Over the past three weeks, the Nigeria Weekly Update has examined how total cumulative equity returns (returns with dividends reinvested) have outperformed equities this year and examined the best dividend-paying stocks. Yet, over a long study period (six years) the returns have been poor. The reason, we believe, is the de-rating of the market, with investors demanding more earnings for each Naira they invest in stock. This process cannot go on forever, in our view, so equities are worth a second look now. See details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) depreciated by 0.08% to close at N412.00/US$1. Similarly, the Naira weakened by 0.77% in the parallel (or street) market to close at N524.00/US$1. As a result, the gap between the I&E window and parallel market rates now stands at 27.18%. Elsewhere, the Central Bank of Nigeria’s FX reserves rose by 0.17% to US$33.57bn. We reiterate our view that the FGNs potential Eurobond issuance and the US$3.3bn allocation from the International Monetary Fund’s (IMF) Special Drawing Right (SDR) are likely to help shore up the external reserves. Amidst these developments, we expect the parallel rate and the I&E Window rates to trade range-bound in the near term.

Bonds & T-bills

Last week, the bullish trend in the secondary market for FGN bonds persisted, given the fall in the 364-day bill stop rate at the T-bill primary auction. As a result, the yield of an FGN Naira-denominated bond with 10-years to maturity fell by 28bps to 11.64%, the yield on the 7-year bond fell by 15bps to 11.40%, and the yield on the 3-year bond fell by 39bps to 9.82%. The overall average benchmark yield fell by 23bps w/w to close at 11.15%. We maintain that a future rise in bond yields, if any, is unlikely to be sharp over the coming three months due to unaggressive borrowing as the Debt Management Office manages its debt service costs.

Trading in the Treasury Bill (T-Bill) secondary market was bearish as the Central Bank of Nigeria (CBN) mopped up N60bn (US$146 million) via an OMO auction – the first in six weeks. As a result, the average benchmark yield for T-bills rose by 27bps over the week to close at 4.95%, while the average yield for OMO bills was up by 9bps on the week to close at 6.04%. On the other hand, the annualised yield on a 321-day T-bill in the secondary market fell by only 6bps to 6.68%, while the yield on a 200-day OMO bill fell by 1bp to 6.74%. At the T-bill primary market auction (PMA), the DMO allotted N307.34bn (US$747.8m) worth of bills to investors – the highest allotment this year. Stop rates remained unchanged on the 91-day (2.50%) and the 181-day (3.50%) bills, while the 364-day bill declined by 55bps to 6.80%. The auction recorded strong demand with a subscription of N392.1bn and a bid-to-offer ratio of 2.5x ( same as the previous auction). At the OMO auction, the CBN sold N60bn worth of bills across three tenors. Stop rates remained unchanged at 7.00% for the short, 8.50% for the mid and 10.10% for the long tenor bills. While there are indications of a declining short-term interest rate environment, we believe it is too early to make a clear short-term call on rates now.

Oil

The price of Brent crude rose by 11.54% last week to close at US$72.70/bbl, showing a 40.35% increase year-to-date. The average price year-to-date is US$67.03/bbl, 55.09% higher than the average of US$43.22/bbl in 2020. The price appreciation was driven mainly by supply disruptions in Mexico and the severe storm hitting the U.S. Gulf Coast. OPEC+ will meet on 1 September to discuss the previously agreed increase of 400,000 barrels per day (bpd) over H2 2021. The group will likely keep its oil output policy unchanged and continue with its planned modest production increases. We maintain that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months

Equities

The NGX All-Share Index (NGX-ASI) edged higher by 0.01% to close at 39,485.65 points. Consequently, the year-to-date return rose to -1.95%. Honeywell Flour Mills +18.33%, FBNH +1.35%, Access Bank +1.11% and Sterling Bank +0.65% closed positive last week, while Unilever Nigeria -10.00%, PZ Cussons -4.17%, Lafarge Africa -3.08% and Guinness Nigeria -2.52% closed negative. Sectoral performances were mixed: the NGX banking index gained +0.29%, followed by NGX Oil & Gas +0.31%, while the NGX Consumer Goods -0.25% and the NGX Insurance -0.65% indices declined. The NGX Industrial Index closed flat. See Model Equity Portfolio below.

De-rating the equity market

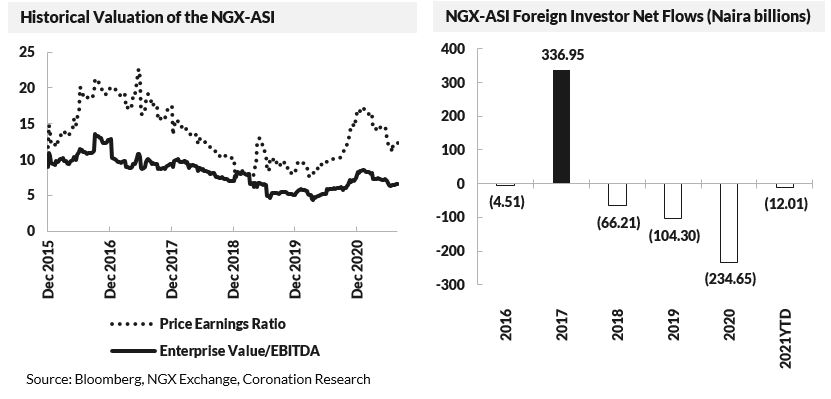

Last week, we examined the impact reinvesting dividends has on the total returns of our basket of stocks and how investors have priced them this year. We have found that reinvesting dividends outperforms the market. However, in the case of Nigerian equities, we think the total return and outperformance should have been much more significant over a long period of time (six years). Now, we examine why.

