One can almost hear the sigh of relief coming from Abuja. Oil prices are up and the immediate threat to the nation’s foreign exchange reserves has receded. Markets (long-dated bonds and equities) have responded positively. However, inflation is still far above risk-free rates and the unofficial exchange rate is slipping. The game is not yet won. See details below.

FX

Last week, the exchange rate in the Investors and Exporters Window (I&E Window) strengthened by 0.30% to close at N410.75/US$1. However, in the parallel (or street) market, the Naira weakened by 1.41% to close at N502.00/US$1, the lowest level since 22 February 2017 (N505.00/US$1). The move has widened the gap between the two market rates to 22.22%. In the past week, ABCON (Association of Bureau De Change Operators) commenced its “Operation No Street Trading” to stop the hawking of foreign exchange by unlicensed BDC operators, in order to (1) clamp down on speculation, and (2) reduce the divergence between the official and parallel rates. The CBN also announced that it would increase FX allocations to meet travel allowance requests and tuition payments, amongst other invisibles. Elsewhere, the CBN’s FX reserves fell very slightly, by 0.07% over the week to US$34.22bn. Despite the efforts of the CBN to increase US dollar supply to the I&E Window and NAFEX market, we expect the parallel rate and the I&E Window rates to continue to be under pressure over the months to come.

Bonds & T-bills

Last week, the secondary market for FGN bonds experienced renewed bullish sentiment, as investors cherry-picked yields across the curve. As a result, the yield of an FGN Naira-denominated bond with 10 years to maturity fell by 27bps to 12.94%, the yield on the 7-year bond fell by 28bps to 12.87%, and the yield on a 3-year bond fell by 54bps to 11.66%. The overall average benchmark yield fell by 31bps w/w to close at 12.21%. Despite the recent improvement in demand, we maintain our view of an upward trend in bond yields amidst still negative inflation-adjusted returns.

Activity in the Nigerian Treasury Bill (T-bill) secondary market remained bearish. The annualised yield on a 328-day T-bill in the secondary market fell by 7bps to 9.50%, and the yield on a 284-day OMO bill fell by 61bps to 9.79%. However, the average benchmark yield for T-bills rose by 16bps w/w to close at 6.26%, while the average yield for OMO bills rose by 37bps w/w to close at 9.96%. On Wednesday the Debt Management Office is expected to roll over N91.26bn (US$221.9mn) in maturing T-bills via auction. We anticipate another oversubscribed auction, which may enable the DMO to keep stop rates on hold for the time being. The CBN mopped up liquidity via an OMO auction last week, selling a total of N18.30bn in bills. As a result, the stop rates for the 89-day (7.00%), 180-day (8.50%), and 348-day (10.10%) bills remained unchanged from recent auctions. We still expect secondary market yields to trend upwards over the coming weeks amidst the continued squeeze on system liquidity.

Oil

The price of Brent crude rose by 3.25% last week, closing at US$71.89/bbl, the highest level since May 2019, with a 38.78% increase year-to-date. The average price year-to-date is US$63.81/bbl, 47.65% higher than the average of US$43.22/bbl in 2020. Last week, oil prices rallied to levels above US$70/bbl, higher than pre-pandemic levels, off the back of the positive global economic outlook. During the OPEC+ (Organization of the Petroleum Exporting Countries, plus Russia) meeting on Tuesday, the plan to ease production cuts by 840,000bpd in July was reaffirmed, as global oil demand is anticipated to increase by 6 million barrels per day. Additionally, members were required to submit plans to compensate for producing at levels above the set quota. With the proposed increase in global supply unlikely to exceed expected demand, our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was up by 1.23% last week, moderating the year-to-date loss to 3.84%. MRS +9.57%, FCMB Group +8.20%, and PZ Cussons +3.77% closed positive last week, while International Breweries -6.14%, Lafarge Africa -4.43%, and Stanbic IBTC -1.96% closed negative. Sectoral performances were mixed as the NGX Industrial Goods index led the gainers, rising by +2.60%, followed by the NGX 30 index +1.35%, NGX Insurance index +1.25%, NGX Pension index +0.63%, and NGX Banking index +0.04%. Conversely, the NGX Oil and Gas index led the losers, declining by 0.79%, followed by the NGX Consumer Goods index -0.37%. Bargain buying has ensued following the slowdown in the upward trend in yields in the fixed income market. It seems possible that the bulls will decide the direction of the market over the coming weeks. However, given our expectation for fixed income yields to resume their upwards movement, we are not sure for how long this trend can continue. See Model Equity Portfolio below.

