Last week the Central Bank of Nigeria removed the directors of First Bank of Nigeria, but reinstated its managing director, in a move that grabbed headlines. It raises the issue of corporate governance and of governance overall in Nigeria. What is the cost of poor governance and what are the benefits of good governance? We put our views forward below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) was unchanged to close at N410.00/US$1. In the parallel, or street, market the Naira was unchanged, closing at N485.00/US$1, 18% weaker than the I&E rate. The CBN’s FX reserves held almost steady at US$34.91bn (the data point is a one-month moving average) with a loss of just 0.09% on the week. The CBN’s Naira 4 Dollar scheme, designed to improve FX liquidity, is set to come to an end later this week. It has had some success but incremental inflows have not significantly outweighed outflows, in our view, with the FX position showing just 0.29% accretion since the start of the scheme on 8 March. We think the CBN may continue the scheme. Although the I&E rate (and, together with it, the NAFEX rate) and the parallel rate have been quite stable for a few weeks, the relative weakness of the parallel rate still suggests to us that pressure on the I&E and NAFEX rates is likely to continue.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira-denominated bond with 10 years to maturity fell by 4bps to 12.66%, the yield on the 7-year bond was unchanged at 12.43% while the yield on a 3-year bond rose by 104bps to 10.96%. Activity in the market was low, with trading seen mainly at the short-to-mid durations of the curve. The overall average benchmark yields increased by 51bps to 8.80% at the close of the week.

The annualized yield on a 335-day T-bill in the secondary market fell by 1bp to 8.05%, while the yield on a 319-day OMO bill rose by 106bps to 10.18%. By the end of the week, the average benchmark yield for T-bills closed at 4.74%, while OMO bills closed at 7.91%. In the OMO market, the CBN offered N20.00bn (US$48.78m) worth of notes across all maturities. The 96-day notes were allotted at 7.00%, 180-day notes at 8.50%, and 348-day notes at 10.10%.

Last week the yield on 364-day T-bills crossed the 10.00% benchmark in the Primary Market Auction (PMA) for the fist time this year. At the PMA a 91-day T-bill sold at a stop rate of 2.00% (a 2.05% annualised yield), a 182-day T-bill sold at a stop rate of 3.50% (a 3.56% annualised yield), but a 364-day T-bill sold at a stop rate of 9.75% (10.80% annualised yield). The Debt Management Office offered N88.45bn (US$215.73m) worth of bills with the auction recording N242.93bn (US$592.51m) of transactions across all maturities on Wednesday. Our sense is that upward pressure on 364-day T-bill rates is likely to continue.

Oil

The price of Brent crude rose by 1.72% last week, closing at US$67.25/bbl, meaning a 29.83% increase year-to-date. The average price year-to-date is US$62.32/bbl, 44.21% higher than the average of US$43.22/bbl in 2020. Last week the US had an interesting role to play in the sentiments of the oil market. The Chief Executive Officer of the Federal Reserve Bank of New York, John Williams, hinted that the US economy would grow faster than hitherto expected. However, the increasing number of Covid-19 cases in India has continued to suppress the rally in oil prices as the recovery is not assured in some parts of the world. Our sense is that prices will remain above US$60.00/bbl over the coming weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 1.36% last week, trimming its loss to 1.08% year to date. Okomu Oil Palm +11.11%, Nigerian Breweries +7.03%, and MTN Nigeria +6.00%, closed positive last week, while Honeywell Flour Mills -17.14%, International Breweries -8.77%, and PZ Cussons -8.26%, closed negative. Performance across sectors was mixed last week as the NSE Insurance Index was the highest gainer for the week, rising by +3.80%, followed by the NSE-Iindustrial +2.36%, NSE-30 +2.03%, NSE Oil & Gas +1.30% indices. Conversely, the NSE Consumer Goods -0.02% and NSE Banking -2.09% indices closed the week negative. See Model Equity Portfolio below.

Transparency and Foreign Direct Investment

The news that the Central Bank of Nigeria last week replaced the directors of the country’s third-largest bank by assets highlights the issue of corporate governance and of governance in Nigeria overall. There are many indices for this, one being the Corruption Perception Index published by Berlin-based Transparency International. This index has the advantage of being a compilation of other such indices and studies. Our question is how governance influences investment, specifically foreign direct investment (FDI).

