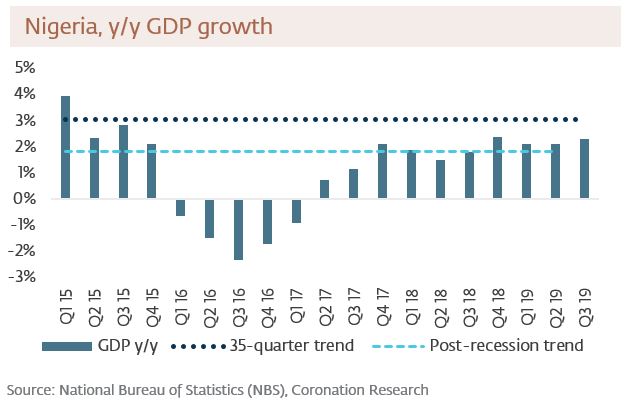

Q3 2019 GDP growth was reported on Monday at 2.28% y/y, exceeding the Bloomberg consensus estimate of 1.85% y/y. However, it marked an improvement on Q2 GDP which grew at 2.12% (restated from the original print of 1.94%).

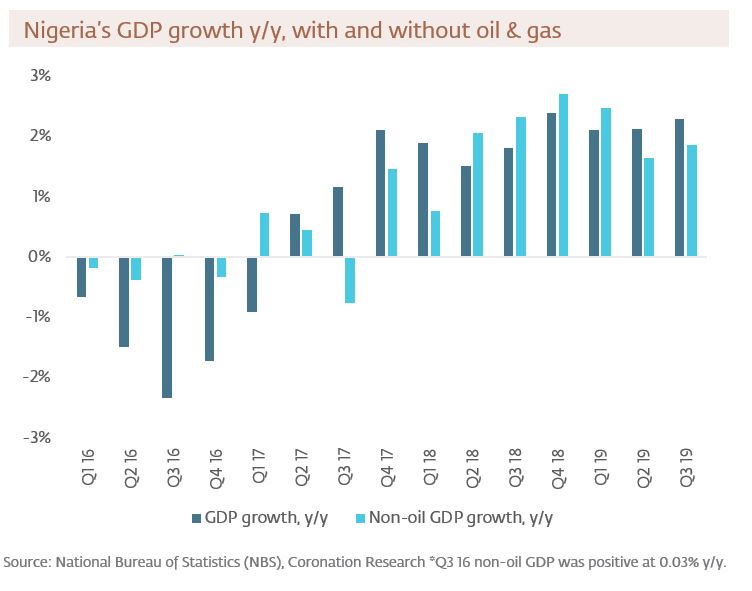

Significantly, Q3 non-oil GDP grew at 1.85% which marked an improvement in Q2 when it grew at 1.64% y/y. Since the rate of growth in the non-oil economy had been slowing up to and including Q2 (see chart on page 2) this recovery comes as a relief.

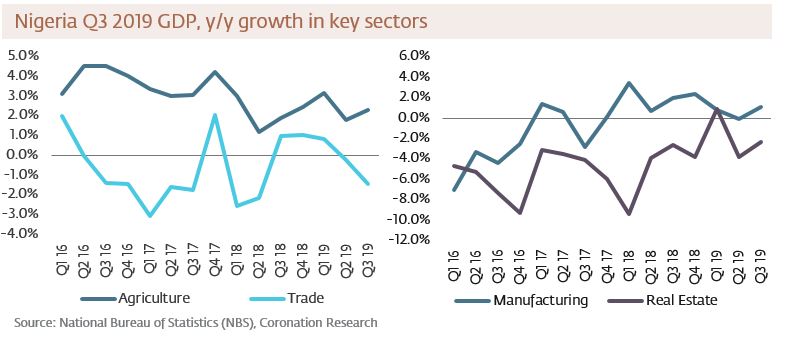

The non-oil growth drivers were: Agriculture, which grew at 2.28% y/y; Telecoms, which grew at 12.16% y/y; Manufacturing, which grew at 1.10% y/y. The Trade sector contracted at 1.45% y/y and Real Estate fell by 2.31% y/y.

Negative implications for equities. A growth rate of 2.28% is not high for a developing market (a developed market like the US is estimated to have grown by 2.1% y/y in Q3). As such, it does not provide much support for listed companies that depend on growth, particularly food and consumer goods manufacturers, brewers, and cement makers.

Negative for inflation. Q3 saw the first effects of August’s land border closures. Trade was negatively affected and food prices (particularly rice and frozen chicken) shot up. New price levels may stimulate domestic agricultural production but push the cost of living upwards.

Neutral-to-negative for interest rates. If inflation is under pressure then we expect upward pressure on interest rates. However, Nigeria has embarked on a bold policy of maintaining two risk-free market interest rates, see Coronation Research, Dual Interest Rates, 20 November 2019. It is the success of this policy, more than fundamentals like inflation, which is likely to determine interest rates going forward.

