Last week several countries, including Nigeria, announced a gradually loosening of lock-down restrictions associated with the COVID-19 pandemic. A gradual return to normal life is planned because it is feared that a full resumption of normal life could lead to a renewed outbreak of infections. Meanwhile, several international newspapers report on the curiously low impact of COVID-19 in Africa. This is variously attributed to sunlight, heat, delayed spread of the virus and inadequate reporting. We have a further explanation.

FX

Last week the International Monetary Fund (IMF) committed to disbursing its recently-approved Rapid Financing Instrument (RFI) facility of US$3.4 billion (N1.3 trillion) by May. If this is recorded as a loan to the Federal Government of Nigeria (FGN) then we expect it to boost the reported FX reserves of the Central Bank of Nigeria (CBN), currently reported at US$33.4bn. However, we do not expect this to bring more than temporary alleviation to pressures in the foreign exchange market, even if the World Bank follows the IMF with a loan of US$2.5bn. Our point is that US dollar inflows from oil are reduced and this negatively affects the sentiment of private-sector US dollar lenders. In the short term the CBN has announced the resumption of FX sales to small and medium-sized entreprises (SME), which shows a degree of confidence, but which may result in a rise in outflows.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 4bps to 11.29%, and at 3 years contracted by 27bps to 8.49% last week. The annualised yield on 287-day T-bill, remained flat at 3.19%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 14.38%, 290bps up week-on-week. We anticipate slightly higher yields in the secondary bonds market this week, following the Senate’s approval of the FGN’s request to borrow N850.0 billion (US$2.2bn) in the domestic T-bill and bond markets. The impact of the borrowing on rates is likely to be dampened by the high cash positions of pensions funds and mutual funds, in our view.

Oil

The price of Brent rose by 23.23% last week to US$26.44/bbl. The average price, year-to-date, is US$44.64/bbl, 30.47% lower than the average of US$64.20/bbl in 2019, and 37.74% lower than the average of US$71.69/bbl in 2018. In our view, the increase in price is attributable to a decline in oil production from a combination of scaling-back in activity, and core-OPEC/Russia production cuts. Though the glut of oil stocks may persist for a further month, we believe there is a fair prospect of prices around US$35.00/bbl in Q3 2020.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) advanced by 1.87% last week in four days of trading (Friday was a public holiday). The year-to-date return is negative 14.23%. Last week Ardova Oil (+20.94%), GT Bank (+8.81%), Oando (+7.83%) and MTN Nigeria (+7.69%) closed positive, while Nigerian Breweries (-13.04%), Unilever Nigeria (-4.55%), Guinness Nigeria (-2.65%) and Fidelity Bank (-1.65%) fell. Although gains were recorded in the four trading sessions last week, we are not convinced that this is a rally that will be sustained all the way through to the end of the year – as was the case of the rally we saw in April 2017. All the same, we believe it makes sense to increase portfolio positions which we consider to be good value. See the Model Portfolio on page 3 for details.

The strange case of Africa and COVID-19

Over the past few days we have attempted to build a model of COVID-19 infection – and given up. Despite the best efforts of two former colleagues, both with math degrees, and plenty of our own time hunched over spreadsheets, the task is too difficult. The reason is lack of data on infection, as well as lack of data on recoveries, both of which are essential inputs into the standard model. This is as true of developed nations as it is true anywhere else in the world. Until countries can test entire populations (Germany might achieve this benchmark by year-end), we doubt there will be a trusted model. Nevertheless, epidemiologists still develop models and influence government policy. And, of course, they differ.

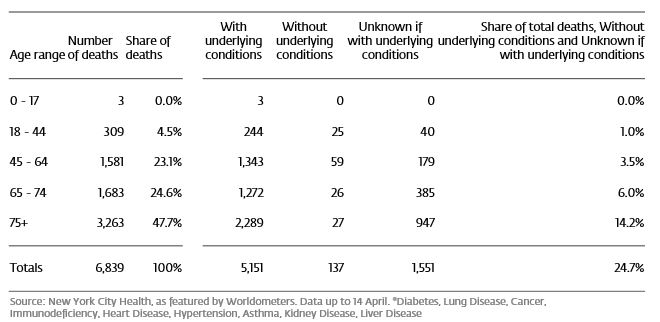

There are, however, data on deaths from COVID-19, and we are inclined to treat these as much more reliable than any model of infection rates. We came across this table of deaths from COVID-19 recorded up until 14 April in New York State. The breakdown is by age group.

COVID-19 fatality data for New York State

What are the implications for Africa, and Nigeria in particular? The main implication is that deaths are concentrated among those over 44 years of age, and the older the age group the greater incidence of recorded death from COVID-19. In Nigeria 62.3% of people are under 25, and 92.7% are under 55. If (and it is a big ‘if’) one can read across from New York State to Nigeria, then Nigerian survival rates may turn out be higher than those in New York State.

This could explain recent newspaper reports about a puzzlingly low impact of COVID-19 in African countries. Is it due to under-reporting? Is it due to a delay in the spread of the disease? Is it due to COVID-19’s dislike of heat and ultra-violet light? These may be factors. But a youthful population, in our opinion, is likely to prove key.

This does not address – it does not even begin to address – the issue of infection rates. The data in the table has nothing to add to the debate about the prevalence of COVID-19 infection. It cannot be used as evidence that COVID-19 is a widespread infection with a low fatality rate (concentrated among the elderly), which is the opinion of the influential Swedish epidemiologist Johan Giesecke. But it is consistent with that view. Whether COVID-19 infection proves to be narrow or widespread, we believe Africa’s best chances lie in its youthful demographics.

Model Equity Portfolio

What is it about short weeks? Last week had just four trading sessions, ahead of a public holiday on Friday, and the market gained 1.87%. During the two short trading weeks either side of Easter it gained a total of 8.66%. This can be unnerving when looking after a portfolio with a notional cash position of 42.1%.

The question comes up again, “Is this a rally that can be sustained for several months, and is this the rally that anticipates the end of the crisis?” This was certainly the case with the rally in April 2019, but that rally came at the end of a five-quarter-long recession and when oil prices were firmly above US$40.00/bbl (though not always trending upwards). Today we are likely entering a recession and oil prices (Brent) cannot even manage US$30.00/bbl (though we expect it to trade around US$35.00/bbl in Q3).

All the same, in market that can rise this way it makes sense to buy stocks that we like, hence our move two weeks ago to increase our notional position in MTN Nigeria from 20% of the portfolio to 26% of the portfolio.

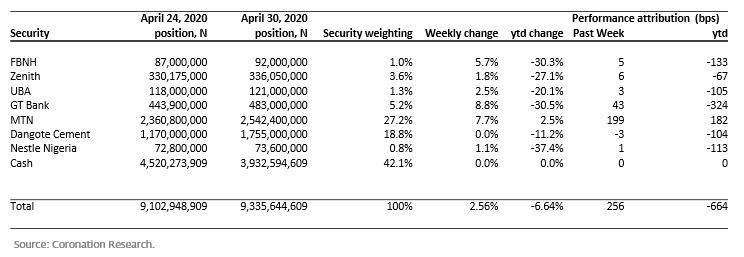

Model Equity Portfolio for the week ending 30 April 2020

Last week the Model Equity Portfolio gained 2.56%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.87%, therefore outperforming by 69basis points. Year-to-date it has lost 6.64%, against a loss of 14.24% in the NSE-ASI, outperforming it by 759bps.

Last week we made notional purchases, in the middle of the week, to take our notional position in Dangote Cement to close to a neutral weight of 19.0%, as indicated in last week’s publication. We have no plans for further notional purchases this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.