As oil demand is expected to grow strongly in the summer months, the OPEC+ alliance is still unable to reach an agreement on oil supply going forward with mixed results for the Nigerian economy. This month, the Senate passed the Petroleum Industry Bill (PIB); it is expected to create efficient and effective governing institutions with clear and separate roles for the petroleum industry. See details below.

FX

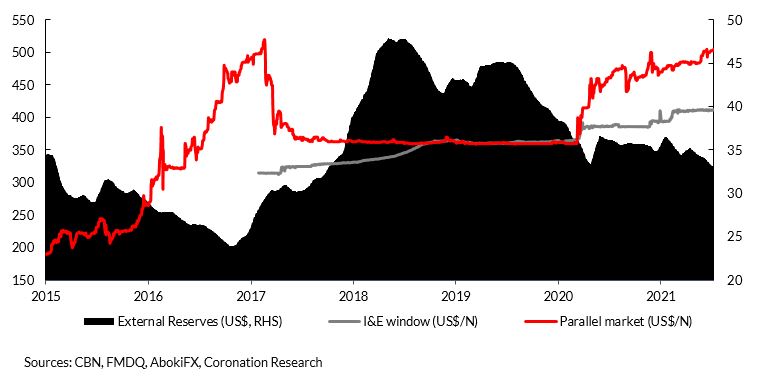

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) weakened by 0.12% to close at N411.75/US$1. In the parallel (or street) market, the Naira weakened by 0.40% to close at N505.00/US$1. Currently, the gap between the I&E window and the parallel market stands at 22.65%. Last week, the CBN’s reported FX reserves fell by 0.34% to US$33.12bn, the lowest level since October 2017. At levels of liquidity in the I&E Window and NAFEX markets that are well below what they were early last year (before the divergence between the NAFEX and parallel rates), we expect the parallel rate and the I&E Window rate to remain under pressure over the months to come.

Bonds & T-bills

Last week, bearish sentiments returned to the secondary market for FGN bonds was bearish. The yield of an FGN Naira-denominated bond with 10 years to maturity was up by 24bps to 12.45%; the yield on the 7-year bond also rose by 19bps to 12.36%, while the yield on a 3-year bond fell by 2bps to 11.20%. The overall average benchmark yield rose by 9bps w/w to close at 11.66%. Selloffs were focused at the short and mid segments of the curve, with slight demand seen at the long end of the curve. We reiterate our expectation for a further fall in yields in the near term, with inflows from the JUL-2021 bond maturity (N561.0 bn) and other coupon receipts (N40.68bn) supporting demand in the secondary market.

Activities in the Nigerian Treasury Bill (T-bill) secondary market remained bearish as system liquidity remained squeezed. The annualised yield on a 356-day T-bill in the secondary market closed at 9.44%, while the yield on a 249-day OMO bill fell by 8bps to 10.33%. The average benchmark yield for T-bills rose by 31bps w/w to close at 6.89%, while the average yield for OMO bills fell by 4bps w/w to close at 9.89%. At the T-bill auction scheduled for July 14, 2021, the CBN plans to offer N109.40bn in instruments, comprising N12.46bn of the 91-day bill, N25.37bn of the 182-day bill, and N N71.60bn of the 364-day bill. We expect the auction stop rates, especially on 364-day bills, to fall due to the expected oversubscription. Amidst incoming inflows from the bond maturity and coupon payments, we expect yields in the secondary market to fall slightly on liquidity-driven demand.

Oil

The price of Brent crude fell by 0.81% last week, the first weekly loss since May 2021, closing at US$75.55/bbl and showing a 45.85% increase year-to-date. The average price year-to-date is US$65.78/bbl, 52.22% higher than the average of US$43.22/bbl in 2020. Oil prices slipped amid persisting uncertainty around the OPEC+ coalition’s ongoing standoff – the unresolved deadlock threatens to unravel the alliance and spark a new price war. Nevertheless, amidst the recent developments, our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was down by -0.57% last week. Consequently, the year-to-date return fell to -5.65%. Seplat +10.00%, Access Bank +5.81%, and Oando +4.65% closed positive last week, while Airtel Africa -9.99%, Presco -8.72%, and FCMB Group -1.85% closed negative. Sectoral performances were bullish as the NGX Oil and Gas index led the gainers, rising by +6.53%, followed by the NGX Banking +3.29%, the NGX 30 +0.80%, the NGX Industrial +0.19%, and the NGX Insurance +0.17% indices. Conversely, the NGX Consumer Goods index declined by 0.32%. There is no Model Equity Portfolio page this week, but we will resume next week.

The oil industry remains an economic backbone for Nigeria. Oil’s formal share of real GDP was 9.2% in Q1 2021, which makes it the fifth-largest sector in the economy after agriculture, trade, information & communications and manufacturing. However, through its linkages across other sectors, the indirect oil economy probably makes up at least 40% of GDP.

In 2020 oil prices declined primarily on the back of the Covid-19 pandemic which resulted in lockdowns and the Saudi-Russian oil price war. To rescue the market, members of the Organisation of the Petroleum Exporting Countries and Russia (OPEC+) agreed to cut their joint output by ten million barrels per day (mbpd) compared with pre-pandemic levels (equivalent to roughly 10% of global production) in May and June. The cut was subsequently reduced to 8 mbpd between July and December 2020. The curbs have been gradually relaxed and now stand at about 5.8 mbpd. We note that Nigeria’s 2021 budget is predicated on daily crude oil production of 1.86 million barrels. The success of the vaccination programs across many developed countries has allowed economies to reopen and by extension, oil price (Brent) has witnessed a 47% rise year to date.

