The scorecard for the listed banks that have reported their H1 results is mixed. We believe that it is a matter of timing changes in interest rates and that Q3 is likely to be a better story than Q2 and H1. See details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) depreciated by 0.12% to close at N412.00.00/US$1. Similarly, the Naira weakened by 2.83% in the parallel (or street) market to close at N545.00/US$1. As a result, the gap between the I&E window and parallel market rates now stands at 32.28%. Elsewhere, the Central Bank of Nigeria’s FX reserves rose by 1.75% to US$34.78bn. We maintain our view that the FGNs potential Eurobond issuance and the US$3.3bn allocation from the International Monetary Fund’s (IMF) Special Drawing Right (SDR) are likely to help shore up the CBN’s external reserves. Amidst these developments, we expect the parallel rate and the I&E Window rates to trade range-bound in the near term.

Bonds & T-bills

Last week, activities in the Federal Government of Nigeria (FGN) bond market were mixed, albeit with a bearish tilt, following the increased stop rate on the 364-day bill at the Treasury Bill (T-Bill) Primary Market Auction (PMA). As a result, the overall average benchmark yield rose by 5bps w/w to close at 11.09%. The yield of an FGN Naira-denominated bond with 10-years to maturity rose by 1bp to 11.56% while the yield on the 7-year bond fell by 4bps to 11.21%, and the yield on the 3-year bond was down by 24bps to 9.67%. We reiterate that a future rise in bond yields, if any, is unlikely to be sharp over the coming three months due to unaggressive borrowing as the Debt Management Office (DMO) manages its debt service costs.

Trading in the Treasury Bill (T-Bill) secondary market was also bearish, as the CBN mopped up liquidity via Open Market Operation (OMO) auction. As a result, the average benchmark yield for T-bills rose by 30bps in the week to close at 4.91%, while the average yield for OMO bills was up by 10bps on the week to close at 6.22%. The annualised yield on a 349-day T-bill in the secondary market closed at 7.39%, while the yield on a 186-day OMO bill fell by 4bps to 6.57%. At the T-bill primary market auction (PMA), the DMO allotted N209.50 billion (US$509.73m) worth of bills across all tenors. Stop rates remained unchanged on the 91-day (2.50%) and the 181-day (3.50%) bills, while the rate on the 364-day bill unexpectedly rose by 40bps to 7.76%. The auction recorded the weakest demand since 14 May 2021 with a bid-to-offer ratio of 1.85x (2.51x as of the previous auction). We expect the results of the T-bill auction this week to help bring clarity as to the direction of rates.

Oil

The price of Brent crude rose by 0.43% last week to close at a US$72.92/bbl, showing a 40.77% increase year-to-date. The average price year-to-date is US$67.34/bbl, 55.80% higher than the average of US$43.22/bbl in 2020. The price dipped early in the week as Saudi Arabia cut October crude contract prices for Asia by a larger than expected margin. However, the oil price grew towards US$73.00/bbl towards the end of the week, driven by continuing signs of supply tightness in the United States as a result of Hurricane Ida. As of Friday, 66% (1.2 mbpd) of the Gulf of Mexico oil production was still offline.

However, we note that the estimate has remained unchanged since July despite the resurgence of Covid-19 across major economies. Nevertheless, we maintain our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months

