For the past 18 months investors in 1-year risk-free Nigerian Treasury Bills (T-bills) have been denied a return anywhere near the rate of inflation. Yet this has begun to change and, we believe, conditions are set to improve still further. After the radical interest rate policies of 2020, we see a return to something close to normality. We believe that we may see 1-year T-bill rates at close to 15.0% on a three-month time horizon, and even 17.0% later on in Q3 2021. See below for details.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.33% to close at N411.67/US$1. In the parallel (or street) market, the Naira weakened by 0.21% to close at N484.00/US$1. Elsewhere, Central Bank of Nigeria’s (CBN) FX reserves fell to US$34.57bn, a loss of 0.40% in the week. The CBN removed the official exchange rate of N379.00/US$1 from its website in a move seen by many as an attempt to unify multiple exchange rates. There has not been any official communication on this topic. However, this suggests that the NAFEX rate has been adopted as the reference exchange rate for official transactions and is in line with the Minister of Finance’s March comments that monthly Federal Accounts Allocation Committee (FAAC) distributions are to be done with reference to the NAFEX rate. We also note that the World Bank has linked approval of a US$1.5 billion loan on the unification of exchange rates. Nonetheless, persisting FX illiquidity in the I&E Window, and the parallel market rate’s weakness still suggest that pressure on the I&E rate is likely to continue, in our view.

Bonds & T-bills

Last week, trading in the secondary market was slightly bullish following renewed interest at the mid-to-long segments of the curve. The yield for an FGN Naira-denominated bond with 10 years to maturity fell by 6bps to 13.25%, the yield on the 7-year bond fell by 8bps to 13.02%, and the yield on a 3-year bond fell by 1bp to 12.05%. Thus, the overall average benchmark yields for the week declined by 8bps w/w to close at 12.29%. Selloffs are expected to resume this week amidst the persisting bearish sentiment in the market. We also expect rates to take a cue from auction stop rates; the CBN is offering N150bn in bonds at Wednesday’s primary auction. Amidst tight liquidity conditions, we expect auction rates to move higher than the previous auction.

Last week, the annualised yield on a 349-day T-bill in the secondary market rose by 121bps to 9.25%, while the yield on a 305-day OMO bill fell by 2bps to 9.88%. The Nigerian Treasury Bill Auction was oversubscribed last week. At the auction, the CBN offered a total of N117.56bn (US$286.73m) and with a total allotment of N138.99bn, comprising of N8.44bn for 91-day, N7.99bn for 182-day, and N122.56bn for 364-day bills. Stop rates for the 91-day bill rose by 50bps to 2.50%, while the rates on the 182-day (3.50%) and 364-day (9.75%) remained unchanged. We expect secondary market yields to trend higher over the coming weeks amidst the continued squeeze on system liquidity.

Oil

The price of Brent crude rose by 0.63% last week, closing at US$68.71/bbl, meaning a 32.64% increase year-to-date. The average price year-to-date is US$62.97/bbl, 45.69% higher than the average of US$43.22/bbl in 2020. Oil prices rose last week as the Colonial Pipeline restarted product supply following the cyber-attack. In its monthly report, the Organization of the Petroleum Exporting Countries (OPEC) was optimistic that the increased pace of vaccinations and rising fuel demand will raise global oil demand by 5.95 million barrel per day (bpd) this year, despite the current COVID crisis in India. According to the report, world oil demand is set to average 96.5 million bpd in 2021, nearly 6 million bpd higher than in 2020, with the pace picking up in H2 2021. On the other hand, the International Energy Agency (IEA) revised down its oil demand forecast for 2021 by 270,000 bpd, citing weak demand in Europe, OECD Americas, and India. Our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several weeks, at least.