Non-oil & gas GDP

The non-oil economy still growing but no longer accelerating

The non-oil GDP growth in Q3 improved to 1.85% y/y after growth of 1.64% y/y in Q2. Agriculture and Telecoms continue to drive the developments of non-oil GDP while Real Estate remained a laggard, declining by 2.31% y/y in Q3.

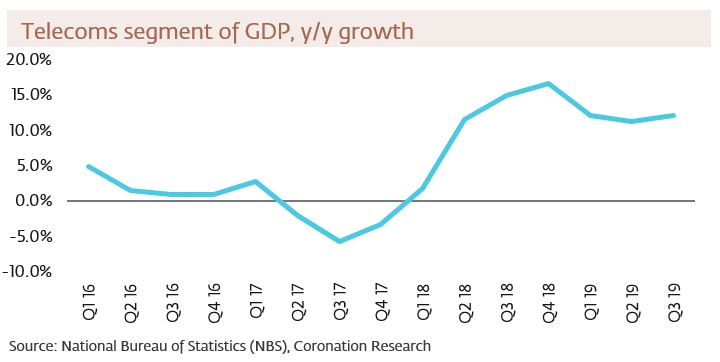

Telecoms growth (up 12.16% y/y) is outpacing levels recorded during the last decade. Operators are differentiating subscribers between high value and mass-market niches and developing smart products that manage subscriber numbers effectively. Access costs (tariffs and devices) are also declining, enhancing the perception of telecommunications as a utility. This has been driving the sector’s double-digit growth.

The large Trade sector, however, contracted by 1.45%. As the economy continues to expand, trade has been declining in its relative contribution to total output from 17% in 2018 to 15% today. The fact that incomes have hardly kept pace with the rate of inflation underscores the extent of economic dislocation affecting the Trade sector. Construction expanded for the sixth consecutive quarter (up 2.37% y/y) and Cement (up 6.87% y/y) has now grown for the seventh consecutive quarter.

The Manufacturing sector, up 1.10% y/y, proved it could be elastic to easy credit. The Central Bank of Nigeria (CBN) reported that loans to Manufacturing grew by N459.69 billion (US$1.27 billion) between Q2 and Q3, providing a catalyst for the 1.1% y/y growth in Q3. Weak earnings from the listed consumer companies and industrial goods producers were more than compensated by growth in unlisted FMCG companies and smaller manufacturers, in our view. This dynamic we highlight in Coronation Research’s Nigerian consumer report Power to the price point, 20 May 2019. These manufacturers benefit from consumers’ migration to low price points and are successfully challenging the market share of the listed corporates whose costs are sticky.

GDP breakdown

The breakdown among the major segments

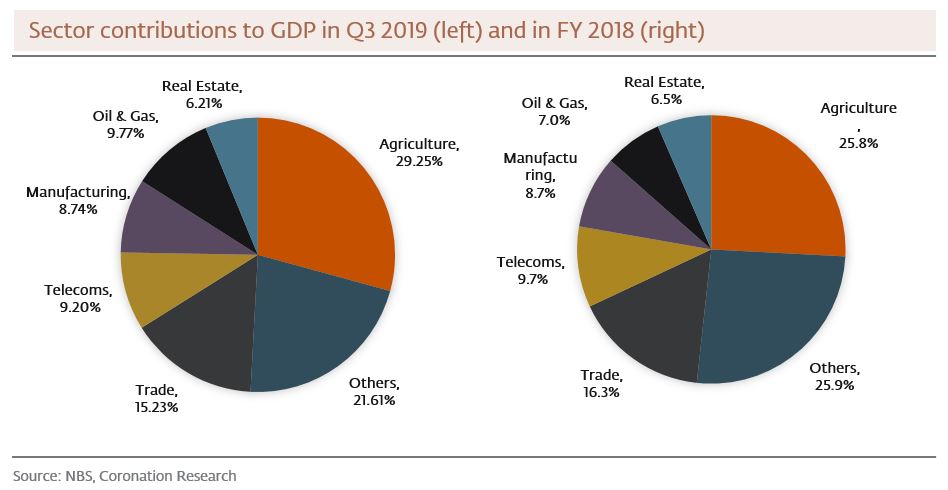

The top six sectors accounted for 78.39% of the Nigerian economy in Q3 2019. In order of size, they were Agriculture, Trade, Oil and Gas, Telecoms, Manufacturing, and Real Estate.

In Q3 2019 Agriculture (29.25% of GDP) grew by 2.28% y/y. Trade (15.23% of GDP) contracted by 1.45% y/y. Oil & Gas (9.77% of GDP) grew by 6.49% y/y. Telecoms (9.2% of GDP) grew by 12.16% y/y. Manufacturing (8.74% of GDP) grew by 1.10% y/y. And Real Estate (6.21% of GDP) fell by 2.31% y/y.

