The Central Bank of Nigeria (CBN) last Friday changed the rate in the principal foreign exchange markets by 3.6% in US dollar terms. This looks like a swift adjustment to the pressures in the markets and suggests flexibility. When it comes to the Monetary Policy Rate (MPR) to be decided by the CBN’s Monetary Policy Committee (MPC) today, the way may be open to adjust the headline 13.5% rate downwards, in our view, as a response to economic pressures caused by the coronavirus.

FX

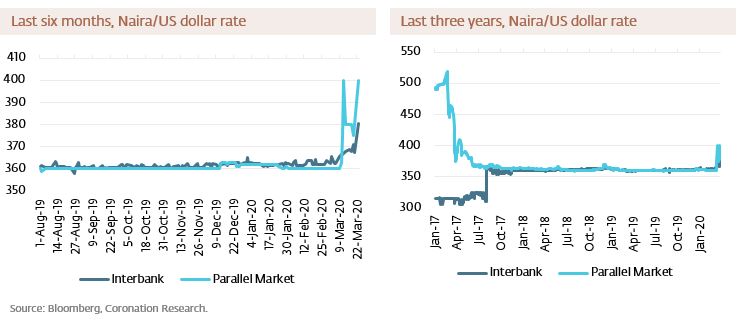

The CBN changed the Naira/US dollar exchange rate on Friday last week. It pegged the rate at N380.2/US$1 for the NAFEX market (which is the price indicated on the Bloomberg page USDNGN), which is also known at the Importers and Exporters Window (I&E Window), and for registered bureaux de change. The official exchange rate was changed from N306.5/US$1 to N360.0/US$1. These changes have led to a high degree of convergence of exchange rates, although we notice one website indicating US dollars sold at N400/US$1 today. Be that as it may, the CBN’s actions show a swift reaction (much faster than in 2016, for example) to market pressures. This suggests a degree of flexibility.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity rose by 77bps to 12.79%, and at 3 years rose by 136bps to 10.78% last week. The annualised yield on 328-day T-bill, the longest duration available in the secondary market, remained at 5.90%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 20.93%, 536bps up week-on-week. Last week the CBN recorded zero subscription for its N150.0bn (US$394.7m) OMO sale across different tenors despite the elevated yields on these instruments.

Oil

The price of Brent declined by 20.30% last week to US$26.98/bbl. The average price, year-to-date, is US$53.94/bbl, 15.97% lower than the average of US$64.20/bbl in 2019, and 24.76% lower than the average of US$71.69/bbl in 2018. Oil prices have fallen for four straight weeks by 69.55% and we think they will remain suppressed in the short term amid falling demand, build-up of global stocks and the end of production limits within OPEC after April 1.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 2.36% last week, the year-to-date return is negative 17.30%. Last week Oando (+16.93%), Cadbury Nigeria (+13.64%), MTN Nigeria (+10.52%) and Fidelity Bank (+10.46%) closed positive while Dangote Cement (-15.23%), International Breweries (-13.39%), UBA (-10.71%) and Seplat (-10.00%) fell. Given that there is no improvement in the global outlook – depressed oil prices and the COVID-19 epidemic – we think there remains the possibility of further declines.

Foreign exchange flexibility

Last Friday, 20 March, the CBN changed the Naira/US dollar exchange rate. The rate for reference in the Nigerian Autonomous Foreign Exchange Market (the NAFEX market), which is also known at the Importers and Exporters Window (I&E Window), was changed from N366.7/US$1 to N380.2/US$1, a 3.6% change in US dollar terms. This rate was also set for the officially-sanctioned bureaux de change. The official rate (which is used in budget calculations, for example) was changed from N306.5/US$1 to N360.0/US$1.

As we wrote in Coronation Research, Year Ahead 2020, 16 January, our three methods of reaching Naira/US dollar fair value came to values of N346.69/US$1, N399.44/US$1 and N400.40/US$1, with a simple average, for these three rates, of N382.18/US$1. We did not think that this rate would be reached during 2020, reasoning that oil revenues, issues of Eurobonds and other debt, together with sales by the CBN of its open market operation (OMO) bills to foreign investors, would combine to keep the rate at close to N362.50/US$1 for most, if not all, of 2020. We have been overtaken by events in a short space of time.

The CBN appears to be reacting swiftly to the build-up in pressure in the markets. One reason is that, despite its name, the NAFEX market enjoys supply of US dollars from the CBN. Managing the need to carefully manage its US$35.9bn of FX reserves and the exchange rate, the CBN has altered the latter.

It also seems that the Monetary Policy Council (MPC) of the CBN, which meets today and tomorrow, no longer makes a close connection between domestic interest rates and the Naira/US dollar rate. This may give the MPC the confidence to signal economic stimulus – as most of the world’s central banks are doing now – by reducing its headline 13.5% Monetary Policy Rate (February CPI: 12.20% year-on-year) when it concludes its meeting tomorrow.

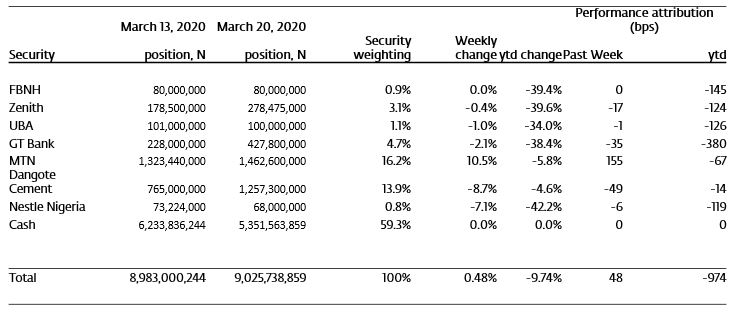

Model Equity Portfolio

Last week the Model Equity Portfolio gained 0.48% compared with the NSE-ASI which lost 2.35%. Year-to-date it has lost 9.74% compared with a loss of 17.30% for the NSE-ASI. Last week’s outperformance was due to two factors. First, the market showed renewed interest in MTN Nigeria; it rose by 10.5% over the week and we began the week with a 14.7% position in it. Second, our cash position was extremely high, starting the week at 69.4% of the portfolio, so we missed much of the correction in other stocks.

Naturally, we know that most equity funds could not hold so much cash. For most fund managers the question, during times like these, is where to hide. Last week we complained that there are almost no stocks with low volatility and therefore few places to hide (really, it seemed, nowhere). To an extent MTN Nigeria provided an answer last week. It had high volatility (only this time it was going up) and has a strong investment case in the current climate if only because usage of telecommunications is a defensive part of an economy under pressure.

Model Equity Portfolio for the week ending 20 March 2020

Last week, and as indicated in the last edition of Nigeria Weekly Update, we made notional purchases of Zenith Bank, Guaranty Trust Bank and of Dangote Cement, in order to bring these positions up to close to neutral index weights. (In fact, the percentage values of NSE-ASI index weights change all the time with price changes.)

At this point, and with a notional cash position equal to 59.3% of the portfolio, we will hold off notional trades for a week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.