Equities

The Nigerian Stock Exchange All-Share Index (NGX-ASI) advanced by 0.75% in the three trading sessions of last week, reducing the year-to-date loss to -1.93%. Presco +9.58%, International Breweries +7.55%, Zenith Bank +6.76%, and Fidelity Bank +6.25% closed positive last week, while Sterling Bank -6.92%, Okomu Oil Palm -6.31%, and Honeywell Flour Mills -5.04% closed negative. Across sectors, performance was broadly positive. We expect investors to be cautious, given the fact that fixed income yields and yields on bank deposits have improved considerably over the past few weeks. And we expect investors to react to the fact that many bank stocks have gone ex-dividend (at least, the full-year dividend) recently. See Model Equity Portfolio below.

15.0% T-bills rates in prospect

In February, when 1-year Nigerian Treasury Bill (T-bill) rates were close to 4.2%, we said that we expected to see 1-year rates of 10.0%, or more, by mid-year. We did not have to wait long, with a primary market auction of T-bills at the end of April yielding 10.80%, annualised, for 364-day paper. Secondary market T-bill yields are catching up. What do we expect now?

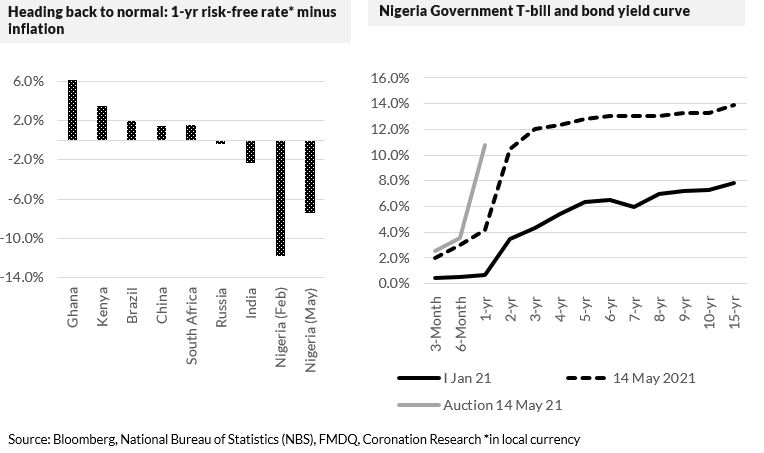

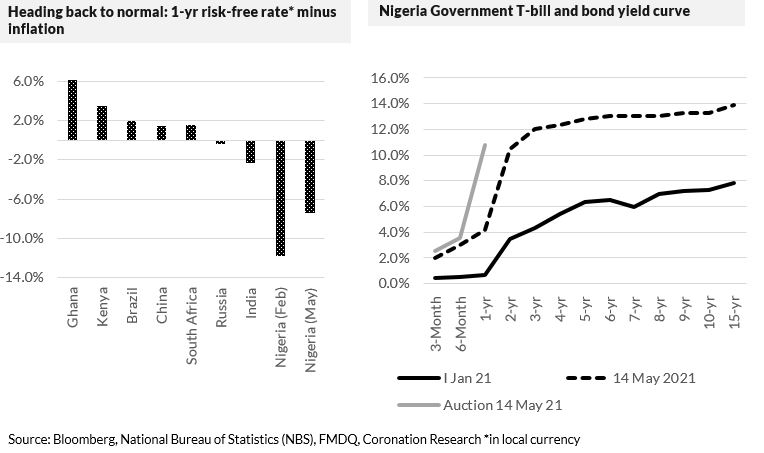

We believe that 1-year risk-free Naira rates can reach 15.0% over the coming three months and could even reach 17.0% later in the third quarter (Q3) of this year. We are seeing a process of rebalancing between 1-year risk-free rates and inflation. Many countries set their 1-year risk-free rates close to, or considerably above, the rate of inflation in order to: a) deal with inflation; b) protect their currencies. This was often the case with Nigeria, up until late 2019 and 2020 when unorthodox policies forced interest rates to very low levels.

