As fixed income yields tighten the dividend yields of some of the largest stocks listed on the NGX Exchange are beginning to look juicy. From our own brokerage activity, we are aware of how investors appreciate dividend yields. So, the question is as follows. Could one construct a portfolio of high dividend-paying stocks and thereby generate a positive return and outperform the market? Read details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) depreciated by 0.21% to close at N411.67/US$1. Similarly, the Naira weakened by 0.97% in the parallel (or street) market to close at N520.00/US$1. As a result, the gap between the I&E window and parallel market rate now stands at 26.31%. Elsewhere, the Central Bank of Nigeria’s FX reserves fell by 0.20% to US$33.51bn. We reiterate our view that the FGNs potential Eurobond issuance and the US$3.3bn allocation from the International Monetary Fund’s (IMF) Special Drawing Right (SDR) are likely to shore up FX reserves soon. Amidst these developments, we expect the parallel rate and the I&E Window rates to trade range-bound in the near term.

Bonds & T-bills

Last week, the bullish trend in the secondary market for FGN bonds persisted as evidence by the fall in stop rates at the primary auction. The yield of an FGN Naira-denominated bond with 10-years to maturity fell by 25bps to 11.92%, the yield on the 7-year bond fell by 35bps to 11.55%, and the yield on the 3-year bond fell by 39bps to 10.21%. The overall average benchmark yield fell by 17bps w/w to close at 11.38%. At the bond primary auction, the Debt Management Office (DMO) allotted N260.09bn (US$632.8m) worth of bonds to investors. Stop rates eased on average for the third successive auction, with the rates on the February 2028 (-75bps to 11.60%), March 2036 (-40bps to 12.75%), and March 2050 (-45bps to 12.80%) bonds all declining. The auction was oversubscribed and recorded more robust demand than at the previous auction (bid-to offer: 2.4x vs 1.91x previously). We reiterate that a future rise in market yields, if any, is unlikely to be sharp over the coming three months due to unaggressive borrowing as the DMO manages its debt service costs.

Trading in the Treasury Bill (T-Bill) secondary market was mixed, with a bullish tilt, following the slight moderation in inflation and sustained demand for OMO bills due to the absence of renewed primary market supply by the CBN. As a result, the annualised yield on a 328-day T-bill in the secondary market fell by 120bps to 6.73%, while the yield on a 207-day OMO bill fell by 218bps to 6.75%. Overall, the average benchmark yield for T-bills rose by 2bps in the week to close at 4.69%, while the average yield for OMO bills fell by 170bps on the week to close at 5.95%. At this week’s T-bill primary market auction (PMA), the DMO is expected to offer N157.20bn worth of bills across all tenors. Accordingly, we expect quiet trading in the first few days of the week in the T-bill secondary market as participants position for the PMA.

Oil

The price of Brent crude fell by 7.66% last week to close at a three-month low of US$65.18/bbl, showing a 25.83% increase year-to-date. The average price year-to-date is US$66.91/bbl, 54.80% higher than the average of US$43.22/bbl in 2020. The price decline was due to uncertainty over new Covid-19 outbreaks, combined with a strengthening US dollar following signs that the US Federal Reserve is considering cutting its stimulus measures this year. Also, in July, OPEC+ compliance with production quotas stood at 109%, down by 3pp from June as Saudi Arabia rolled back its unilateral supply cuts. Nevertheless, we reiterate our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) fell by a marginal 0.10% last week to close at 39,483.08 points. Consequently, the year-to-date return moderated to -1.96%. Nestle Nigeria -9.09%, Nigeria Breweries -8.77%, and Cadbury Nigeria -5.56% closed negative last week, while Honeywell Flour Mills +46.34%, MRS +9.92%, Dangote Cement +3.31%, and FCMB Group +2.32% closed positive. Sectoral performances were mostly bearish. The NGX Consumer Goods led the losers, declining by 6.31% while the NGX Insurance -0.96, NGX Banking -0.82%, NGX Pension -0.63, NGX Oil & Gas -0.61% and the NGX-30 -0.30% indices followed suit. The NGX-Industrial index was the sole gainer, closing +1.85 higher. See Model Equity Portfolio below.

Dividend yields and total investment returns

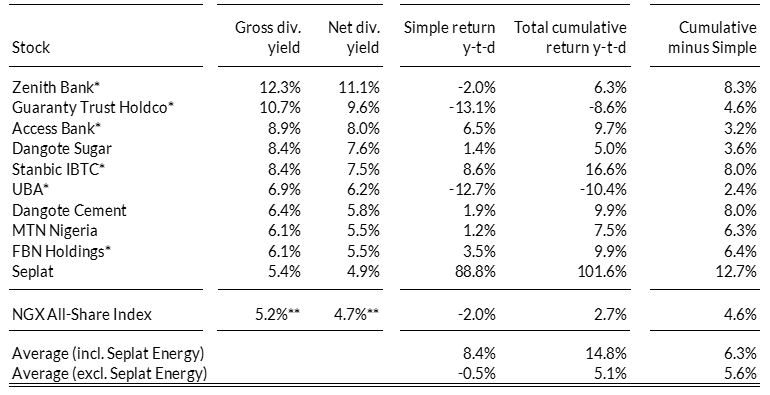

Two weeks ago, we demonstrated the importance of total returns and showed that reinvesting dividends in the NGX All-Share index generated a return over four percentage points more than the simple index return. Last week, we answered the question of what stocks among the major stocks on the exchange pay the most attractive dividends. Now, we examine what impact reinvesting these dividends has had on the total returns of those individual stocks and how investors have priced them this year.

