Today we turn our attention to the recently released national accounts for Q2 2021 from the National Bureau of Statistics. The data show that GDP grew by 5.0% y/y in Q2. Although the oil economy contracted by -12.7% y/y, the non-oil economy grew by 6.7% y/y. For the latter, this is an improvement from the 0.79% y/y growth recorded in Q1 2021. There were at least six key drivers of non-oil growth in Q2, manufacturing sector inclusive. The manufacturing sector accounted for 8.7% of total GDP in Q2 and grew by 3.5% y/y. The relaxation on movement restrictions and lockdowns since Q3 2020 contributed to a pickup in not just economic activity, but also demand and this has supported growth for the manufacturing sector.

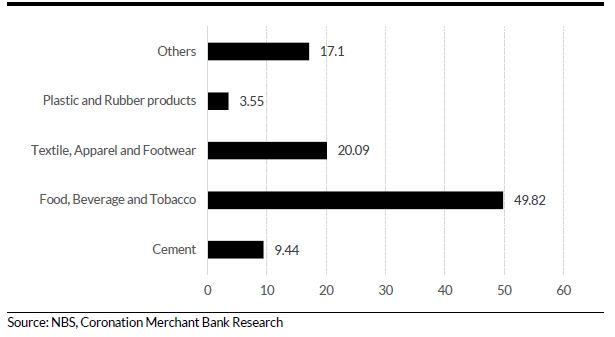

- Within the manufacturing sector, food and beverages, its largest segment posted growth of 4.9% y/y compared with 7.1% recorded in the previous quarter (and accounted for 50% of total manufacturing GDP). The textile, apparel and footwear segment grew by 1.8% y/y. For the latter, although Nigeria has a huge appetite for fashion and related industries, textile manufacturers struggle with limited capacity for clothing production, poor patronage, and meagre purchasing power.

- The economic downturn experienced in 2020 resulted in fx policy adjustments by the CBN. Both fx illiquidity and pricing pose additional challenges for manufacturers. According to some manufacturers, fx is more accessible in the parallel market (N527/US$) but the transaction volumes are not sufficient to cover their necessary dollar-denominated costs.

- Some local manufacturers are considering passing on increased production costs to consumers but also worry that they could lose market share to their foreign competitors due to their relative affordability. Also, on the supply-side, apart from existing structural issues, heightened insecurity in some areas of the country has disrupted the flow of movement of goods and people.

- The headline inflation has been at double-digit y/y each month since February 2016 (however, there have been modest declines over the past months). Other than the impact on household wallets, the inflationary conditions in Nigeria adversely affect the profitability of the manufacturing sector.

- The African Continental Free Trade Area (AfCFTA) is expected to positively impact domestic manufacturing. To maximise the benefits of the agreement, Nigeria’s manufacturing sector needs to be strengthened. Furthermore, local manufacturers need to significantly improve their service delivery and product standards if they are to be competitive in a burgeoning intra-continental marketplace.

Segments of Manufacturing GDP, Q2 2021 (constant prices; % shares)

Team

E-mail: coronationresearch@coronationmb.com

Tel: +234 (0) 1-2797640-43