Equities

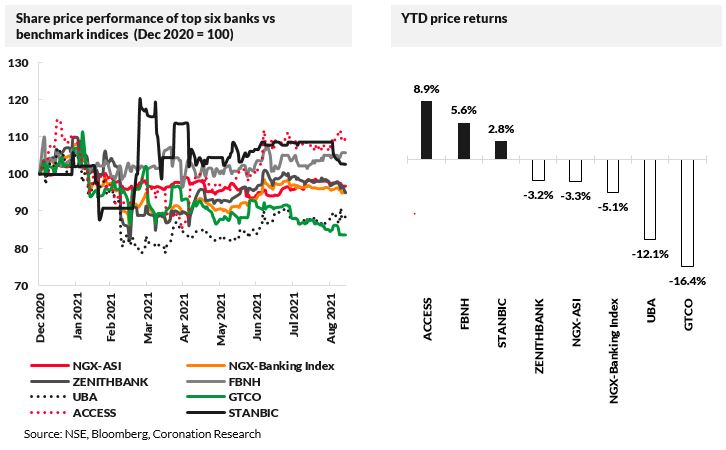

The NGX All-Share Index (NGX-ASI) fell by –0.86% last week. Consequently, the year-to-date return fell to -3.35%. Cadbury Nigeria -5.88%, Airtel Africa -4.67%, Flour Mills of Nigeria -3.50% and Guaranty Trust Holdco -2.87% closed negative last week, while Oando +14.00%, International Breweries +3.23%, Honeywell Flour Mills +2.70% and FCMB Group +1.69% closed positive. Sectoral performances were mixed: The NGX Insurance, -3.39%, and NGX Banking, -0.96%, indices declined, while the NGX Oil & Gas, +2.28%, and NGX Consumer Goods, +0.18%, indices gained. The NGX Industrial Goods closed flat. The Model Equity Portfolio will resume next week.

Nigerian Banks: H1 2021 Scorecard

Last week, the final set of H1 2021 earnings among the six banks we cover were released following a lengthy approval process by the regulator. Overall, the results across the banks were mixed, with exactly half of the banks recording growth in Net profit, while the others recorded Net profit declines. However, with most of the reported earnings, when annualised, missing analyst’s consensus estimates by wide margins, investors were clearly not impressed. As a result, there were selloffs across many bank stocks last week and the week before.

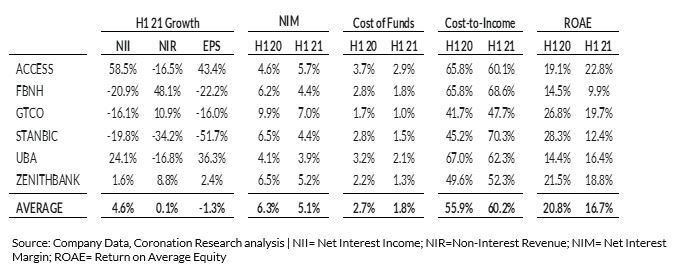

As we stated last week, when we spoke with banks for our report, Nigerian Banks, Resilience Built In (25 June), almost all of them related that they were adapting deposit and lending rates to reflect the rise in rates during the first quarter of the year. Where they seemed to be more successful was in lowering their Cost of Funds (borrowing costs). Specifically, the average CoF across the banks we cover fell from 2.7% in H1 20 to 1.8% in H1 21. On lending, most banks stated they were implementing changes (e.g., making loans costlier for customers) at the end of Q1 2021 or the beginning of Q2 2021. However, to a large degree, this did not seem to play out in H1 21. In our view, it is either the pass-through of rising interest was not yet fully reflected in Net Interest Income or that repricing loans upwards proved more challenging amongst the price-sensitive customer base.

Elsewhere, some banks found alternative means of driving top-line growth. For example, Access Bank benefitted from favourable yields on its sovereign swap portfolio. At the same time, UBA invested some of its excess cash at favourable rates in the interbank market. Overall, average Net Interest Income growth across our coverage was muted (+4.6% y/y). However, Net Interest Margins fell to 5.1% from 6.3% amidst the still relatively low yield environment.

Top six banks H1 2021 Performance Metrics

Although the market is disappointed with the spreads and Net Interest Income realised during the first half of the year, we emphasise that the timing of interest rate changes is important. For example, most banks stated that they were implementing changes (e.g. making loans more costly for customers) at the end of Q1 2021 or at the beginning of Q2 2021. Therefore, if market rates fall, and their cost of funds also fall after they have just raised lending rates, spreads are likely to have increased during Q3.

In other words, this has the potential to improve banks’ Net Interest Margins. However, not all banks move at the same speed, as the different results from Zenith Bank and Access Bank show (see our notes on 30 August and 3 September, respectively). The good news is that the interest rate decreases, which are likely to impact margins positively, began in mid-May and continued. This not only helps the largest and most liquid banks but may take pressure off the smallest and least liquid banks that frequently depend on the interbank market to balance their books.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.