What will be the fiscal and monetary responses to the events of the last week? The monetary authorities are probably relieved that the equity market advanced last week; that there was a rally in the bond market; and that the exchange rate barely moved. There is no evidence that financial markets were alarmed. In most countries, the fiscal and monetary authorities would consider a fiscal stimulus and monetary easing. We discuss the outlook for such policies below.

FX

Last week the foreign exchange rate held essentially flat, with the Naira appreciating by 0.06% against the US dollar to N385.71/US$1 in the NAFEX market (also known as the I&E Window). In the parallel or street market, the Naira depreciated by 0.22% to close at an offer price of N463/US$1. The two rates are still within 20% of each other. We expect continued pressure on the parallel exchange rate going forward but do not think that it will move much, given the policy of the Central Bank of Nigeria (CBN) to supply US dollars to the Bureaux de Change (BDC).

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 107 basis points (bps) to 4.17%, and at 7 years fell by 102bps to 4.00%, while at 3 years the yield declined by 20bps to 3.18%. The annualised yield on 328-day T-bill fell by 122bps to 0.77% while the yield on an OMO bill with similar tenure fell by 209bps to 0.78%. Following the contraction in yields witnessed last week, we expect demand for instruments in the T-bills secondary market to slow down over the coming week. We expect investors’ focus to be on the primary market auction (PMA) holding next week, in which the CBN will roll over NGN160.3 billion (US$414.5m) worth of maturing bills. However, we do not expect a sharp rise in market interest rates.

Oil

The price of Brent crude dropped by 2.70% last week to US$41.77/bbl. The average price, year-to-date, is US$42.50/bbl, 33.79% lower than the average of US$64.20/bbl in 2019. Demand for crude around the world has slowed due to the surge in Covid-19 cases especially for countries in Europe, Latin America and the USA. The surge has helped explain the weakening in demand for gasoline in affected countries. But, on the bright side, the demand for aviation fuel is rising in Asia. We think that the pandemic will continue to keep the price in a narrow range of between US$40/bbl and US$46/bbl. over the coming weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 0.13% last week, with a gain of 6.91% year-to-date. Losses early in the week were reversed as a result of bargain hunting in the last two trading sessions of the week, pushing the market into the black. Last week, International Breweries (+18.20%), Flour Mills (+6.24%) and Nigerian Breweries (+5.69%) closed positive, while Cadbury Nigeria (-6.83%), Honeywell Flour Mills of Nigeria(-6.19%) and Guinness Nigeria (-5.34%) closed down. See model Equity Portfolio below.

The policy response to events

The domestic outlook

How will Nigeria’s fiscal and monetary authorities react to the events of the past week? We believe that their concerns will focus on business continuity, in other words figuring out how quickly businesses can return to normal and what can be done to help. There are many practical aspects to this, such as the loss of POS machines from retailers, damage to property, and the impact on insurers. All these will be assessed. The next step is to formulate policies.

In terms of monetary policy, the Central Bank of Nigeria (CBN) already has a pro-growth stance which encourages commercial banks to lend to businesses (for example, through the mandatory 65% loan-to-deposit ratio) and it has seen market interest rates fall to record lows this year. A back-to-business policy would be consistent with its existing stance, requiring no change in direction. It could signal its desire for further expansion through its Monetary Policy Rate (MPR) which it recently cut, on 22 September, from 12.50% to 11.50%. It could also introduce measures to further encourage banks to lend and to increase overall system-wide liquidity, though it might wish to maintain the current cash reserve rate (CRR) at 27.5%. It could also expand its own targeted lending initiatives. In short, we expect the CBN to be busy.

Like the CBN, the Federal Government of Nigeria (FGN) already has a pro-growth stance with its N2.3 trillion (US$5.9bn) Nigerian Economic Sustainability Plan so, again, no change in policy direction is required. As we often point out, the government in Nigeria is not large in relation to GDP, so the ability of the government to stimulate the economy is much less than in developed economies. However, this does not rule out an initiative on this front.

One key point is the stability of the Nigerian financial markets. The equity market rallied a little last week, the bond market continued its rally, and the exchange rate hardly moved. The Nigerian Stock Exchange Insurance Index fell last week, but only by 0.6%. From the point of view of US dollar investors, yields on FGN Eurobonds moved very little last week. In fact, they were affected more by the contagion from Zambia and Angola in late September than they were last week.

