We began this year with the view that the Naira / US dollar exchange rate could hold for most of 2020. When the coronavirus outbreak became apparent at the end of January we still believed that a combination of monetary stimulus in developed markets and foreign portfolio investment into Nigeria would stabilise the risk outlook. Last week’s crash in oil prices, however, elevates risks considerably.

FX

The Central Bank of Nigeria (CBN) has been able to stabilize the Naira/US dollar rate since mid 2017, but we now see increased FX risk. With oil prices currently trading around US$35.61/bbl and after recent declines in FX reserves, it may become difficult for the CBN to continue its intervention in the FX markets for a sustained period. The proposed sovereign Eurobond issue, which could bolster CBN FX reserves by up to US$3.0bn, is not yet underway and reserves are currently US$36.2bn. Based on the increased risk associated with oil earnings our foreign exchange outlook needs to be put under review.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity rose by 71bps to 10.79%, and at 3 years rose by 178bps to 8.73% last week. The annualised yield on 342-day T-bill, the longest duration available in the secondary market, rose by 28bps to 5.91%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 14.12%, 149bps up week-on-week. Subscription for last week’s OMO auction of N110.51bn (US$305.60m) – the smallest this year – was 1.12x, an indication of weak demand from foreign investors, in our view.

Oil

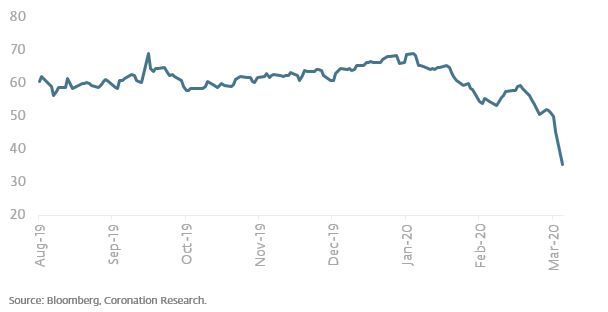

The price of Brent declined by 10.39% last week to US$45.27/bbl but trades at close to US$35.61/bbl today. The average price, year-to-date, is US$58.75/bbl, 8.48% lower than the average of US$64.20/bbl in 2019, and 18.05% lower than the average of US$71.69/bbl in 2018. During last week’s OPEC-plus-Russia meeting, the parties involved could not reach a compromise on production cuts as they had done over the last two years. We think oil prices will continue to be under pressure as Saudi Arabia intends to increase production and discount prices.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index rose by 0.26% last week, the year-to-date return is negative 2.10%. Last week FBNH (+13.83%), Sterling Bank (+11.43%), Mobil (+9.98%) and FCMB (+8.19%) closed positive. Unilever Nigeria (-13.33%), Lafarge Africa (-11.94%), Ardova Oil (-10.00%) and Nestle Nigeria (-10.00%) fell. The sell-offs eased slightly last week, but may resume in the coming days, in our view. The economic outlook for Nigeria in the face of declining oil prices and the coronavirus epidemic appears to have worsened considerably.

Oil price crash is a defining factor

Our core view of the Naira / US dollar exchange rate in 2020 has been founded on oil prices trending around US$60.00/bbl this year and, specifically, not trending below US$50.00/bbl. We also predicated our currency view on a resumption in Foreign Portfolio Investment (FPI) in the open market operation (OMO) bills of the CBN (because such sales bring US dollars into the CBN’s FX reserves). These benchmarks, set out in Coronation Research, Year Ahead 2020, 16 January, have now been crossed.

Following a remarkable break-down in the so-called OPEC-plus arrangement (the member nations of OPEC plus Russia), which has enforced production cuts since 2016, the price of oil (Brent) fell from US$51.90/bbl last week to US$35.61/bbl today. In the OMO market the CBN sold US$1.7bn to foreign investors in January, which we considered a good number: but it sold only US$1.0bn in February, which we consider mediocre. Whereas the threat posed by the coronavirus might have been manageable in terms of issuing OMO bills and sovereign Eurobonds (see below), the crash in oil prices elevates risk factors considerably.

Oil (Brent) prices, US$

This is not the end of the oil price story. It is generally acknowledged that Saudi Arabian brinksmanship is driving down prices. Its ally, the USA, might have something to say about this, given the threat that low oil prices pose to US shale production (or at least some of it). However, though we do not rule out a rally in oil prices from here, a sustained level above US$/50.00/bbl, let alone US$60.00/bbl, does not seem likely in the immediate future.

Another problem is that, while Nigeria could have sold sovereign US dollar Eurobonds in January (both Ghana and Gabon did so), permission was only recently granted to the Debt Management Office (DMO) to commence marketing, and market conditions for African sovereign eurobonds are very different now to two months ago.

In summary, we are placing under review our core view, namely that the current interbank rate of N365.91/US$1 can be held for most if not all of 2020 (as we wrote on 16 January). The risks have risen.

Model Equity Portfolio

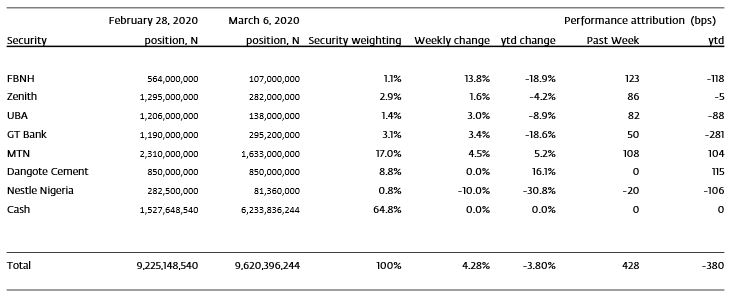

In last’s week’s Nigeria Weekly Update (2 March) we published our intention to radically de-risk our Model Equity Portfolio, detailing the stocks in which we intended to make notional trades (mainly sales). Our intervention turned out to be well-timed, as we found ourselves selling into a sharp rally. And we doubt we will see a rally like that for a while. We made notional sales of our stocks during mid-session during the middle of the week.

We made notional sales of FBN Holdings, Zenith Bank, UBA and GT Bank and were able to crystalise gains from our massively overweight positions in those stocks (a 43.30% weight in banks versus a 18.30% index weight). Those notional stock positions are now at slightly lower levels than their respective weights in the Nigerian Stock Exchange All-Share Index (NSE-ASI). We made notional sales of MTN Nigeria shares in order to bring it down to a more-or-less neutral weight. We were not able to make notional purchases of Dangote Cement shares in order to bring it up to a neutral weight, but will continue to try this week. We cut our notional position in Nestle Nigeria by two-thirds.

Model Equity Portfolio for the week ending 6 March 2020

The Model Equity Portfolio, as at Friday’s close of business, was 3.80% down on the year compared with a market down by 2.10% on the year. Though 170bps under-performance is not good, it is much better than what we were looking at one week ago. We have a notional cash position of 64.8%, compared with 15.4% a week ago, but this may work well given the state of global markets in general and the Nigerian equity market in particular.

We have swung from a high-risk model portfolio to a low-risk one (though we are still exposed to heavily-traded stocks which can fall quickly during a correction). This highly-cautious stance itself is a risk and we will devote time to figuring out how to manage it over the coming week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.