two kinds of different reporting. Some funds use Mark-to-Market Accounting, meaning they report the market price of the bonds which they hold. This can mean that Unit Prices (UP) are volatile when interest rates change, and bond prices rise and fall. This happened in 2020 and is happening in 2021. Other funds use Amortised Cost Accounting, which smoothes out the price performance of a fund. Some use a mixture.

A third issue is the Guarantee. Some funds guarantee their investors a return (they even have it in their name). This means that they may seek to avoid Mark-to-Market Accounting because Mark-to-Market Accounting introduces volatility in Unit Prices (UP), and volatility looks like risk. However, the fact is that market risk exists anyway, no matter how you account for it.

Total Assets Under Management of Nigerian Mutual Funds, Naira millions

If Nigerian funds want to play in the international leagues, they need to adopt Global Investment Performance Standards (GIPS). Very few Nigerian fund managers apply GIPS at the moment and Mark-to-Market Accounting is one of the cornerstones of GIPS.

Global investors have access to data on thousands of funds across the world, and thanks to the adoption of GIPS, the data is comparable. And it is free. Anyone can use the Morningstar and Financial Times websites to compare thousands of funds.

The first step is to harmonise reporting among Nigeria’s Mutual Funds. GIPS has to be a long-term goal because introducing GIPS is expensive and takes time to enforce. Harmonising the reporting of Nigeria’s Mutual Funds is a necessary step to creating comparable UP data and helping the industry to achieve its potential.

Model Equity Portfolio

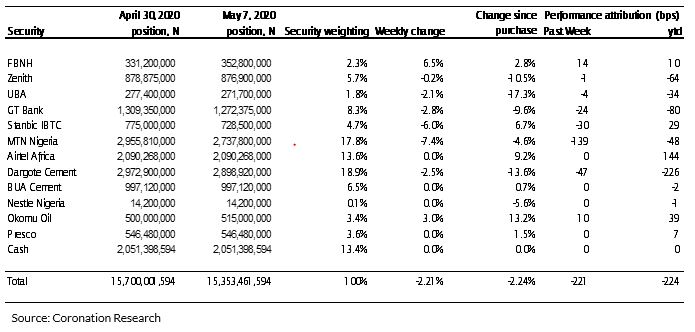

Last week the Model Equity Portfolio fell by 2.21% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.61%, therefore underperforming it by 60 basis points. Year to date it has lost 2.24% against a loss in the NSE-ASI of 2.66%, outperforming it by 42bps. Such underperformance in a week (albeit a short week of four trading days) ranks as one of our worst, and is a concern.

Model Equity Portfolio for the week ending 7 May 2021

To be brief, our notional overweight in the bank sector (a notional 22.8% position against an index weight of 16.7%) cost us 44bps last week. This would have been worse – the notional banks position would have lost 58bps – were it not for our 2.3% notional position in FBNH which earned us 14bps. At least we made a little notional return by not turning against the stock over its recently-reported corporate governance issues, believing instead that identifying and sorting our corporate governance issues is a positive step.

However, there were bigger forces at work. We do not have a notional position in oil producer Seplat, which is an error, given that the stock is rebounding and is a clear beneficiary from strong oil prices. Seplat rose 8.8% last week and it is 1.8% of the NSE-ASI, so we missed 14bps of performance.

There were mark-downs for dividends and the week was a short trading week after the holiday on Monday 3 May, so it is important to keep things in perspective. All the same, our Model Equity Portfolio requires new ideas. We will add Seplat and, among the insurers, Custodian Allied Insurance and AIICO to our list of notional positions, bearing in mind that insurance stocks tend not to be liquid and so creating notional positions (we respect market liquidity) may be difficult. And we will consider our stance on banks.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.