2020 will see the results of three bold policy experiments started in 2019. First and second were the minimum loan-to-deposit ratio (LDR) of 65% imposed on banks and the ban on local institutions buying open market operation (OMO) bills, both policies aimed at banks growing their loan books. We explain the tensions caused in Coronation Research, Naira Rates for a Credit Boom?, 20 December. The third was the closure of the land borders to encourage local production. We examine this on page 2.

FX

The Central Bank of Nigeria’s (CBN) foreign exchange reserves witnessed a downtrend towards the end of 2019; 10.40% (US$4.48 million) was shed during the year. This reversed the gains seen in 2018 when FX reserves grew by 10.81% (US$4.20 million). Currently, at US$38.54 billion, reserves are almost back at Q4 2017 levels. We, however, believe the CBN is capable of maintaining the current naira foreign exchange level for at least the first six months of this year, as well as the current OMO market to draw Foreign Portfolio Investment (FPI) flows.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity fell by 21bps to 11.40%, and at 3 years rose by 34bps to 10.30% last week. The yield on a near-364-day primary market OMO rose by 158bps to 14.92%, while a Nigerian T-bill with similar tenure closed at 5.20% in the secondary market.

At the OMO auction held on 3 January, there was a no-sale, again, on the 81-day and 197-day offers. The 361-day tenor had a stop rate of 13.26%. For local investors, the T-bill auctions saw stop rates at 3.5% for a 91-day tenor, 4.9% for a 182-day tenor, and 5.2% for a 364-day tenor. Despite these low rates, all three tenors were oversubscribed by 2.55 times on average, edging yields further downward.

Oil

The price of Brent has risen by 3.55% so far this year to US$68.60/bbl. The average price, year-to-date, is US$67.43/bbl, 5.03% higher than the average of US$64.20/bbl in 2019, but 5.95% lower than the average of US$71.69/bbl in 2018. Oil prices started the year on a bullish note following an airstrike by the USA which killed Qassem Soleimani, an Iranian general. The demand-supply narrative in the oil market had previously pressured prices downwards.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index rose by 2.09% last week, the year-to-date return is 0.47%. Last week Seplat (+7.70%), UBA (+7.10%) and FBNH (+5.60%) closed positive while Unilever Nigeria (-5.91%), Nigerian Breweries (-3.19%) and Lafarge Africa (-1.43%) fell.

The first two trading sessions of the new year saw mild gains. The limited investment opportunities for local investors in the money markets provide some support for equities. We expect this week to feature continued gains on the index, assuming that investors build up an appetite for equities.

Food prices settle

What are the effects of closing Nigeria’s land borders? Have there been any benefits to Nigeria’s agriculture and food manufacturing sectors?

The Federal Government of Nigeria (FGN) closed the Seme border, the major border with the Republic of Benin, on 13 August last year and subsequently closed all land borders. This choked the importation of food items such as rice, chicken and turkey, which in turn led to steep increases in market prices.

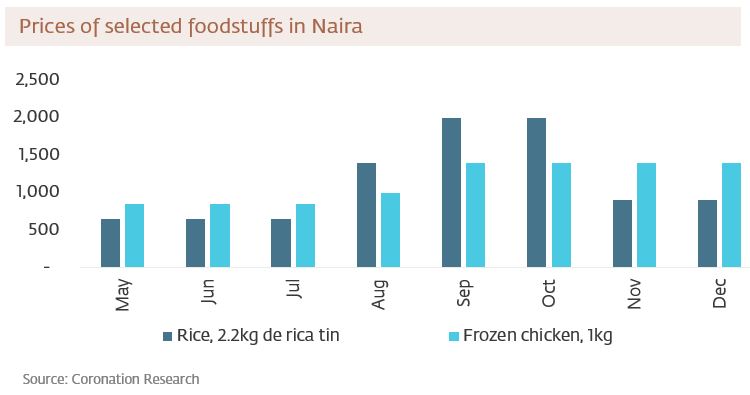

Coronation Research makes routine monthly rounds of street markets to measure prices of Home & Personal Care (HPC) and food items, a continuation of the study behind our 20 May 2019 Nigerian Consumer Report: Power to the Price Point. In the aftermath of the closure of land borders, the prices of rice and frozen chicken rose dramatically.

Prices rose so much that our model low-income household actually adjusted its shopping basket in response. The price of rice (in retail volume) rose by a factor of 2.1x between July and October; the price of frozen chicken rose by 65%. We also noticed that prices of rice moved less the higher the volume, suggesting that market traders were passing on more than their own costs, to begin with.

What has happened subsequently? Prices of locally-produced rice have fallen to around N900 (US$2.50) per 2.2kg “De rica” tin (a standard retail measure), so they are still up 38% from July. Frozen chicken prices have not budged, and are still at around N1,400/kg (US$3.89/kg), still up 65% from their July level.

Does this stimulate agriculture, which is a significant (25.8% in 2018) part of Nigerian GDP? It is too early to tell since Q4 GDP data will not be published for several weeks. Agricultural GDP did register a gain of 2.28% year-on-year (y/y) in Q3 2019 and we expect a bigger year-on-year gain in Q4 2019. Trade (16.3% of GDP in 2018) registered a 1.45% contraction y/y in Q3 2019, not surprisingly. Manufacturing (8.7% of GDP in 2018) registered a small, 1.10%, y/y gain in Q3 2019 (this segment includes food manufacturing) and may benefit from border closures.

All in all, we expect small positive impacts on agricultural and food production from the border closures. The expense, for the consumer, is sticky inflation, which trended upwards to 11.85% y/y in November after 11.41% y/y in October.

Model Equity Portfolio

Today we launch our Model Equity Portfolio. This will feature a small (by institutional standards) sum of notional (not actual) money invested in the Nigerian stock market, following the choices of Coronation Research analysts. The notional sum to be invested will be N10.0bn (US$27.8m).

The Model Equity Portfolio will not be a fund, nor an actual portfolio. As such, it will not be bound by rules concerning diversification across sectors, maximum percentages held in a single stock, etc. Instead, its composition will simply answer the question: “What would Coronation Research analysts hold if required to make investments in Nigerian equities?”

However, we will obey some self-imposed rules: we will publish its notional positions and notional NAV every week that the Coronation Research Weekly is published; we will fully cost our notional purchases and sales of equities with commissions and fees and we will respect liquidity conditions by consulting stockbrokers (i.e. we will avoid making purchases of blocks of stocks that are impossible to buy in reality); we will state in advance our notional purchases for the week ahead, and only make notional purchases after publication (i.e. the opposite of front-running). For example, in the coming week, we intend to make notional purchases of Zenith Bank, UBA, Access Bank, GT Bank, FBN Holdings, MTN Nigeria, Dangote Cement and Nestle Nigeria.

Note that the small notional size of the Model Equity Portfolio may enable it to make purchases, in time, of several small and illiquid stocks that would normally be beyond the scope of mainstream institutional investors.

Our intention it to beat the performance of the Nigerian Stock Exchange All-Share Index over two years.