The Nigerian Stock Exchange All-Share Index (NSE-ASI) staged a rally last week (see Model Equity Portfolio), reflecting optimism. Part of that optimism came from market speculation, later confirmed, of a deal between the US, OPEC and Russia to reduce oil production. But oil prices have barely rallied and Brent crude, at US$32.12/bbl, is well short of the US$50.00 – US$60.00/bbl range that signals Nigeria’s comfort zone for its own oil earnings and for foreign portfolio investment. Although financial support for Nigeria is likely to come from the IMF and the World Bank, these will be short-term measures designed to address the coronavirus pandemic. Over a period of two years (the medium-term), low oil prices are likely to present difficult challenges.

FX

Month-to-date the FX reserves of the Central Bank of Nigeria (CBN) have declined by US$582.2m to US$34.5bn (a data point that represents a one-month moving average), the lowest level since November 2017. There appears to be continued outflows on the part of foreign investors, compared with an inflow of US$136.5m month-to-date into the NAFEX market (also known as the I&E Window, where the rate is the one quoted by Bloomberg). The CBN has a difficult balancing act because it is the provider of last resort of US dollars to the NAFEX market but at the same time success is judged by the level of its FX reserves. US$30.0bn is widely seen as a key point. The prospect of the IMF and the World Bank supplying US dollar funds to the government is an important one. It cannot come too soon, in our view.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 32bps to 12.26%, and at 3 years declined by 139bps to 9.21% last week. The annualised yield on 308-day T-bill, the longest duration available in the secondary market, declined by 125bps to 3.43%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 14.59%, 276bps down week-on-week. Last week OMO maturities worth N130.9bn (US$344.5m) entered the financial system and led to compression of yields. Since last October the T-bill and OMO markets have been effectively separate.

Oil

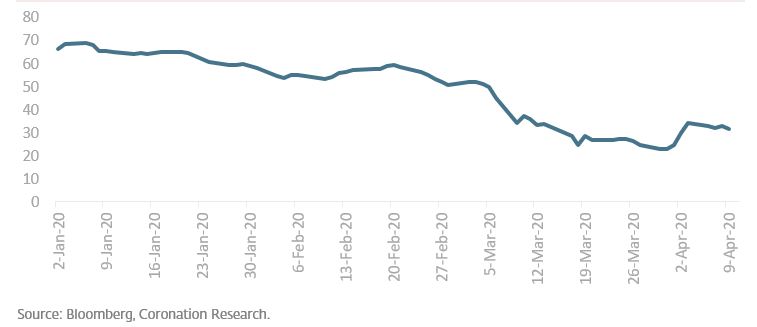

The price of Brent declined by 7.71% last week to US$31.48/bbl. The average price, year-to-date, is US$48.64/bbl, 24.23% lower than the average of US$64.20/bbl in 2019, and 32.15% lower than the average of US$71.69/bbl in 2018. With the favourable resolution between the US and the OPEC+ countries (i.e. OPEC plus Russia), a production cut of c.10mbpd seems likely to keep oil prices stable at around current levels. However, we do not think the cut is deep enough to cause a significant increase in oil prices given a glut of 11.4mbpd forecast by the US Energy Information Administration (EIA).

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) advanced by 1.37% last week, the year-to-date return is negative 20.33%. Last week Lafarge Africa (+41.34%), UBA (+25.25%), Sterling Bank (+25.23%) and Fidelity Bank (+24.26%) closed positive, while Ardova Oil (-18.48%), Seplat (-9.09%), Dangote Cement (-6.04%) and Cadbury Nigeria (-1.43%) fell. The gains reflect a degree of optimism and a certain amount of value selection by institutional investors, though we are doubtful about a sustained rally.

Oil prices, the new normal

Last week’s deal between the Organization of the Petroleum Exporting Countries (OPEC), Russia and the US, was heralded as a breakthrough. It ended the stand-off that had brought oil prices down from above US$50.00bbl (Brent crude traded at US$51.13/bbl as recently as 3 March) to under US$30.00/bbl (US$22.76/bbl on 30 March). Yet oil prices have not rallied much since the deal, with Brent now at US$32.12/bbl. If oil prices stay this low for six months or more, then there are far-reaching implications for Nigeria’s access to US dollars, the currency, and for its budget.

