Which countries will be Africa’s winners and losers at the end of the Covid-19-induced recession? We believe it makes sense to a take a two-year view on this question so, when the International Monetary Fund (IMF) revised its GDP forecasts for 2020 and 2021 last week, we took the opportunity to combine them. The results are on the following pages. There are some surprising results. Generally, it is the non-oil producing nations that do well and among these are some of the poorest countries. East Africa looks poised for a remarkable recovery. On the global stage, China emerges with much better growth than other industrialised nations.

FX

Last week the foreign exchange rate closed essentially flat, with the Naira down by just 0.04% against the US dollar at N385.96/US$1 in the NAFEX market (also known as the I&E Window). In the parallel or street market, the Naira depreciated by 1.09% to close at an offer price of N462/US$1. The two rates are within 20% of each other. While we doubt that the two rates will converge soon, we also doubt that the parallel rate will fall significantly (e.g. more than 10%), so further depreciation may be limited.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 199 basis points (bps) to 5.24%, and at 7 years fell by 74bps to 5.02%, while at 3 years the yield declined by 12bps to 2.98%. In our view, the ongoing crash in bond yields reflects the reinvestment of redemptions from the Open Market Operation (OMO) market as there are no risk-free investment alternatives with better yields. The annualised yield on 335-day T-bill fell by 15bps to 1.99% while the yield on an OMO bill with similar tenure rose by 44bps to 2.87%. Though fewer OMO redemptions are due in November than in October, they resume in volume in December, pointing high institutional liquidity and likely downward pressure on rates ahead.

Oil

The price of Brent crude rose by 0.19% last week to US$42.93/bbl. The average price, year-to-date, is US$42.51/bbl, 33.79% lower than the average of US$64.20/bbl in 2019. According to OPEC Secretary-General, Mohammad Barkindo, the cartel will not be allowing prices to slump again. An OPEC meeting a week ago made no changes to the scheduled production cuts but urged compliance by members. We think that oil prices will remain in a range between US$40.00/bbl and US$46.00/bbl over the coming weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 0.86% last week, with a gain of 6.77% year-to-date, as the market is still experiencing a level of positive sentiment from Nigerian retail and institutional investors. Last week, International Breweries (+12.92%), Cadbury (+12.59%) and Guinness (+12.33%) closed positive, while Ardova (-3.61%), Flour Mills of Nigeria (-1.59%) and Sterling Bank (-1.43%) closed down. See model Equity Portfolio below.

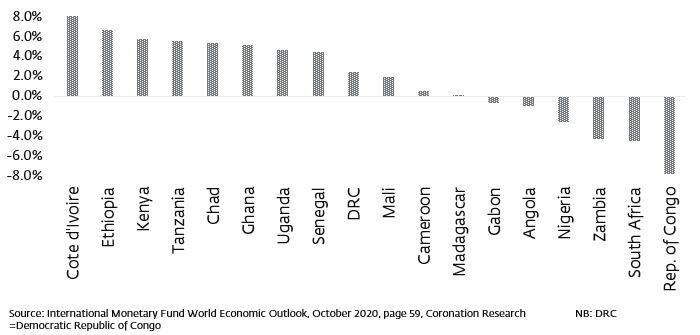

Winners and losers in Africa

The IMF’s World Economic Outlook was published last week and there was some good news for Nigeria. It reduced its earlier (June) forecast of Nigeria’s recession in 2020 from 5.40% to 4.20%. However, this was true of the IMF’s forecasts for many countries because it sees a less severe medium-term impact from Covid-19 than it did four months ago.

We also notice a pattern of winners and losers among countries. This is true of Africa as well as of the biggest economies in the world. And, rather than look at 2020 and 2021 as two separate years, we think it makes sense to combine the IMF’s forecast for both years to arrive at the overall forecast change for the Covid-19-induced recession.

What we are measuring is the forecast two-year change. So, for example, Nigeria is forecast to suffer a recession of 4.3% in 2020f followed by a return to growth of 1.7% in 2021f. That means that the Nigerian economy is forecast to be 2.6% smaller in 2021f that it was in 2019. Taking this measure across Sub-Saharan countries comes up with intriguing results.

Growth of selected African economies, 2020f and 2021f combined

What is the pattern in Africa? To begin with, oil-exporting nations tend to appear on the right-hand side of the chart: Nigeria, Angola and Gabon. The copper producer Zambia also appears on the right-hand side, though its problems are related to its fiscal and monetary imbalances rather than the price of copper (whose price, unlike oil, is higher than a year ago).

Also on the right-hand side is the most highly – industrialised African nation, South Africa. Being industrialised brings all the problems of low levels of international trade and investment during a recession.

What of the winners? They tend not to be commodity producers, tend to be among the poorer African nations, and tend to be in east Africa. (e.g. Ethiopia, Kenya, Tanzania and Uganda). This suggests that poor nations are able to grow when they are industrialising from a low base and when fiscal and monetary policies are complementary.

Winners and losers in Africa

What these changes within Africa mean is that investment, both domestic and international, is going to be more prevalent in the high-growth economies than in low-growth and shrinking ones. The IMF World Economic Outlook publication also gives clues as to where this investment is going to come from if we assume that expanding economies in the developed world will invest more than ones in recession.

When it comes to the world’s largest economies, the IMF’s forecasts carry a very clear message. As we measure the combined forecasts for 2020f and 2021f, China emerges as the clear winner over the G-8 group of highly-industrialised nations.

This does not mean that China will soon overtake these nations. The USA, for example, is forecast to have an economy of some US$21.15 trillion (trn) in 2021f, compared with China’s forecast US$15.59trn in 2021f. But China is catching up fast and maybe in a position to provide further investments in Africa, in our view.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.