The VIX Index, a US index of volatility, stands at its highest level since the global financial crash of 2008. Volatility is not the same thing as risk, but volatility can cause risk if global investors head towards safe assets (e.g. US bonds) and do not wish to refinance comparatively risky assets in emerging markets. Meanwhile oil prices fell sharply last week, with a familiar story of a country taking on the US shale industry. This looks like a problem.

FX

Nigeria’s foreign exchange markets were volatile last week in the face of low oil prices and currency disruption in other commodity-producing nations such as Russia and Brazil. In the NAFEX market (which supplies the rate quoted by Bloomberg – it is also known as the I&E Window) the Naira began the week at N363.45/US$1 and ended it at N368.34/US$1. In the parallel, or street, market the Naira was quoted at N360/US$1 (to buy US dollars) at the beginning of the week and briefly touched N400/US$1 on Thursday before strengthening to N380//US$1 on Friday. Late in the week the Central Bank of Nigeria supplied the NAFEX market with US$210m which quietened things down.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity rose by 123bps to 12.02%, and at 3 years rose by 69bps to 9.42% last week. The annualised yield on 335-day T-bill, the longest duration available in the secondary market, declined by 1bp to 5.90%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 15.57%, 145bps up week-on-week. The bond market was bearish as market players remained wary of the impact of falling oil prices on the country’s crude oil revenues.

Oil

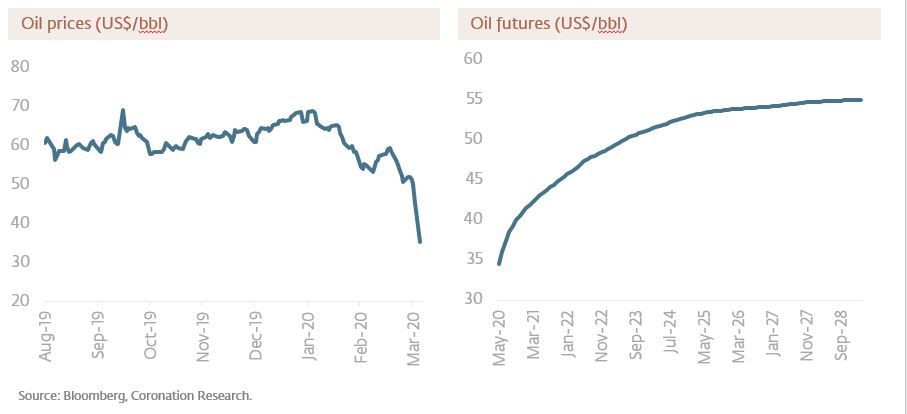

The price of Brent declined by 25.23% last week to US$33.85/bbl. The average price, year-to-date, is US$56.46/bbl, 12.06% lower than the average of US$64.20/bbl in 2019, and 21.25% lower than the average of US$71.69/bbl in 2018. The sharp slow-down in economic activity brought on by the COVID-19 is being compounded by a potential flood of supply, with top producers Saudi Arabia and Russia pledging to ramp up production. At the moment, there is no likelihood of a reconciliation between these countries, dimming the possibility of price increase in the short-term.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 13.49% last week, the year-to-date return is negative 15.30%. Last week Zenith Bank (-42.3%), Cadbury Nigeria (-32.1%), Access Bank (-31.2%) and Oando (-30.0%) fell. Zenith Bank went ex-dividend on Tuesday 10 March. Nigeria’s equity market joined the global rout. Given that there is no improvement in the global outlook – depressed oil prices and the coronavirus pandemic – we think there is still a possibility of further declines.

Oil price crash

The recent crash in the oil market promises a lot of pain for the two countries at loggerheads – Saudi Arabia and Russia – and other oil dependent economies such as Nigeria, Iran and Venezuela. While the impact may be less severe for Russia, because of its reported US$570.0bn FX reserves, it could be problematic for other countries if oil prices remains at the current level for a long period.

Russia depends heavily on oil production taxes and needs the price of oil to stay above US$42/bbl to keep its budget balanced: Saudi Arabia, on the other hand needs it to be around US$50/bbl. The difference, then, is not large, and it might seem that the best option would have been to reach an agreement to reduce production in a coordinated fashion so as to stabilize prices. Indeed, this happened during the period from 2016 until now. But both countries have chosen confrontation, which has led to a slump in oil prices that were already affected by reduction in demand due to the coronavirus epidemic.

Russia appears to be making a point of taking oil prices down in order to win back market share lost to shale oil producers in the US during recent years. If Russia truly has the resources to do this – in other words, if it can make good budget shortfalls with savings – then this could be bad news for oil prices over a long-perhaps two-year – period. Saudi Arabia has vowed to increase production and also has significant foreign exchange reserves (though it is not clear how much it can spend meeting budget shortfalls).

A similar move by Saudi Arabia to curtail US shale production in late 2014 and 2015 ended in failure, and prompted the ‘OPEC plus Russia’ agreements to hold prices steady after 2016. The problem, this time around, is not only that Russia and Saudi Arabia are at loggerheads, but that the US is in a good position to grant soft loans to its shale producers, something that might stave off recession in key US states during an election year.

Therefore, our concern is that oil prices may remain depressed for a long time because the world’s three largest oil producers may attempt to out-finance each other. Even if the oil price slump is only as long as it was in 2015 and 2016 (the average price of Brent was US$53.56/bbl in 2015 and US$45.08/bbl in 2016) then the potential for disruption for other oil producers would be significant, in our view.

Model Equity Portfolio

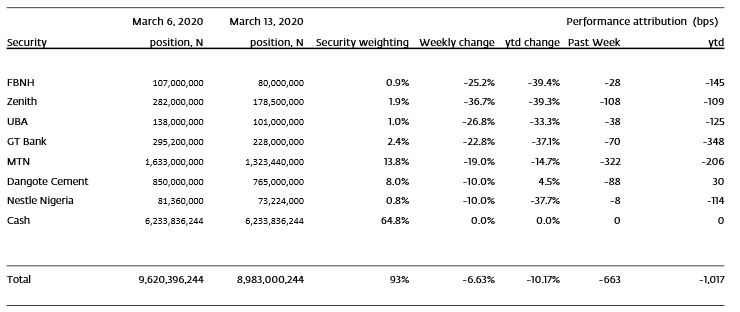

Last week the Model Equity Portfolio lost 6.63% compared with the NSE-ASI which lost 13.49%. Year-to-date its loss is 10.17% compared with a loss of 15.30% for the NSE-ASI. Much of the relative outperformance of the Model Equity Portfolio can be attributed to our decision to de-risk it, taking the cash position 64.8%. Naturally, we understand that most equity funds are restricted from holding such a high proportion of cash.

It was noticeable last week that there was almost nowhere to hide in the equity market, at least among the largest index weights and the most traded stocks. There is a frustrating lack of low-beta stocks, and our bank positions tended to move a lot last week.

Model Equity Portfolio for the week ending 13 March 2020

Having not been able to buy Dangote Cement last week we aim to build an index-neutral position in it this week, and we will make index-neutral, by buying a little extra stock, our positions in Zenith Bank and GT Bank, both of which look remarkably cheap at these levels.

However, we intend to remain underweight equities overall, believing that the market is still set for stormy weather.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.