Therefore, of the six largest sectors, four grew and two contracted. Agriculture continued to grow, faster than the previous quarter, but 72bps slower than its three-year average of 3.0%. Manufacturing performance was positive and a surprise after Q3 2019 results from listed food manufacturers and cement producers were weak. Our view is that a cluster of unlisted brands are growing more aggressively than their established peers and their performance supported Q3 growth. Telecoms retained its status as the fourth largest segment of GDP and the fastest-growing major segment of the economy.

Base effects and new investments are helping Oil & Gas reclaim some of its vaulted status as a key sector of the economy, and not just the country’s major source of FX. Headline growth suffers a drag when exploration and production activities are constrained, but production build-up to 200,000bpd and 124MMSCF on the Egina oil field has supported headline growth for the last two quarters. Trade fared worse than in Q2 on the persistence of structural problems relating to merchandise logistics, land border closures and attacks on some major retailers. Real Estate remains in recession.

Agriculture on the rise

Post-recession Agriculture has grown in relevance to the CBN both as a stabilisation bastion as well as for its potential to provide employment. The strategy is to encourage participation, accelerate the process of growth from an era of bootstrapping to mechanized and fully-integrated ecosystems. The primary vehicle for this change has been credit and subsidies. Under the Commercial Agricultural Credit Scheme, N610.4 billion (US$1.7bn) has been disbursed to qualifying projects.

Crops, particularly grains and tubers, continue to dominate agricultural production in terms of capital and human resources. The closure of the land borders and timely rainfall have helped growth.

Swing sectors

Telecoms, shoulder-high above peers

The Telecoms sector (9.20% of GDP), grew by 12.16% y/y in Q3 2019. This continues six consecutive quarters of double-digit growth since Q1 2018.

The channels for growing data usage are proliferating. Video-on-demand services are becoming mainstream among consumers and affordable data-enabled devices are gaining traction. However, there is migration from traditional voice communication, as telecom companies strengthen infrastructure, allowing voice offerings via internet protocols to perform better than before.

New subscribers for mobile and fixed telephony services expanded by more than five million during the quarter. Operators reported strong service revenues for voice and data and FYE 2019 CAPEX at MTN Nigeria (representing 37% market share) is forecast to exceed FYE 2018 y/y by 8.6%.

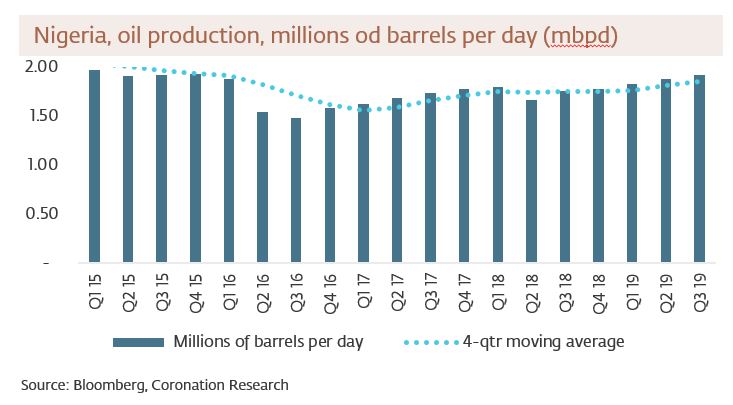

Nigeria has been able to pump more crude oil successively over the last six quarters. Loose compliance with OPEC quotas, maturity of new investments and reduction of militant activities in the Niger Delta have been helpful. Q3 oil and gas production is up 2.1% q/q, and 9.3% y/y.

Conclusions

The pattern of growth and outlook for the rest of 2019

Q3 2019 GDP growth surprised the market, printing 43bps above the mean analyst expectation on Bloomberg. Trade, a key economic sector, was the major drag on growth, following up a 0.20% contraction in Q2 with a 1.45% contraction in Q3. Widely-condemned retaliatory attacks on a South-African business during the review period compounded the shocks from the border closure.

We note the first effects of the CBN’s credit stimulation on the Manufacturing sector in Q3. Trends in monthly manufacturing PMI data also indicate that some seasonally-induced activity is expected to have a knock-on effect on the economy in Q4.

Expansion of oil production could continue to provide Oil & Gas sector growth into Q4 2019: but we note that Oil &Gas is inherently volatile and such trends can reverse.

In any case, the global market in crude is riddled with vulnerabilities: Saudi Aramco’s initial public offering was not widely taken-up; oil prices are projected to be flat; OPEC’s market share is being ceded to shale producers, as output cuts remain in place; and the Deep Offshore and Inland Basins Production Sharing Contracts Act as amended could be a blow to new investment.

Nevertheless, we retain our overall growth forecast for FY 2019 at 2.25%, and we see scope for an uplift in the growth rate on Q4.