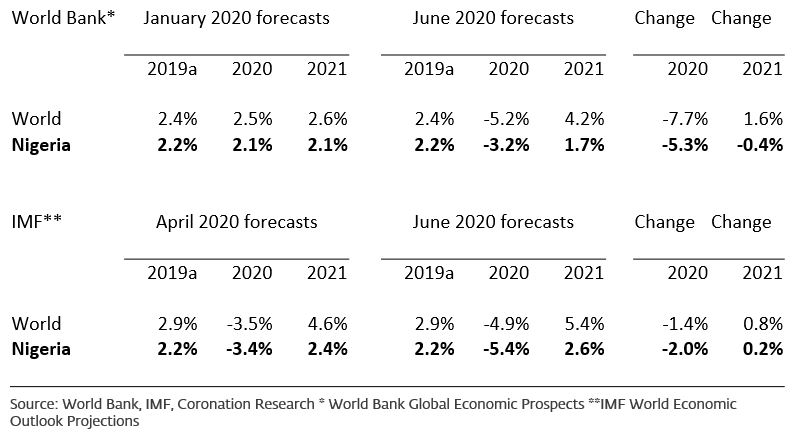

The International Monetary Fund (IMF) recently revised downwards its estimates of global economic activity. The global economy is now forecast to contract by 4.9% this year, with Nigeria due to shrink by 5.4%. Global equity markets were already nervous in June, giving up some recent gains. Yet key commodity markets (e.g. oil and copper) continue to trend upwards, suggesting that global demand is gaining ground. See details below.

FX

Last week there were very small – but perhaps significant – changes in currency rates. In the NAFEX market (also known as the I&E market), which supplies the data for the exchange rate quoted by Bloomberg, the Naira appreciated by just 0.06% to N387.56/US$1. In the parallel market, the Naira (offered for US dollars) fell 1.09% to N460/US$1, having fallen 1.10% the week before. This means that the difference between the NAFEX rate and the parallel market rate is 18.69%. We doubt that this is troubling to the Central Bank of Nigeria (CBN) just yet. However, with NAFEX volumes still quite low, we think there is potential for further pressure on the parallel market rate over the coming weeks.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined last week by 96 basis point (bps) to 10.01%, and at 3 years declined by 127bps to 6.01%. The annualised yield on 230-day T-bill remained flat at 3.06%, while a CBN Open Market Operation (OMO) bill with similar tenure increased by 42bps to 5.59%. This week we expect market liquidity to improve as total maturities worth N246.1bn (US$647m) are due to enter the system. Given high institutional liquidity, we expect rates for stay this low the coming weeks.

Oil

The price of Brent crude decreased by 2.77% last week to US$41.02/bbl. The average price, year-to-date, is US$42.12/bbl, 34.39% lower than the average of US$64.20/bbl in 2019, and 41.25% lower than the average of US$71.69/bbl in 2018. Last week, the rally in oil prices stalled as acceleration in the number of COVID-19 cases globally began to threaten the viability of the global demand recovery. With current market conditions and outlook, we think oil prices are likely to find support around US$40.00/bbl.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) advanced by 0.01% last week. The year-to-date return is negative 7.50%. Last week Nestle Nigeria (+9.64%), FCMB Group (+8.14%), Sterling Bank (+7.50%) and MTN Nigeria (+1.21%) closed positive, while PZ Cussons (-21.43%), Dangote Sugar (-16.78%), Guinness Nigeria (-11.76%) and Seplat (-9.98%) closed negative. The All-share index recorded losses in four of five trading sessions last week, highlighting increased profit-taking and weak investor sentiment, as indicated by low turnover, read below.

Doubts over the global recovery

Never have we heard so much debate over the shape of letters. A V-shaped recovery will see the world moving swiftly out of recession. A U-shaped recovery will see the recession persist for a while, but also end with a sharp recovery. And a W-shaped recovery will see a brief recovery, followed by another dip, followed by another recovery. None of these patterns will be symmetrical, unlike the letters themselves, so the W-shaped recovery could really mean anything.