As we argued in Coronation Research, Year Ahead 2020, 16 January, Nigeria’s comfort zone for Brent crude prices is above US$50.00/bbl and preferably above US$60.00/bbl (which they have not touched since the US$60.69/bbl recorded on 24 January). Foreign portfolio investors (FPI), in our view, feel comfortable with oil prices in this range (and above US$60.00/bbl), but tend to withdraw money when prices fall below US$50.00/bbl. And, for the Central Bank of Nigeria (CBN), oil is the primary source of its US dollars from the Nigerian National Petroleum Corporation (NNPC), with the secondary (but larger) sources of FPI, bilateral loans and Eurobond sales depending on oil prices being in or above the comfort zone.

Oil prices, US$/bbl

The reason why oil prices did not rally are several. First, an agreed production cut of 9.7 million barrels per day (mbpd), although roughly 10.0% of global production, may only represent half of what the world has lost to the coronavirus in terms of demand. There is still a glut. Second, the base on which the 9.7mbpd cut was calculated may be higher than what is actually produced, so in practical terms the cut may be less than 9.7mbpd. Third, the idea (or at least Saudi Arabia’s and Russia’s idea) of the cut is to bring prices to a level which is uneconomic for a portion of shale producers in the US. The intention, it appears, is not to bring prices up to US$60.00/bbl again.

For Nigeria it makes sense to think in terms of oil prices in a range around US$35.00/bbl. The amended 2020 budget has already adjusted the assumed price down from US$57.00/bbl to US$30.00/bbl and taken the envisaged government deficit up from N2.7 trillion (US$7.1bn) to N5.1 trillion (US$13.3bn).

How can the CBN replace its primary source of US dollars from the NNPC? It will continue to earn some US dollars from oil revenues with the NNPC, but it is difficult to say with any certainty how much. The answer, in the short term, is that development finance institutions such as the IMF and the World Bank, are likely to supply the government with funds and these will be banked with the CBN. However, these funds are for deployment in tackling the coronavirus, not for dealing with shortfalls from oil revenues.

Therefore, if oil prices trade at around US$35.00/bbl in the medium term, say a year or even two, then deep adjustments will be required, in our view, to how Nigeria sources and manages foreign exchange reserves.

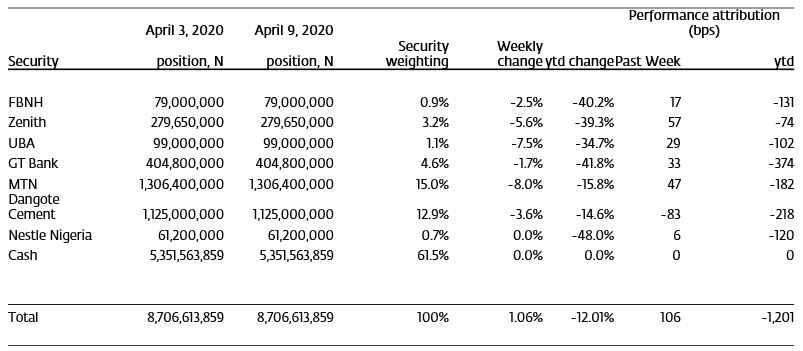

Model Equity Portfolio

Last week the Model Equity Portfolio gained 1.06%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.37%. Year-to-date it has lost 12.01%, against a loss of 20.33% in the NSE-ASI. Last week we benefited from our notional positions in volatile bank stocks which contributed 136bps to the portfolio, but were let down by our notional position (actually close to a neutral weight for the index) in Dangote Cement, which cost us 83bps. Last week there was a rare upswing in the market, and it was perhaps too much to expect that we could match market performance while holding a notional cash position of 55.9%.

Why did the market turn? We have spent a long time (since last November) arguing that some of the top bank stocks have excellent dividend yields: it was not as if, having ignored this advice for five months, the market suddenly paid attention. News of other markets rebounding might have had something to do with it, or rumours (which turned out to be true) of an impending deal involving OPEC, Russia and the USA to cut global oil production. Quite possibly, domestic investors saw the NSE-ASI edge down close to the level of 20,000.00 and thought that enough was enough. The low point of 20,669.38 was reached on Monday 6 April.