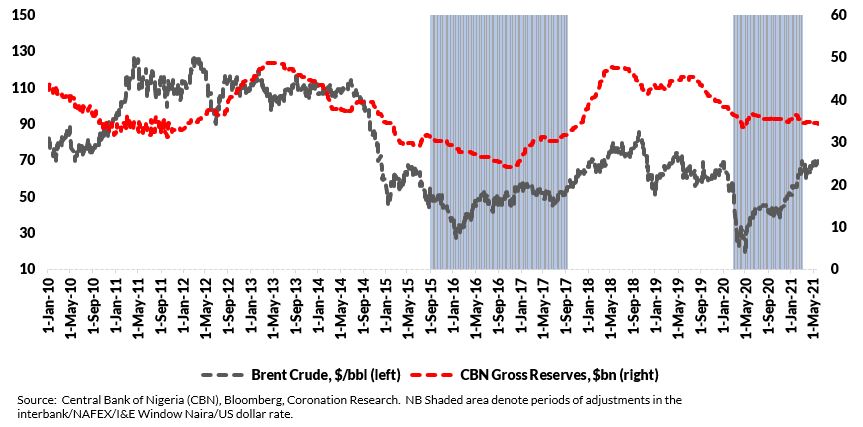

Oil prices and FX reserves

Ask a Nigerian the Naira/US dollar exchange rate on any given day and you will receive an answer. The same is true of fuel prices and, by extension, crude oil prices. Both economic indicators are close to the heart of anyone running a business or a household.

So, the news that the price of Brent crude has risen through the US$70.00/bbl mark is good for some (e.g. government oil revenues) and bad for others (e.g. fuel prices). Oil and gas account for some 80% of Nigeria’s exports and upwards of 60% of government budget revenues. High oil prices, combined with sustained production, support the Federal Government’s (FGN) finances and the foreign exchange reserves of the Central Bank of Nigeria (CBN).

Price of Brent crude and Foreign Exchange Reserves of the CBN

However, the relationship between oil prices and production on the one hand, and the reserves of the CBN on the other, is complicated. Oil is sold at forward, not spot, prices; Nigeria’s gas is sold at contracted, not commodity, prices; and oil is exchanged for fuel in swaps. So, accurately determining oil & gas revenues is not easy. And the CBN’s FX reserves are influenced by other factors, including the government’s foreign borrowing and how many US dollars the CBN supplies to the foreign exchange markets at any given time. (For example, the CBN was supplying some US$1.0bn per month to Nigeria’s FX markets during the second half of 2019.)

Rather than attempt a granular model of the relationship between oil prices and CBN reserves (we have tried) it is better to look at the long-term relationship between them and establish some rules of thumb. Accordingly, the CBN’s FX reserves tend to prosper when Brent crude is consistently above US$60/bbl (though above US$50/bbl will do). They fall when the price of Brent crude holds below these levels, at which times the FX reserves of the CBN can trend below US$30bn. At this point the Naira is susceptible to devaluation. This was the case in June 2016 when it fell from N199/US$1 to N316/US$1, with a knock-on devaluation in August 2017 to N357/US$1.

Alternatively, and more recently, the CBN might look at oil prices and choose to allow the interbank rate to devalue. (What we refer to as the interbank rate is, these days, the same as the NAFEX and the I&E Window rates.) This was the case in March 2020 when the NAFEX and I&E rates moved from N367/US$1 to N388/US$1 and in February 2021 when they moved from N381/US$1 to N410/US$1. By using pre-emptive and small-step exchange rate adjustments, the CBN has protected its FX reserves over the past fifteen months (see chart).

