From time to time we notice equity markets taking a pause, trading sideways for a month, before launching again upwards or downwards. One of the ways to measure the health of an equity market is its turnover. The Nigerian equity market’s turnover has been trending downwards recently, prompting the question: “Where is the institutional investor?” The answer might be: “Presumably, buying long-dated bonds, rather than equities.” Read below for details…

FX

Last week, the Central Bank of Nigeria (CBN) increased the bid price for FX at its Secondary Market Intervention Sales (SMIS) window, which is also known as the Retail Window, from N360/US$1 to N380/US$1. In effect, the existence of an ‘official rate’ of N360/US$1 has been brought to an end, though the NAFEX (or ‘I&E Window’ or ‘interbank’) rate is still a little lower, at a mid-price of N388/US$1. We think the CBN’s intention is to satisfy the World Bank’s request that Nigeria unifies its exchange rates (and the World Bank has a US$1.5bn loan to Nigeria in the offing). The acid test, in our view, is whether these rates lead to a rebound in liquidity in these FX markets. We shall see.

Bonds & T-bills

The rally in bonds continues. The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 121 basis point (bps) to 8.80%, and at 3 years declined by 55bps to 5.46% last week. The annualised yield on 342-day T-bill declined by 10bps to 2.96%. At the auction last week, demand for T-bills remained strong. There was oversubscription of 3.7x for the N88.9bn (US$227.8m) worth of bills on offer. We still expect rates to stay low for weeks, and even months, ahead.

Oil

The price of Brent crude increased by 4.34% last week to US$42.80/bbl. The average price, year-to-date, is US$42.12/bbl, 34.39% lower than the average of US$64.20/bbl in 2019, and 41.25% lower than the average of US$71.69/bbl in 2018. OPEC’s crude oil production is at its lowest level in thirty years, at 22.69mbpd. We think oil prices are likely to find support around US$40.00/bbl, though a move to a support level of US$50.00/bbl, at which we believe Nigeria’s public finances look comfortable, appears remote to us.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 1.98% last week. The year-to-date return is negative 9.34%. Last week Okomu Oil Palm (+20.94%), Nestle Nigeria (+4.73%) and PZ Cussons (+1.30%) closed positive, while Unilever Nigeria (-18.82%), Sterling Bank (-10.85%), Ardova Oil (-10.73%) and Flour Mills of Nigeria (-10.20%) closed negative. Sectoral performances were negative, with the Banking (-7.5%), Industrial Goods (-6.4%), Insurance (-2.2%), Oil & Gas (-1.2%) and Consumer Goods (-0.5%) indices recording losses over the week. Our sense is that the market will continue to drift downwards over the coming week.

Where are the institutions?

Stock markets are fickle things. A glance at global equity markets during June shows a worrying trend, namely a sideways pattern. At least the S&P 500 in the US and the Euro Stoxx 50 looked like that, though the tech-based Nasdaq in the US was surging ahead. Since June both the S&P 500 and Euro Stoxx 50 have begun to move up again, though of course, it is early days yet.

The problem with a sideways pattern in a stock index is that it never holds for long (unless the index actually stops trading). It either breaks upwards or breaks downwards. For the Nigerian Stock Exchange All-Share Index (NSE-ASI) June also showed a more-or-less sideways trend, with the market losing 3.1% gradually over the month. Where is it going to go next?

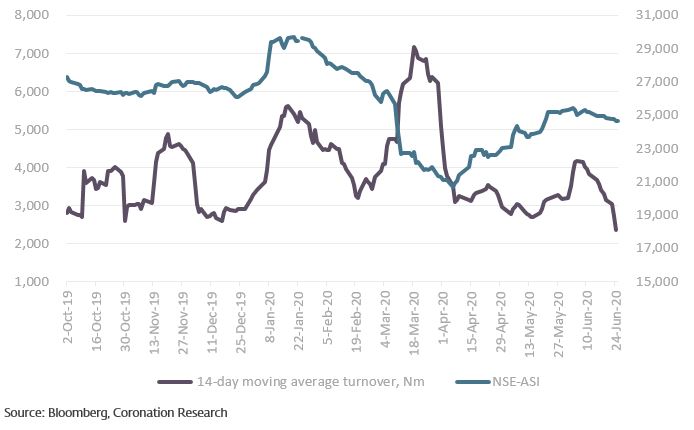

NSE Turnover vs All-Share Index

One worrying aspect is the drop in turnover. Turnover surged during the bull run of January 2020, then again during the panic of March. So, high turnover does not mean that an equity market will go up, only that it will go somewhere. If the turnover in the NSE returns to its mean, then its turnover must rise, and the market will take a new direction.

One strange characteristic of the lull in stock market turnover is the absence of Nigerian institutional investors (if they were present, turnover would be much higher than it is). Instead of buying stocks whose gross dividend yields are well above bond rates, they are chasing bond rates down by buying them. This is remarkable behaviour because long-dated bonds can trade with as much volatility as equities. So, one reason not to give up on the major NSE-listed stocks is that institutional investors might come back. Their bond-buying habit cannot be a one-way bet and cannot continue indefinitely.

Model Equity Portfolio

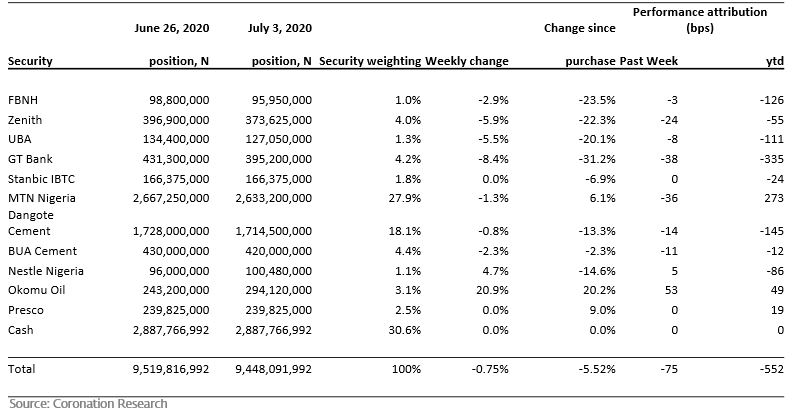

Last week the Model Equity Portfolio fell by 0.75%, compared with a decline in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.98%, therefore outperforming it by 123 basis points. Year-to-date it has lost 5.52%, against a loss of 9.34% in the NSE-ASI, outperforming it by 382bps.

As we announced two weeks ago, we lightened our positions in bank stocks during the week of 22 June to 26 June, taking our total notional position in the sector down from 19.8% of the portfolio to 12.9% (with last week’s declines it is now 12.3% of the portfolio). Adjusting these positions in time saved us 36bps last week.

Our reasoning for this move was that we were out of step with the movements in the banking sub-index, and we did not want to have large a position if the sector sold off heavily, which it is prone to do when the market overall is drifting off. On the other hand, we retain meaningful positions – close to neutral weights – in Zenith Bank and GT Bank.

Model Equity Portfolio for the week ending 03 July 2020

We also began to build a position in BUA Cement during the week of 22 June to 26 June, which promptly began to decline in price when we were halfway to building our intended stake. We, therefore, decided to wait longer before taking a fully neutral position in the stock.

Last week we remarked on the unusual performance of Airtel Africa, which is a large part of the NSE-ASI, at 9.58%, but which seldom trades. We continue our investigations into the stock with a view to taking a position in it.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.