Wise investors in the Nigerian equity market count the dividend yields of the stocks they hold. These days, and with T-bill yields and bond yields trending downwards (and far below the level of inflation), there are some stocks with yields as strong as fixed income. As investors consider risk assets, like equities, again, they need to measure total returns. See details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) depreciated by 0.01% to close at N411.50/US$1. On the other hand, in the parallel (or street) market, the Naira strengthened by 0.97% to close at N510.00/US$1. In our view, the news of the US$3.35bn Special Drawing Right (SDR) allocation to Nigeria from the International Monetary Fund (IMF) and the Federal Government of Nigeria’s (FGN) imminent Eurobond issue have raised confidence and prompted a slight rally. Currently, the gap between the I&E window rate and the parallel market rate stands at 23.94%. The Central Bank of Nigeria’s (CBN) reported FX reserves rose by 0.49% to US$33.56bn. Amidst the recent developments, we expect the parallel rate and the I&E Window rates to trade range-bound in the near term.

Bonds & T-bills

Last week, the bullish trend in the secondary market for FGN bonds persisted. The yield of an FGN Naira-denominated bond with 10-years to maturity fell by 24bps to 12.41%, the yield on the 7-year bond fell by 14bps to 12.36%, and the yield on the 3-year bond fell by 2bps to 10.80%. The overall average benchmark yield fell by 13bps w/w to close at 11.94%. Our expectations for yields is that the rise if any will not be sharp in the coming three months due to less aggressive borrowing.

Activities in the Treasury Bill (T-bill) secondary market was bullish following the improvement in liquidity for much of last week. The annualised yield on a 342-day T-bill in the secondary market fell by 50bps to 8.35%, while the yield on a 221-day OMO bill rose by 4bps to 8.95%. Overall, the average benchmark yield for T-bills fell by 27bps w/w to close at 5.63%, while the average yield for OMO bills fell by 91bps w/w to close at 7.78%. At this week’s T-bill PMA, the DMO is expected to offer N51.49bn worth of bills across all tenors. We expect quiet trading in the first few days of the week in the T-bill secondary market as participants position for the primary market auction (PMA) during the week.

Oil

The price of Brent crude fell by 7.38% last week to close at US$70.70/bbl, showing a 36.49% increase year-to-date. The average price year-to-date is US$66.76/bbl, 54.46% higher than the average of US$43.22/bbl in 2020. Oil prices declined last week as COVID-19 cases climbed in the U.S. and China, and U.S. crude inventories recorded a week-on-week increase. Nevertheless, we reiterate our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was up 0.68% last week to close at 38,811.11 points. Consequently, the year-to-date loss eased to -3.62%. Airtel Africa +5.69%, Unilever Nigeria +3.57%, and FCMB Group +3.33% closed positive last week, while Ardova -4.91%, Honeywell Flour Mills -4.76%, and Dangote Sugar -4.32% closed negative. Sectoral performances were broadly bearish, with the NGX Insurance index, -1.65%, being the biggest loser. The NGX Oil and Gas -0.61%, NGX Banking -0.58%, NGX Consumer Goods -0.48%, NGX Industrial index -0.21%, and the NGX 30 -0.11% indices followed suit. See Model Equity Portfolio below.

Total Equity Returns

The NGX All-Share Index stood at 38,811.11 points at the end of last week, 3.6% down from the beginning of the year. This year it has traded within a range of 93.5% and 105.3% of its starting value, meaning that, so far, 2021 has been a less-than-usually volatile year (in contrast with last year, for example). Yet, has the index really lost that much money? What if investors in the index at the beginning of the year hold on to their investments, collect their dividends and reinvest them?

NGX All-Share Index and the Bloomberg Cumulative Return Index, (1 Jan 2021=100)

Here the story is different. The total cumulative gross return, as presented by Bloomberg, is a positive 0.4% year-to-date, which is almost four percentage points better than the simple index return. This assumes that investors collect their dividends gross and reinvest them. In the chart, the Cumulative Gross Return begins to diverge from the simple index return in March, when companies started paying their full-year dividends for 2020.

However, this is not a strictly realistic account of what investors have earned this year. Most investors pay a 10% withholding tax on their dividend income, so we would have to reduce the incremental return of almost four percentage points by about a tenth to arrive at a true return. (Bloomberg does have a net cumulative return function, but it gives the same data as the gross cumulative return function for the NGX All-Share Index this year, so presumably, it does not subtract withholding tax.)

This brings up another topic, namely the effectiveness of reinvesting dividends. If the cumulative total return merely took gross dividends and added their cash value to the return, then adjusting the incremental return for withholding tax would be easy (i.e. reduce it by 10%). However, gross dividends are reinvested, meaning that in a falling market the reinvestment destroys value and in a rising market (like last year) it boosts value. Tracking the effectiveness of reinvesting dividends (both gross dividends and net dividends) is a complex business. However, it would create a much better guide to overall equity investment returns than either the simple index (essential though it is) or the Bloomberg data for gross cumulative returns.

Followers of our Model Equity Portfolio may have noticed our predilection for bank stocks, and one reason (not that simple stock prices necessarily show it) is that their dividend yields are generally higher than the market overall, and in some cases match the yields of T-bills. One of our main investment themes is that, for the past 18 months, investors have not been able to beat inflation with T-bill yields, and they are being forced to look at risk assets (like equities) again. Sorting them out by dividend yield and by total return is probably a good place to start.

Model Equity Portfolio

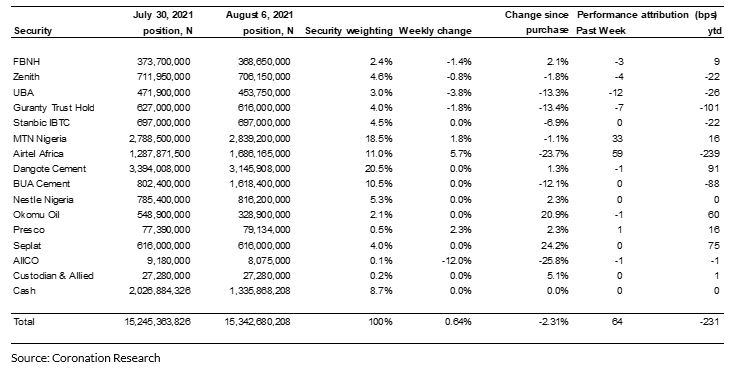

Last week the Model Equity Portfolio rose by 0.64% compared with a rise in the NGX Exchange All-Share Index (NGX-ASI) of 0.68%, therefore underperforming it by 5 basis points (allowing for rounding of basis points). Year to date it has lost 2.31% against a loss in the NGX-ASI of 3.62%, outperforming it by 131bps.

Model Equity Portfolio for the week ending 6 August 2021

As advised a week ago, we spent last week neutralising our notional positions (i.e., took our notional exposure to close to index-neutral weights) in the four big index weights, namely Dangote Cement, Airtel Africa, MTN Nigeria and BUA Cement. We adjusted our notional cash position accordingly. It came down from 13.3% to 8.9%.

This month we look forward to the announcement of first-half results from the major banks. In our publication ‘Nigerian Banks: resilience built in’ (25 June) we argued that the banks have proven to be adept at protecting their margins over the interest rate cycle and that 2021 is likely to prove no exception. We will seek to increase our notional overweight in banks stocks this week, making notional purchases and taking our notional cash position down towards 3.0%.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.