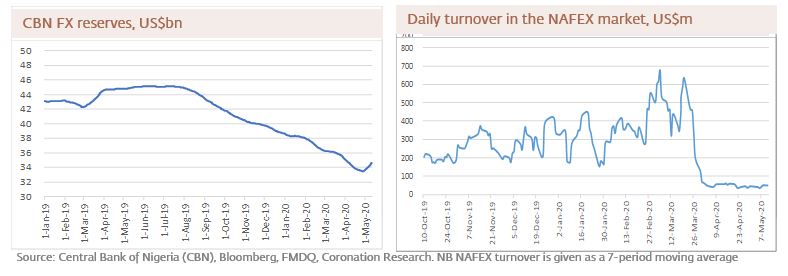

The foreign exchange reserves of the Central Bank of Nigeria (CBN) are going up again. This is largely thanks to public-sector loans (such as the US$3.4bn facility granted recently by the IMF) to the government. It is tempting to see such loans as the building blocks of a bridge; this bridge takes the CBN’s FX reserves from the dark days of April through to a future, in a few months’ time, in which global oil prices will have rebounded and international private-sector investor confidence in Nigeria will return. That is one possible theory of how things might work out. It will be interesting to see whether the Monetary Policy Council of the CBN considers it when it meets next week.

FX

Month-to-date the FX reserves of the CBN are up US$1.51bn to US$35.03bn. Inflows are now largely from the public sector, in our view, notably supra-national lending to the Federal Government. By contrast, the combined month-to-date inflow from foreign direct investment (FDI) and foreign portfolio investment (FPI) month-to-date is just US$40.1m (N15.6bn). Significant inflows from the private sector (such as the US$1.7bn received in January, for example) are unlikely to resume until oil prices trend above US$50.00/bbl, in our view. Such an outcome in the oil markets look some way off, in our view.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity increased last week by 31bps to 11.25%, and at 3 years rose by 88bps to 9.17% last week. The annualised yield on 272-day T-bill declined by 12bps to 3.07%. This week we think activities in the bond market will be influenced by the N60.0bn (US$153.8m) re-opening of auctions in three maturities: 12.75% April 2023; 12.50% March 2035, and 12.98% April 2050. Our overall sense is that issuance by the Debt Management Office, pursuant to the government’s substantial budget the deficit, will have the effect of gently pushing T-bill and bond rates up, tempered by high system liquidity.

Oil

The price of Brent crude rose by 4.94% last week to US$32.50/bbl. The average price, year-to-date, is US$43.12/bbl, 32.83% lower than the average of US$64.20/bbl in 2019, and 39.86% lower than the average of US$71.69/bbl in 2018. Oil prices extended their recovery for the third week running as sentiment towards a global recovery improves and numerous countries ease their lockdown conditions. We believe that oil prices may hold firm going forward, though we recognize that news of renewed outbreaks of the COVID-19 virus has the potential to derail the market again. A key question for us is whether Russia and Saudi Arabia, given their apparent desire to re-take market share from marginal independent shale oil producers in the US, will tolerate Brent crude prices in excess of US$45.00/bbl.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 0.72% last week. The year-to-date return is negative 11.07%. Last week Unilever Nigeria (+20.95%), Stanbic IBTC (+12.81%), Mobil (+9.94%), Presco (+9.88%) and FBN Holdings (+5.32%) closed positive, while Honeywell Flour Mills (-8.41%), Dangote Cement (-4.33%), International Breweries (-4.00%) and Seplat (-3.64%) fell. There appear to be numerous domestic investors still interested in the market, reminiscent of May 2017. We are unsure whether this rally will last for the rest of this year, but nevertheless we have positioned the Model Equity Portfolio for upside potential in the stocks which we like.

Breathing space for FX reserves

The foreign exchange reserves of the CBN have been trending upwards recently, reversing a downward pattern which began in earnest last August. It appears that the International Monetary Fund’s (IMF) recent grant of US$3.4bn to the government to deal with the COVID-19 outbreak is supporting FX reserves, and these also have received a boost of several hundred million US dollars recovered from the estate of a former military ruler. Given that a foreign exchange level of US$30.00bn is widely seen as endangering Nigeria’s exchange rate, the change in direction is very welcome to the authorities. The current interbank rate quoted on Bloomberg (for the NAFEX rate, also known as the I&E Window rate) is N386.80/US$1.

At the same time oil prices have been moving back up, with the price of Brent crude closing at US$32.50/bbl last week, far in excess of the sub-US$20.00/bbl level seen in early April. Given our core thesis that Nigeria’s public finances (both those of the CBN and the Federal Government of Nigeria) work effectively when Brent crude is over US$50.00/bbl, this looks like a positive trend.

Will these factors encourage the CBN to think that markets are returning to normal and that pressure on the Naira will soon alleviate? Might the CBN believe that, at least, it has a breathing space that enables it to defer precipitous decisions about the exchange rate and interest rates for a few months? These are important questions as the Monetary Policy Council of the CBN meets this time next week.

Despite the upswing in the CBN’s FX reserves, problems in the foreign exchange markets are not likely to evaporate, in our view, though they are likely to improve a little. The CBN’s role as the back-stop provider of US dollars to Nigeria’s principal FX market, the NAFEX market, puts pressure on its FX reserves if it decides to meet all un-met demand for a long period of time. The bid price for US dollars in the parallel, or street, market, was quoted at N455.00/US$1 last week, suggesting that this is where un-met demand for US dollars has been heading.

After mid-March, volumes in the NAFEX market declined sharply, suggesting that the CBN’s back-stop role was under considerable pressure. Over the past week – and it is not known yet whether the CBN was the source of the additional flow – turnover in the NAFEX market has ticked upwards.

The real problem with the foreign exchange markets, in our view, is a shortage of private-sector inflows of US dollars, which is a consequence of the fall in oil prices (oil & gas exports account for roughly 90% of all exports and oil & gas earnings inspire confidence in foreign portfolio investors). When private-sector inflows are weak then the spotlight falls on the CBN. So the most important factor in the foreign exchange equations remains the oil price. And there can be no assurance about the future price of oil.

Model Equity Portfolio

Model Equity Portfolio for the week ending May 15 2020

While it is natural to concentrate on our two largest notional positions, MTN Nigeria and Dangote Cement, it is also important to note the continued strength of the bank stocks. It seems that, at long last, these have caught the imagination of investors in a sustainable way. One could have chosen any period since last November (when T-bill rates started to fall precipitously) to tell investors that bank dividend yields are far in excess of T-bill yields, but now is the moment when the market – we understand it is mainly the local investor base – is taking notice.

Earlier this year we chased the rally in banks stocks (to be fair, we had to chase the market because we were starting the Model Equity Portfolio with 100% in cash) which paid off briefly and then led to a period of difficult underperformance as the market turned in February. We need to calibrate our bank positions against their weights in the NSE-ASI and take stock of our bank sector strategy again.

Last week we set ourselves the task of refreshing our ideas, which we have not completed, and we have the task of re-calibrating all our positions against the index. We have a busy week ahead and will report our new ideas next week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.