For Nigeria, this bullish oil market comes with mixed results. In complying with the production quotas from OPEC+, production levels reduced from a 2020 average of 1.7mbpd to 1.51mbpd between January and March 2021. With reserves falling from US$35.64bn at the beginning of the year to US$33.27bn as of 1 July 2021, the lowest level since October 2017. The currency crisis worsened the gap between the I&E window at US$411.00 and the parallel market at US$503.00 to even after two depreciations within the year.

On the fiscal side, recent data from the Nigeria National Petroleum Corporation (NNPC) show that the gap between the landing cost and ex-coastal price of petrol or Premium Motor Spirit (PMS) is widening. The implication of this is either a steep increase in fuel price with adverse effects on living standards as inflation accelerates (17.93% YoY; May 2021) or an increase in the amount used to subsidise the product for local consumers. These subsidy payments increase the FGN’s expenditure/deficit and are said to be over N150bn monthly, according to the Minister of Finance, Hajia Zainab Ahmed.

CBN’s External Reserves and Naira Exchange Rates

Last week, OPEC+ held another meeting with the majority of its members voting to lift the output by about 2.0 mbpd over the second half of the year and extend their remaining cuts to the end of 2022. However, it failed to reach an agreement as the United Arab Emirates (UAE) demanded a higher production quota than what was proposed. The impact of this decision deadlock on Nigeria is that oil revenue will continue to be driven by a rise in prices at a steady production output and is likely to be eroded by the impact of subsidy payments associated with the cost of importing of the PMS.

This month, the Senate passed the Petroleum Industry Bill (PIB). Previous attempts at passing the PIB failed due to lack of ownership, misalignment of interests between Legislature and the Executive branch of government, perceived erosion of ministerial powers, stiff opposition by the petroleum host communities, and investors’ pushback perceived uncompetitive provisions in those versions of the bill. The presentation of the PIB is in five separate pieces which cover Governance and Institutions, Administration, Host Communities Development, the Petroleum Industry Fiscal Framework, and Miscellaneous Provisions.

This piece of legislation is expected to create efficient and effective governing institutions with clear and separate roles for the petroleum industry; establish a framework for the creation of a commercially oriented and profit-driven national petroleum company; promote transparency, good governance and accountability in the administration of the petroleum resources of Nigeria and foster a business environment conducive for petroleum operations.

The major highlights of the PIB include:

- Incorporation of the Nigerian National Petroleum Company Limited (Section 53);

- The Establishment of the Nigerian Upstream Petroleum Regulatory Commission to, among many other duties, be responsible for the technical and commercial regulation of upstream petroleum operations;

- The Establishment of the Nigerian Midstream and Downstream Petroleum Regulatory Authority to, among many other duties, be responsible for the technical and commercial regulation of midstream and downstream petroleum operations in the petroleum industry;

- Decrease the royalty rate for offshore fields producing a maximum of 15,000 barrels per day to 7.5% from the current 10%, and disincentivise gas flaring by making its penalties non-tax deductible.

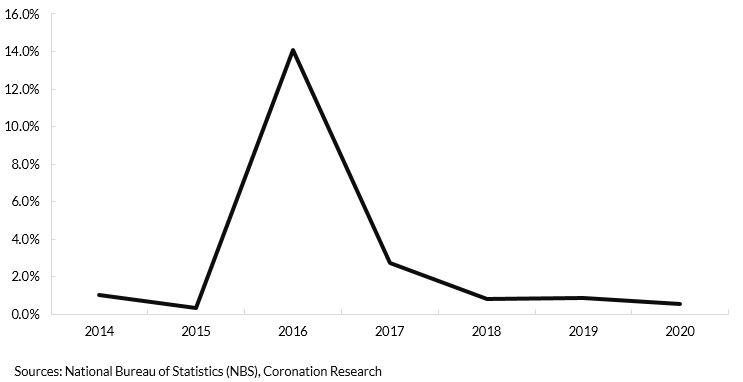

Capital Importation into the Oil & Gas sector (as % of Total Capital Importation, 2014 – 2020)

The impact of the passage of the PIB on the oil sector is an avenue for increased investor participation. In 2020, total capital imported into the country was US$9.68bn, with US$53.51million or 0.55% accounting for oil and gas. With the PIB, investors are likely to receive more favourable fiscal terms that are likely to improve the competitiveness of Nigeria’s oil and gas industry, bolstering the oil and gas portion of capital imports.

The bill is expected to enhance the production of crude oil in the onshore and deep-water segments. In addition, the indirect influence of investments in the sector could boost local refining capacity and employment through increased establishments of local standard refineries, enter the Dangote refinery.

The bill’s passage hopes to improve the standard of living of local communities and raise investor confidence in the sector. This could also indirectly affect the economy as the people benefitting from this would become more productive. We assume that the passage of the bill will reduce the cost of subsidy payments, releasing funds for the improvement of other sectors in the economy. Thereby, easing pressure on the unemployment rate.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.