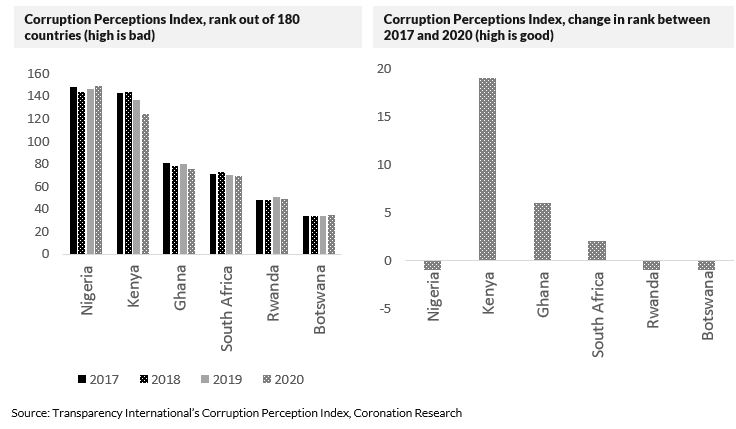

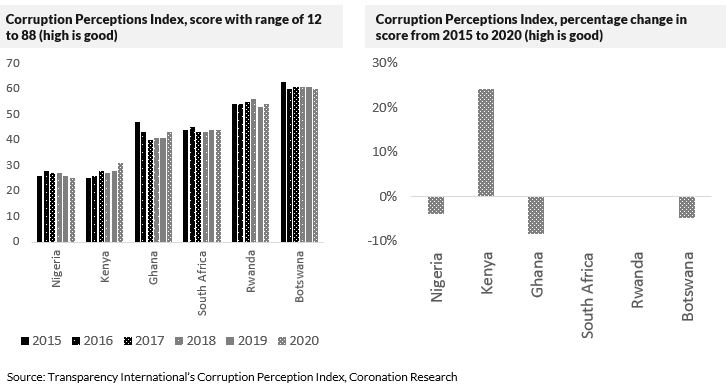

The Corruption Perceptions Index (CPI) measures nations with a score (the range for the 2020 study is from 12 to 88) and assigns a rank out of 180 nations. The headline data usually relates to the rank but we consider the score more meaningful because the rank can be influenced by other nations moving up and down the scale.

The first, and remarkable, characteristic of the data for our selected African countries is how dispersed they are. In the global comparison Botswana outranks Poland, for example, Rwanda outranks Italy. Nigeria ranks close to Lebanon.

Next, it appears that Kenya has been rising in the surveys, at least over period from 2017 to 2020. This impression is confirmed when we look at the improvement in its score from 2015 to 2020. Granted, it helps to commence this comparison with a low score in 2015 (and not with comparatively high scores like Ghana and Botswana), but Kenya does appear to be improving in a consistent manner.

First, nations with poor CPI scores tend to receive low US dollar FDI in per-capita terms, although some nations like Rwanda have good CPI scores but low US dollar FDI in per-capita terms. Second, a nation with an improving CPI score, like Kenya, benefits from a rising trend in US dollar FDI in per-capita terms. Albeit that our statistical base is small for this study, but it appears that good governance leads to high FDI and that improving governance pays off as well.

Model Equity Portfolio

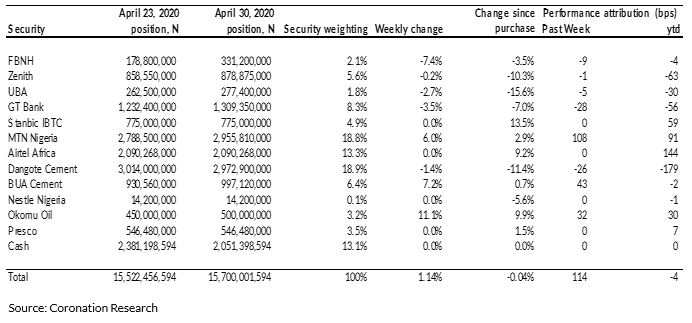

Last week the Model Equity Portfolio rose by 1.14% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.37%, therefore underperforming it by 23 basis points. Year to date it has lost 0.04% against a loss in the NSE-ASI of 1.07%, outperforming it by 103bps.

Our problem last week was in having a somewhat underweight notional position in BUA Cement which cost us when it rallied sharply on Friday. The other issue was our overweight notional position in banks in a week when the Central Bank of Nigeria removed directors of First Bank of Nigeria (part of FBN Holdings) though reinstating its Managing Director, a move which could be considered positive but which hit the sector. We stuck to our commitment, published last week, to increase our notional overweight in banks and to reduce the notional cash position from 15.3% to 13.1%.

Model Equity Portfolio for the week ending 30 April 2021

Once again, our intention is to look at opportunities in the insurance sector in order to diversify the Model Equity Portfolio, but we have not identified the stocks yet. We will report back.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.