Model Equity Portfolio for the week ending 09 April 2020

Last week we finally (we had promised to do this two weeks ago) took our slightly notional underweight position in MTN Nigeria to a slight notional overweight of 20.2%. This purchase took our notional cash position down from 60.8% to 55.9% and cost the portfolio a notional 2bps in commissions. We not intend to make any portfolio changes this coming week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.

It is the role of equity markets everywhere to predict company earnings and future economic conditions. Generally, equity markets rally far ahead of the end of recessions. The current rally in the Nigerian Stock Exchange All-Share Index, which is up 16.3% since 6 April, is therefore intriguing. Does it predict the resolution of Nigeria’s problems, as the rally from April to December 2017 did? And, if one is unsure about that, how should one position an equity portfolio? We address these questions below…

FX

Last week we wrote that the International Monetary Fund’s (IMF) recently-approved Rapid Financing Instrument (RFI) facility of US$3.4 billion (N1.3 trillion) for the Federal Government of Nigeria (FGN) could boost the Central Bank of Nigeria’s (CBN) external reserves. The CBN’s reserves grew by US$449.3 million during the week to US$34.2bn, though this was helped by an apparent inflow of money recovered from the estate of a former military ruler. Either way, this is the first reserve accretion since the start of the year. Against this backdrop, the Naira appreciated against the US dollar by 0.01% to N387.25/US$1 in the main interbank FX market, the NAFEX market, and by 4.12% to N437.00/US$1 in the parallel market. While this is positive, it is not the case that that FX turnover overall is recovering or that private-sector capital inflows have resumed. This just lifts the immediate pressure on the exchange rate, in our view.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 35bps to 10.94%, and at 3 years contracted by 2bps to 8.29% last week. The annualised yield on 279-day T-bill, remained flat at 3.19%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 11.89%, 249bps down week-on-week. We think T-bill rates will rise over the coming month though high liquidity, such as last weeks N96.9bn (US$230.8m) of OMO maturities, is likely to keep such rate rises modest.

Oil

The price of Brent rose by 17.13% last week to US$30.97/bbl. The average price, year-to-date, is US$43.81/bbl, 31.75% lower than the average of US$64.20/bbl in 2019, and 38.89% lower than the average of US$71.69/bbl in 2018. The key driver in the recent rise has been the clearing of global inventories that weighed on the market in April. The market now contends with global oil consumption variously estimated at 30%-35% below its peak and production variously estimated at 10%-15% below its peak. This suggests that the market is taking its time to move back into balance, though eventually it must. The result, in our view, will be slow appreciation of Brent prices as we approach the third quarter of the year.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) advanced by 4.45% last week. The year-to-date return is negative 10.42%. Last week Ardova Oil (+32.47%), Nigerian Breweries (+25.00%), Dangote Cement (+15.38%), Nestle Nigeria (+8.67%) and Zenith Bank (+7.69%) closed positive, while Lafarge Africa (-6.78%), Access Bank (-3.03%), Guinness Nigeria (-2.17%) and Sterling Bank (-1.56%) fell. Sectoral performances this week were positive. The Consumer Goods sub-index (+8.5%) led the gains, followed by the Banking (+4.0%), Oil & Gas (+2.8%), Insurance (+2.8%), and Industrial Goods (+2.2%).

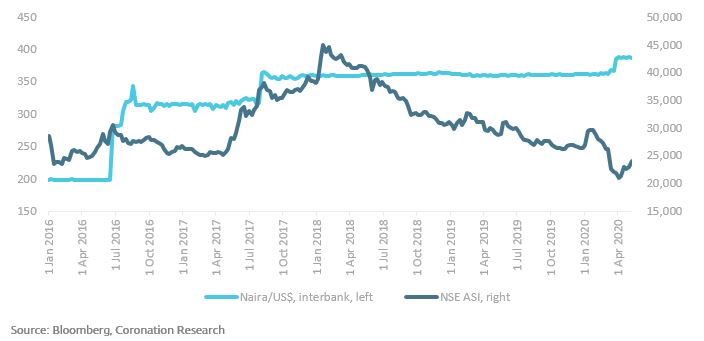

An equity market rally. Is it predicting the end of austerity?