Do stock markets follow these patterns? Until May the S&P 500 equity market in the US certainly believed in a V-shaped recovery, because its own shape was a V. After 23 March it rose as quickly as it had fallen during the previous month, and is up 34.2% from its low-point. However, investors in the S&P 500 appeared to be less convinced during May and unconvinced during June – it has fallen 2.3% month-to-date. (And the S&P 500 is down 7.0% year-to-date.)

World Bank & IMF Forecasts

A recent publication by the International Monetary Fund (IMF), its World Economic Outlook Projections for June, captures this change in expectation. The IMF, which already in April was forecasting some dismal growth figures, revised its forecasts still lower. As if on cue, cases of COVID-19 infections began to rise in several US states and their governors re-imposed lock-downs. Unfortunately, reported rates of new infections continue to rise in India, Brazil and Sweden.

Equity markets are not quite in the bullish mood they were a couple of months ago. But, before we sound too pessimistic, we need to look across at commodity markets. The price of Brent crude has had one or two reversals (such as last week) but continues to trend upwards, with a gain of 16.1% month-to-date. And the price of copper is up 10.8% month-to-date. So commodity markets seem a little more optimistic than equity markets. This does nothing to tell us the shape of the global recession, but at least it confirms the idea that it will end.

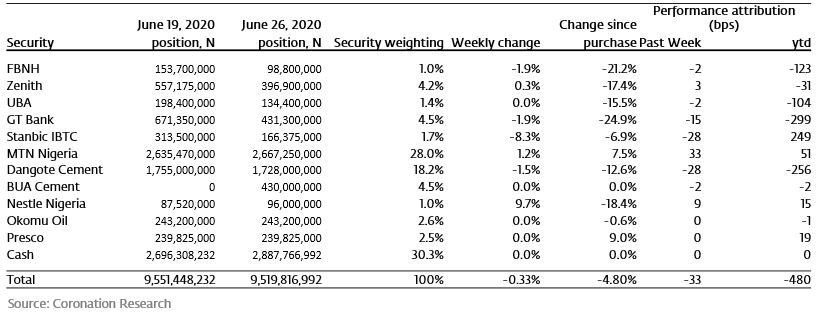

Model Equity Portfolio

Last week the Model Equity Portfolio fell by 0.33% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.01%, therefore underperforming it by 34 basis points. Year-to-date it has lost 4.80%, against a loss of 7.50% in the NSE-ASI, outperforming it by 270bps.

Following our reflections published at the beginning of last week, we embarked on two separate courses of action. The first was to reassess our position on BUA Cement and begin to build a position in the stock. BUA Cement showed some interesting results at the Q1 2020 stage, with sales up 25.1% in nominal terms (April inflation: 12.34% y/y), which showed a pick-up in the growth rate over FY 2020 when sales were up 11.21% y/y. Its RoE rose from 16.66% in FY 2019 to an annualised 20.64% in Q1 2020, just ahead of the 20.53% we set as our equity hurdle rate. The valuation, at a price/earnings ratio of 25.0x, is not cheap, but one usually has to pay for growth. So we made notional purchases and are halfway to taking an index-neutral position in the stock.

Second, we reduced our position in bank stocks from 19.8% of the Model Equity Portfolio (close to an index-neutral weight) to 12.9%, making notional sales in each of our positions mid-week. We believe that low turnover in the market and a lack of positive news herald a decline in the prices of bank stocks and the market generally. It will take several weeks to tell whether we were right in making this call.

Model Equity Portfolio for the week ending 26 June 2020

So, what happened last week? Everything was going according to plan until Friday lunchtime when, following the announcement of a N12 per share dividend, the price of Airtel Africa rose by 9.96%. This, unfortunately, took us by surprise. It is 9.59% of the index but we had not paid it much attention because the stock seldom trades. The result was that index rose last week, just a little (+0.01%) whereas without this one stock move it would have fallen. We will re-examine Airtel Africa with a view to taking a notional position in it, and report back next week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.