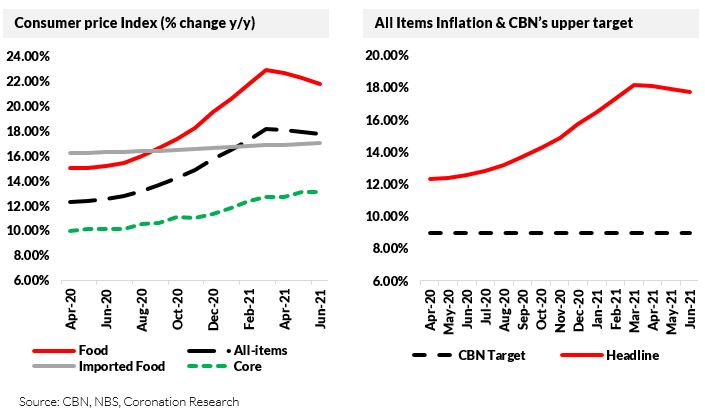

Last week, the National Bureau of Statistics (NBS) Consumer Price Index (CPI) report for June 2021 showed a moderate decline in the headline inflation to 17.75% from 17.93% recorded in May 2021. We attribute the slowdown to the effect of the high base from the previous year. The trend over the last three months suggests that, barring any significant shocks, inflation hit its peak in March (18.17%). See details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) appreciated by 0.33% to close at N410.38/US$1. In the parallel (or street) market, the Naira weakened by 0.20% to close at N506.00/US$1. Currently, the gap between the I&E window and the parallel market stands at 23.30%. Last week, the CBN’s reported FX reserves fell by 0.01% to US$33.10bn, the lowest level since October 2017. At levels of liquidity in the I&E Window and NAFEX markets well below what they were early last year (before the divergence between the NAFEX and parallel rates), we expect the parallel and the I&E Window rates to remain under pressure over the months to come.

Bonds & T-bills

Last week, trading in the secondary market for FGN bonds remained bearish. The yield of an FGN Naira-denominated bond with 10 years to maturity was up by 20bps to 12.65%, the yield on the 7-year bond fell by 1bp to 12.35%, while the yield on the 3-year bond fell by 10bps to 11.10%. The overall average benchmark yield rose by 50bps w/w to close at 12.16%. Selloffs were focused at the mid and long segments of the curve as investors, while demand was seen at the short end of the curve as investors reinvested bond coupon and maturity payments. In today’s bond primary auction, the Debt Management Office (DMO) will be reopening the FEB 2028, MAR 2036 and the MAR 2050 bonds, offering N150bn across the tenures. We expect relatively strong subscription levels, given the liquidity boost from the JUL-2021 bond maturity (N561.0 bn) and other coupon receipts (N40.68bn). Consequently, yields are expected to decline, in line with secondary market levels.

Activities in the Nigerian Treasury Bill (T-bill) secondary market were bullish, following improved system liquidity. The annualised yield on a 349-day T-bill in the secondary market closed flat at 9.44%, while the yield on a 242-day OMO bill fell by 2bps to 10.31%. However, the average benchmark yield for T-bills fell by 20bps w/w to close at 6.69%, while the average yield for OMO bills fell by 59bps w/w to close at 9.29%. At the T-bill primary auction held on Wednesday, the DMO allotted N150bn in instruments. The stop rates on the 91-day bill (2.50%) and the 182-day bill (3.50%) were unchanged from the previous auction, while the stop rate on the 364-day bill fell by 48bps to 8.67%. The auction recorded a total subscription of N574.68bn, the highest level this year, with a bid-to-cover ratio of 3.8x (2.7x at the previous auction. We expect a slight uptick in yields in the T-bill secondary market this week in the absence of any significant inflows to boost liquidity.

Oil

The price of Brent crude fell by 2.59% last week, the largest weekly loss since May 2021, closing at US$73.59/bbl and showing a 42.07% increase year-to-date. The average price year-to-date is US$66.10/bbl, 52.96% higher than the average of US$43.22/bbl in 2020. The Organization of the Petroleum Exporting Countries and its allies (OPEC+) has agreed to gradually add more oil supplies to the market by boosting output by 0.4 mbpd each month from August. It plans to continue this until all its 5.8 mbpd of halted production has been revived. Amidst the still tight market and recovering global oil demand, we reiterate our view that Brent oil is likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was down by -0.12% last week. Consequently, the year-to-date return fell to -5.75%. FBNH -5.19%, Nigerian Breweries -3.33%, and Dangote Sugar -2.24% closed negative last week, while Oando +4.44%, Fidelity Bank +3.90%, and UBA +3.33% closed positive. Sectoral performances across the sectors had a bearish tilt with the NGX Insurance -1.07%, NGX Consumer Goods -0.85%, NGX Industrial index -0.30%, and the NGX 30 -0.19% index declining. Conversely, the NGX Oil and Gas +1.81% index and the NGX Banking +0.09% index were the sole gainers. The Model Equity Portfolio will resume next week.

Inflation on the decline

The latest inflation report for June 2021, released by the National Bureau of Statistics (NBS), showed a moderate decline in the All Items/headline inflation to 17.75% from 17.93% recorded in May 2021. This year, headline inflation peaked at 18.17% in March. The consecutive moderation in the Headline inflation can be attributed primarily to the slowdown in food inflation (down by 45bps to 21.83% y/y) – the primary driver for inflation.

- Food price inflation declined to 21.83% in June (a decline of 45bps), caused by wide-ranging price increases across items such as cereals, yam, and other tubers, meat, fish, and vegetables.

- The core inflation declined by 5bps to 13.09% y/y from 13.15% y/y recorded in May. However, on a month-on-month basis, it rose by 0.81% compared with 1.24% in May.

- Prices of imported food rose by 6bps to 17.83% y/y from 16.97% y/y in April. On a month-on-month basis, the index rose by 0.33% compared with 1.02% in May.

- The latest NBS report tells us that the transport segment, which accounts for 6.5% of the basket, posted price increases of 0.07% m/m in June and 15.9% y/y, compared with 15.8% y/y in May.

- A separate report from the NBS reveals that the average fare paid by commuters for bus journeys within cities increased by 3.36% m/m and 79.39% y/y in May compared with 2.34% m/m and 72.59% y/y the previous month. Zamfara, Bauchi, and Taraba states recorded the highest increases. The same report shows that the average fare paid by commuters for motorcycle journeys increased by 2.3% m/m and 85.83% y/y in May. The hike in the price of Premium Motor Spirit (PMS) is a core reason for the increases across the transport segment.

- The price rises recorded in the health segment were 1.19% m/m and 16.62% y/y in June. Over the past 12 months, pharmaceuticals and medical services have featured as leading drivers of core inflation.

- In June, increases of 1.16% m/m and 13.26% y/y were recorded for the recreation and culture segment within the inflation basket. This has been consequent on an increased appetite for outdoor activities post-lockdown. However, strict social distancing guidelines are still being applied, given the resurgence of the Delta Variant of the Covid-19 Virus.

- Price increases of 1.09% m/m and 12.64% y/y were recorded in the restaurants and hotels segment. The Hospitality industry (like some other sectors) experienced economic scarring because of the COVID-19 pandemic. However, specific segments of the industry are now performing relatively better given the ease of lockdown restrictions.

- Based on the latest monetary policy committee (MPC) communique, the committee noted that as the economy’s productive capacity improves and supply chains are gradually restored, inflationary pressure is expected to ease further.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.