Is this the equity market rally that takes us all the way from April through to the end of the year? The question comes up because the equity market is rallying (it is up 16.3% from its low point on 6 April) and because there appears to be a parallel with the equity market rally from April to December 2017, in which the Nigerian Stock Exchange All-Share Index (NSE ASI) returned 51.8% in Naira (and 32.6% in US dollars at the interbank rate). Nobody wants to miss a rally like that.

It is the task of equity markets to predict future economic conditions and future company earnings. So this might be the rally that heralds a recovery later this year, as in 2017. However, the 2017 rally began nine months after a serious exchange rate dislocation (in June 2016) and after five quarters of negative economic growth. A consensus was being reached, as the NAFEX foreign exchange market was launched in April 2017, as to where Naira/US dollar would settle in the interbank market. Today the recession still appears to be both current and be ahead of us, and currency fluctuations (e.g. in the parallel market rate) are still quite recent. On balance, it feels that we are still close to the beginning of troubles in the market, and that it is too soon to see the resolution of these issues. In April 2016 there was a rally (through to July) but it fizzled out later in the year.

Nigerian Stock Exchange All-Share Index (NSE ASI) and Naira/US dollar rate in the interbank market

So, do we take fill our notional Model Equity Portfolio with equity, or remain cautious? We do not like to make binary choices, still less successive binary choices, about the direction of the market. As Oatree’s Howard Marks put it: “”The bottom” is the day before the recovery begins. Thus it’s absolutely impossible to know when the bottom has been reached . . . ever.” He recommends spending some money when equity prices are low in the stocks you would like to own, but to be prepared to accept further corrections if necessary.

We think this is a wise approach – buy good stocks when they are at historically low levels, but don’t overdo it. Over the past few weeks have raised our notional positions in MTN Nigeria and Dangote Cement, while enjoying strong performance in our selection of the major bank stocks. This has given us some performance without having to take the binary choice of betting on a market rebound. And our key strength is having a small notional Model Equity Portfolio and having flexibility as to how much equity and how much cash we hold. Very few professional equity portfolio managers have this luxury. Our selections express our thoughts on the market and how to survive it without having to call the bottom.

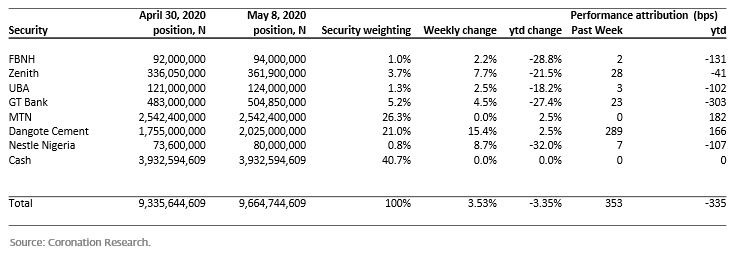

Model Equity Portfolio

Last week the Model Equity Portfolio gained 3.53%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 4.45%, therefore underperforming by 92 basis points. Year-to-date it has lost 3.35%, against a loss of 10.42% in the NSE-ASI, outperforming it by 707bps.

We made no notional purchases of equity last week, but were grateful that we had taken Dangote Cement to a nearly neutral position the week before. Dangote Cement contributed a critical 289 basis points (bps) of performance last week and without our earlier purchases it would only have delivered 193bps instead. Our four bank positions together delivered 56bps last week, though year-to-date they have done quite a lot of mark-to-market damage, namely negative 576bps (though we have not yet accounted for their dividends, which will likely make things better).

Two stocks in our notional portfolio are up 2.5% year-to-date, Dangote Cement and MTN Nigeria. Given the state of the market as a whole (down 10.42% year-to-date), this is remarkable. We are fans of MTN Nigeria, which continues to add subscribers. It has lost a degree of voice revenue during the lock-down but increases in data usage partly made up for this. Fundamentals appear to be strong.

Model Equity Portfolio for the week ending May 8 2020

Our problem is that we are running out of stocks that we like. Some of the stocks participating in the rally are not ones we would wish to own in the long term, so buying them now would purely be a matter of chasing the market. We are wary of doing that. We will spend this week trying to come up with a broader strategy than the one we have, nevertheless. It usually pays to refresh one’s ideas.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.