Table 1: Top-10 dividend-yielding stocks, among the largest listed on the NGX Exchange

Source: NGX Exchange, Bloomberg, Coronation Research estimates | *Final dividend plus interim dividend for 2020 **NGX-ASI Gross dividend yield from Bloomberg and adjusted for Net dividend yield. YTD data to 20 August 2021

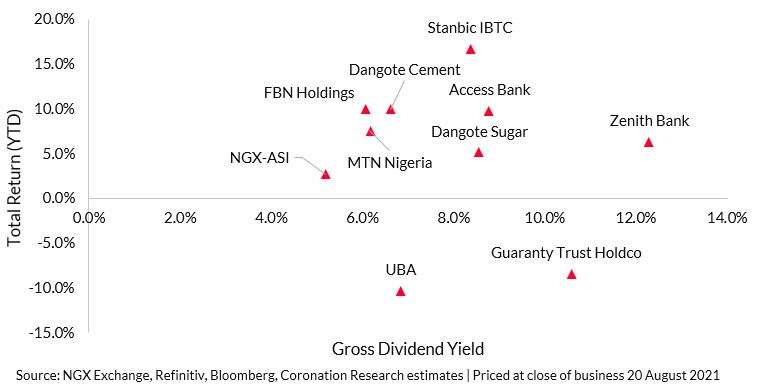

Gross Dividend Yield versus Cumulative Total Return YTD (excluding Seplat)

When it comes to paying out a generous dividend, investors have rewarded many of these stocks with commensurate price performance. Surprisingly, investors have not been as kind to Tier 1 banks Guaranty Trust Holdco and UBA despite their attractive dividend yields. However, in our view, this only presents an attractive opportunity for patient investors, especially as we expect their earnings – and thus dividends – to continue to grow. Overall, there is only a weak correlation between total returns and gross dividend yields (with a very small data set), though enough to make investors think about dividends as a contributing factor in selecting stocks.

In conclusion, our study suggests that merely holding a portfolio of high-dividend stocks alone may not be enough (the outperformance shown above its only for one period) but that including them and reinvesting dividends can aid outperformance of the market if one is selective and attentive to potential outliers. However, this poses the question of when these dividends should be invested. Typically, if dividends are reinvested at a time of low prices, the total return will rise as the price rises. Hence, given the trend that dividend-paying stocks tend to have marked-down prices when dividends are declared, it would seem like a good time to reinvest the dividends to take advantage of any price rally that ensues.

Model Equity Portfolio

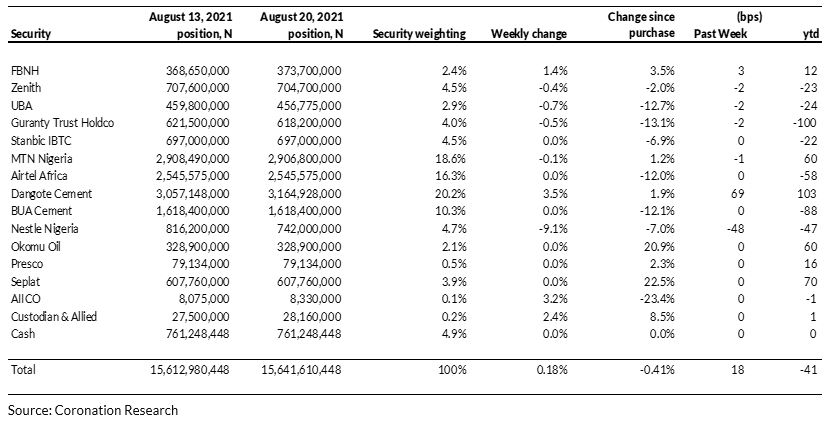

Last week the Model Equity Portfolio rose by 0.18% compared with a fall in the NGX Exchange All-Share Index (NGX-ASI) of 0.10%, therefore outperforming it by 28 basis points. Year to date it has lost 0.41% against a loss in the NGX-ASI of 1.96%, outperforming it by 155bps.

Model Equity Portfolio for the week ending 20 August 2021

Last week the model portfolio bled a little value, 3bps in aggregate, from its notional holdings in banks. We are being patient, waiting for H1 results to be reported soon. We believe that the performance of listed banks can hold up this year, despite the rise in interest rates (see Coronation Research, ‘Nigerian Banks: resilience built in’, 25 June). So, there is potential for the results to surprise on the upside, in our view. We raised our notional positions in these banks during July, following publication of the report.

Last week the biggest contribution to the portfolio came from our notional position in Dangote Cement which delivered 69bps, with a large notional setback from Nestle Nigeria which cost 48bps. In the case of Nestle Nigeria it seems that, according to market comment, the strategic shareholder is prepared to pay a little less for shares than the levels reached in the market recently. We have a neutral notional weight in the stock.

Going forward, we will continue to neutralise, carefully, our exposure to the top-four major index weights, namely Dangote Cement, MTN Nigeria, BUA Cement, Airtel Africa and Nestle Nigeria, while maintaining our notional overweight in banks. We are interested in the insurance sector, again, and we will continue to build a position – liquidity permitting – in Custodian and Allied Insurance.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.