Brent crude prices comfortably above US$60/bbl mean strong FX reserves. Even better is to rely on the comfort of these US dollar inflows to borrow more. The FGN is likely to do this with a US dollar Eurobond issue this year, perhaps in the region of US$3.0bn (which would be banked with the CBN). The CBN issues its own Naira-denominated bills to foreign investors (who sell US dollars to purchase them, holding a non-deliverable forward for their currency exposure) but this form of foreign portfolio investment (FPI) seems to be weak at the moment, and does not appear as a significant source of US dollars for 2021.

As for the price of Brent crude itself, this is in the hands of the Organization of the Petroleum Exporting Countries and its partner Russia (OPEC+). In response to the oil price crash in 2020 they reduced their combined production by 9.7 million barrels per day (mbpd), a limitation which they are now unwinding slowly. The market judges this rate of restoration (there will still be just under 6.0mbpd of cuts by July this year) to be slower than what is required, given the upswing in global demand. Both OPEC+ and the markets appear to be content with this. So, the price of Brent appears firm, at least for the time being, which enhances Nigeria’s US dollar inflows for 2021 and takes the pressure off the FX reserves of the CBN.

This does not mean an end to the pressure on the Naira in FX markets (after all, the devaluation of August 2017 took place when the level of CBN FX reserves was trending upwards), but it does remove the threat of a sharp fall in FX reserves. Policy makers have been spared that and can turn their attention to two other critical issues: inflation and the gap between official and unofficial exchange rates.

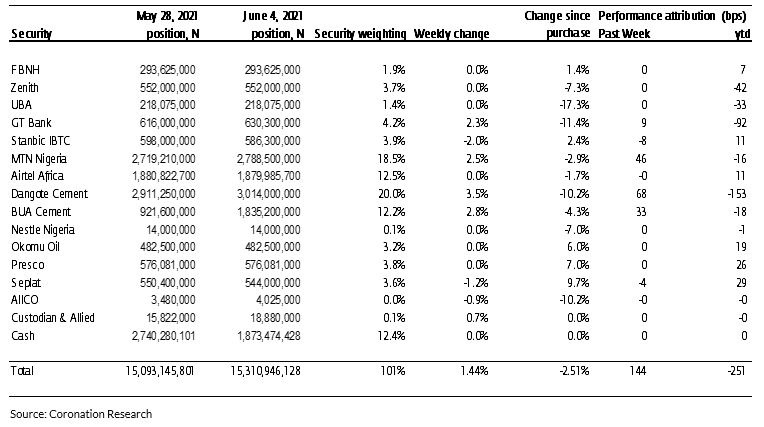

Model Equity Portfolio

Last week the Model Equity Portfolio rose by 1.44% compared with a rise in the NGX Exchange All-Share Index (NSE-ASI) of 1.23%, therefore outperforming it by 22 basis points. Year to date it has lost 2.51% against a loss in the NSE-ASI of 3.84%, outperforming it by 132bps.

Model Equity Portfolio for the week ending 4 Jun 2021

Having taken a knife to our overall overweight (23.1%) notional position in banks in May, to end the month with a more-or-less neutral position (15.1%) it was interesting to see that bank prices generally held up last week, with our overall banks position delivering 2bps. However, over a period of several weeks, our actions have saved the Model Equity Portfolio a notional 8bps.

As we forewarned last week, we made notional purchases in the cement sector in order to largely neutralise our exposure, making notional purchases of BUA Cement while holding a slightly overweight position in Dangote Cement.

Our outperformance came from our slightly overweight position in MTN Nigeria which delivered 46bps last week.

We continued to make notional purchases in insurance companies AIICO and Custodian & Allied, though, as we described last week, liquidity is frustratingly low. We made a small (500 shares) notional sale of Airtel Africa and will continue to do so, whenever opportunities arise (but liquidity is, again, scarce).

As we often write, we do not set ourselves the task of predicting the direction of the market: rather we buy stocks that we like then their valuations are inexpensive. However, the lull in the rise in market interest rates (T-bill rates and bond rates) is bringing a degree of confidence back to the equity market, so we see reasons for its recent gains and think these could continue for a while. For the time being (and this really means until we re-examine the situation next week), we will stick with our notional cash position (12.4%) and largely neutral allocations to the main index weights.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.