We look at the historical valuation of the overall market (NGX-ASI) since the beginning of 2016 with a specific focus on the price-to-earnings ratio (P/E) and the enterprise value-to-EBTIDA (EV/EBITDA) ratios. Our findings show that over the last five years, the overall market has de-rated. i.e., the relative valuation of the market has fallen. Investors’ sentiment has changed for the worse as they demand more earnings for each Naira of share price they are willing to pay. Why has this happened? Before 2016, foreign investors had been major participants in Nigerian equities, accounting for an average of 55.9% of trades. However, following several Naira devaluations and forex liquidity crises, we have seen foreign investors exit en-masse. They now account for only 33.6% of trades.

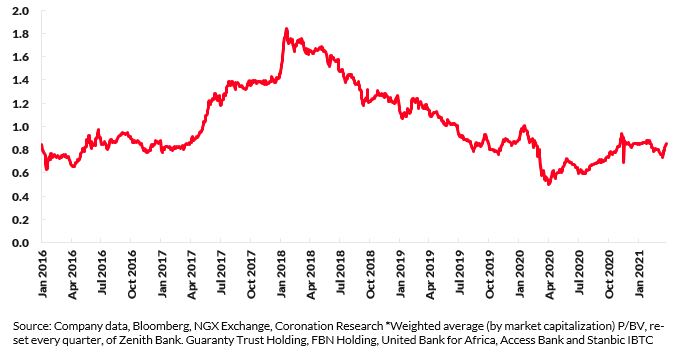

Historical Price-to-Book (P/BV) valuations of six* leading NGX-listed bank stocks

The story above is the same for many of the bellwether stocks and sectors. However, we have seen some resilience amongst the top banks. Banks look remarkably cheap compared with their peak valuations, but their price-to-book ratios show that they are trading at the same levels they were at the start of 2016. This tells us they are trading this way primarily because of the forex liquidity issues and the consequent investor apathy.

With foreign money having all but disappeared, might this be the new normal? With valuations and dividend yields at such attractive levels and earnings still growing, we feel this is an excellent time for domestic investors, especially institutional investors, who now dominate the market, to take another look another at the equities market.

Model Equity Portfolio

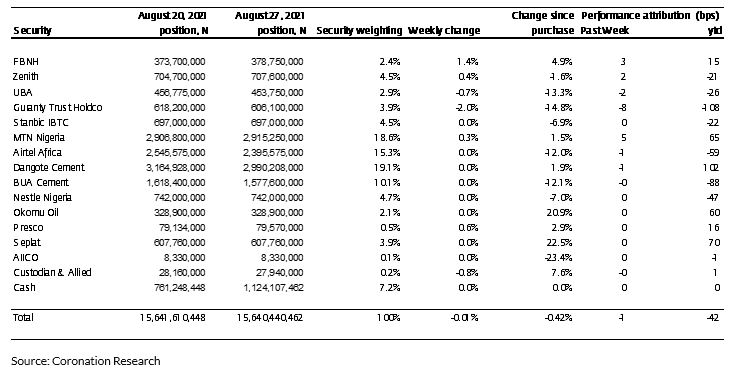

Last week the Model Equity Portfolio fell by 0.01% compared with a rise in the NGX Exchange All-Share Index (NGX-ASI) of 0.01%, therefore underperforming it by 1 basis point (allowing for rounding of basis points). Year to date it has lost 0.42% against a loss in the NGX-ASI of 1.95%, outperforming it by 153bps.

Model Equity Portfolio for the week ending 27 August 2021

Last week the portfolio bled some more value, 5bps in aggregate, from its notional holdings in banks. While our basic stance is to be patient (as it was the previous week when the banks cost us 3bps) we are not going to be inactive. The problem is concentrated in Guaranty Trust Holding, which has cost the portfolio 108 notional basis points this year. The issue is that its transformation from a bank to a holding company means that some institutional investors may need to stop holding it on the grounds that, although it has a long track record of paying dividends as a bank, it does not have a track record in paying dividends as a holding company. Over the coming week we will rotate part of our notional holding in banks from Guaranty Trust Holding into Zenith Bank and UBA.

Otherwise, we are content with our position in banks. Zenith Bank reported Q2 and H1 results last Friday. Although the numbers showed weakness in Net Interest Income (see our note on this topic published this morning) we believe that margins are likely to be recouped later in the year (see Coronation Research, ‘Nigerian Banks: resilience built in’, 25 June).

Last week we spent some time, and roughly 2 notional basis points, neutralising our exposure to the top-four major index weights, namely Dangote Cement, MTN Nigeria, BUA Cement and Airtel Africa. This has taken us time as liquidity during August, even for small fund, has been low. Other than our proposed rotation in banks, and our intended increase in our notional stake in Custodian and Allied Insurance (announced last week), we plan no changes this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.