In 2021 Nigeria has begun to return to the traditional, and normal (for many emerging markets), relationship between rates and inflation. In mid-February the 1-year T-bill rate minus inflation was negative 11.75%: three months later (last Friday) this metric stood at negative 7.37% (see chart, left). At the same time Nigerian bond yields have been moving up sharply. The average yield of 10 durations we track (see chart, right) has risen by 658 basis points since the beginning of the year with an average yield of 12.71% at the end of last week. 96 of those 658 basis points have been added over the last three weeks.

For inflation, we pinpoint three issues. The loan-to-deposit ratio created a surge in credit that, while it softened the impact of recession last year, likely contributed to inflation. Very low market interest rates (1-year T-bill rates fell from 5.40% in January 2020 to O.15% in early December) abetted the process. Fiscal monetisation (lending by the central bank to the government) created a source of un-funded money, which is inflationary. These policies and actions added to the effects of FX depreciation, insecurity, border closures and supply chain disruption.

Can inflation, which was at 18.17% y/y in March, come down? And will the T-bill rate and the inflation rate meet at some point in the near future? One significant driver of inflation, in our view, was the depreciation in the parallel exchange rate in June and July of 2020. If we assume that many businesses adapted quickly to those parallel exchange rates, then the fact that the parallel exchange rate has not depreciated much since then suggests that year-on-year, this source of inflation will be less potent (or dangerous) in the second half of 2021 than in the first half.

Another factor which may bring inflation down over the coming months is the shortage of liquidity in Naira money markets, which contrasts with the surge in liquidity seen last year. One sign of this is the rise in the Nigerian Interbank Offered Rate (NIBOR), which is up sharply this year. In fact, Naira liquidity is so tight these days that it is possible for institutions to make short-term deposits with banks at 10.0% per annum or more. However, there remain forces pushing inflation upwards, notably the rise in oil prices and in electricity tariffs. The outcome for inflation remains uncertain.

15.0% T-bills rates in prospect

The reasons for lack of interbank liquidity worth considering. Credit is not being formed as fast as it was last year. It is possible that the monetary authorities are concerned about the consequences of fiscal monetisation and wish to deal with it. It is also worth noting that pension funds, great sources of liquidity, have not grown lately. The monetary authorities engineered the great fall in market interest rates last year and may believe the time is right to bring interest rates and inflation in line.

Specifically, the Monetary Policy Council (MPC) of the CBN, which meets next week to decide its policy rate (currently 11.50%), will weigh up the risks to the economic recovery of allowing interest rates to rise. (We still do not have GDP data for the first quarter of 2021, though Q4 2020 recorded positive growth.) Members of the MPC will want to know to what extent interest rate rises are being passed on to lenders (our sense is that this process is only just beginning). There are still many data to assess but, given the current trend, we think that we may see 1-year risk-free rates of around 15.0% in three months, and even 17.0% later in Q3.

Model Equity Portfolio for the week ending 14 May 2021

Last week the Model Equity Portfolio rose by 0.83% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.75%, therefore outperforming it by 8 basis points. Year to date it has lost 1.43% against a loss in the NSE-ASI of 1.93%, outperforming it by 50bps.

Last week our overweight notional position in banks earned us a total 46bps, reversing the 44bps it had had lost the previous week. All the same, we think that we are over-exposed here, being some 6 percentage points overweight against the index and having lost a notional 94bps in banks year-to-date.

Note that, when it comes to calculating a total return (i.e. with dividends paid) the notional overweight in banks may prove to have paid off, given that their dividend yields tend to be superior to that of the market as a whole.

Nevertheless, we will trim our notional bank positions this week with the intention of adding up to 4 percentage points of notional cash from this source. We will also seek to reduce our notional position in Airtel Africa, liquidity permitting (and it is not very liquid).

As we forewarned, we made changes to the Model Equity Portfolio last week. We made a notional purchase of Seplat, taking a notional position of roughly double its index weight. We began to make notional purchases of insurance companies AIICO and Custodian and Allied but were held back by the low level of liquidity in these stocks. Granted, there were only three trading days last week, but in any event these insurance stocks are difficult to get hold of. We will continue to build up notional positions in these two stocks, liquidity permitting, this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.