This shows that financial markets believe in a swift return to business as normal, something which, in our opinion, takes the pressure off policymakers in the short term. Rather than having to support financial markets, as sometimes happens in developed nations, Nigeria’s policymakers can afford a hands-off approach to them. And they can focus directly on the issues of business continuity and the flow of credit.

The international outlook

In times like these, it is possible to focus too much on domestic conditions and not pay enough attention to the international outlook. This would be a mistake because significant changes may be afoot. The US presidential election takes place on 3 November and if the Democratic Party candidate, Joe Biden, is elected then there would be knock-on effects on global oil markets. Biden supports a nuclear deal with Iran, which could result in certain sanctions being lifted and an increase in Iranian oil sales to global markets. This could hold the price of oil down, delaying its much-forecast return to over US$50.00/bbl in 2021.

Conversely, a Biden administration would likely take a more positive attitude to engage with African nations than the present incumbent, presenting Nigeria with fresh opportunities.

At the same time, the surge of liquidity directed by central banks in developed markets to combat the effects of the Covid-19 pandemic is likely to have significant effects on emerging markets. Global investors are one again, hungry for yield and are likely to renew their search again in 2021. This augurs well for Federal Government of Nigeria (FGN) should its Debt Management Office opt for a Eurobond issue next year. Nigeria was absent from the Eurobond market in 2019, is unlikely to issue during the closing months of 2020, and therefore might be welcome if it chooses to issue in 2021.

As international investors search for yield in 2021 it may even be possible to resume, at some point, issues Naira-denominated fixed-income securities to international investors, thereby restarting significant levels of Foreign Portfolio Investment (FPI). International factors hold many of the keys for policymakers going into 2021.

Model Equity Portfolio

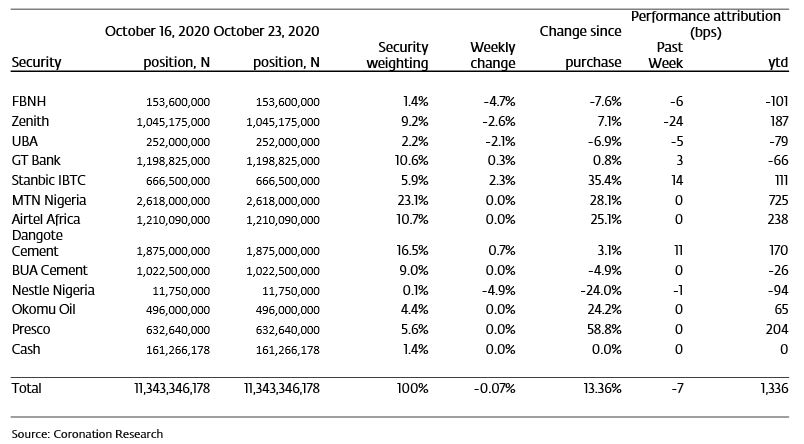

Last week the Model Equity Portfolio fell by 0.07% compared with rising in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.13%, therefore underperforming it by 20 basis points. Year-to-date it has gained 13.36% against a gain of 6.91% in the NSE-ASI, outperforming it by 645bps.

Our underperformance is attributable to our notional positions in banks, notably Zenith Bank, though we note that our notional positions in GT Bank and Stanbic IBTC both made positive contributions.

Our overall notional position in banks is 29.2%, compared with an index-neutral position of close to 20.0%, and this overweight was largely responsible for our three straight weeks of outperformance against the NSE-ASI prior to last week. We continue to think that banks offer interesting dividend yields in the context of falling yields in the bond markets and we are minded to maintain our notional overweight position.

Model Equity Portfolio for the week ending 23 October 2020

In fact, with a strong rally in the bond market and further OMO bill redemptions due in December, it seems to us that Nigerian institutional investors may continue to diversify their holdings and therefore may continue to buy equities. Although we try to make overall calls on the direction of the market as infrequently as possible, the reappearance of institutional investors recently persuades us that the equity market is likely to remain supported going forward. We plan no portfolio changes for the coming week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.