Summary

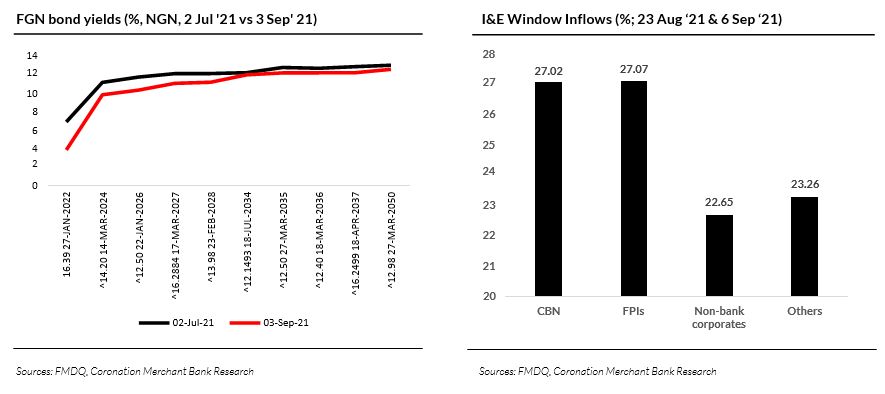

- Opening market liquidity was reported at NGN445.4bn on Friday (03 Sep ‘21). Overnight and repo rates closed within a range of 10.0-13.5%. The secondary market for NTBs was relatively active. As a result, the average NTB yield declined by 34bps over the week to close at 4.6%, while the average yield for OMO bills was up by 1bps w/w to close at 6.1%. The secondary market for FGN bonds was active on the back of improved system liquidity as average yield declined by 11bps to close at 11.0%. At the Eurobond market, average yield of the sovereigns under our coverage declined by 19bps to 5.7%.

- On Thursday last week, the CBN sold NGN50.0bn worth of OMO bills to market participants and maintained the stop rates across the three tenors, unchanged from prior auctions (82-day: 7.0%, 152-day: 8.5%, and 327-day: 10.1%).

- US nonfarm payroll data show a less-than-expected increase of 235,000 from the 943,000 recorded in July. China’s official manufacturing Purchasing Manager’s Index (PMI) declined to 50.1 in August from 50.4 recorded in the previous month, hitting its lowest level since Feb ’20. The challenges hindering China’s productivity include widespread flooding, tough social-distancing measures at ports, chip shortages, far tighter regulation in some industries, among others.

Repo rates and NTB yields (%)

| Repo | Current | Previous | NTB | Current | Previous |

| Overnight | 13.5 | 8.50 | NTB 25/11/21 | 3.20 | 3.29 |

| 30D | 10.0 | 9.0 | NTB 24/02/22 | 4.33 | 5.10 |

| 90D | 12.5 | 10.5 | NTB 26/05/22 | 6.61 | 6.61 |

| 180D | 13.0 | 10.5 | NTB 14/07/22 | 6.68 | 6.68 |

| OBB | 13.0 | 8.3 |

FGN bonds and Eurobonds

| Security | Price (close) | Yield (close, %) | Change (bps) |

| 16.39% FGN Jan’22 | 104.81 | 4.01 | -52 |

| 14.20% FGN Mar’24 | 109.39 | 9.91 | 10 |

| 12.50% FGN Jan’26 | 107.23 | 10.40 | -22 |

| 16.2884% FGN Mar’27 | 120.87 | 11.13 | 1 |

| 13.98% FGN Feb’28 | 112.32 | 11.25 | -15 |

| 12.15% FGN Jul’34 | 100.66 | 12.04 | 0 |

| 12.50% FGN Mar’35 | 101.61 | 12.25 | -35 |

| 12.40% FGN Mar’36 | 100.93 | 12.26 | -27 |

| 16.2499% FGN Apr’37 | 127.37 | 12.27 | -21 |

| 12.98% FGN Mar’50 | 102.70 | 12.63 | -8 |

| 6.38%FGN ’23 USD | 106.40 | 2.79 | -14 |

| 8.75% FGN ’31 USD | 113.68 | 6.75 | -23 |

| 7.88%FGN ’32 USD | 108.13 | 6.77 | -24 |

| 7.63% FGN ’47 USD | 100.73 | 7.56 | -15 |

| 10.50% Access ’21 USD | 100.57 | 5.25 | -33 |

| 7.38% Zenith ’22 USD | 103.12 | 3.00 | -4 |

| 7.75% UBA ’22 USD | 103.26 | 3.30 | -10 |

FX dynamics

Last week, the NAFEX rate appreciated by 0.1% or NGN0.5 to close at NGN411.5/USD. However, the Naira depreciated by 1.2% or NGN6.0 in the parallel market to close at NGN530.0/USD. The depreciation can be partly attributed to the increased demand for fx by importers. As a result, the gap between the I&E window and parallel market rate now stands at 28.8%. In the forwards market, the rate depreciated at the 1-month (-0.4% to NGN413.25/USD), 3-month (-0.8% to NGN417.68/USD) contracts.

Based on data from the FMDQ, NAFEX turnover showed a w/w decline of USD89m from USD216.5m to USD127.5m on Friday. The I&E window (NAFEX) recorded inflows of USD403m with the CBN accounting for 27.02%, the FPIs accounting for 27.07%, non-bank corporates accounting for 22.65%, and others accounting for 23.26%.

Over the past week, Nigeria’s external reserves increased by 1.5% to USD34.1bn. In our view, the FGN’s imminent Eurobond issuance and the allocation from the International Monetary Fund’s (IMF) Special Drawing Right (USD3.4bn) are likely to shore up fx reserves. Amidst these developments, we expect the NAFEX rate to trade range-bound (NGN410.00/USD – NGN415.00/USD) in the near term.

Team

E-mail: coronationresearch@coronationmb.com

Tel: +234 (0) 1-2797640-43