2020 was dominated by the Covid-19 pandemic, the crash in commodity prices and the global recession. Right? Not quite. Looking back over the past 12 months in Nigeria we reason that domestic factors have driven Nigeria’s financial markets: the intentional crashing of market interest rates, and the associated rally in the stock market. Nigeria was master of its own markets in 2020, in our view. 2021 is likely to be a little different. See details below.

FX

Last week the exchange rate in the NAFEX market (also known as the I&E Window and the interbank market) weakened by 0.46% to N392.65/US$1 on Thursday, 24 December. In the parallel, or street market, the Naira appreciated by 2.72% to close at N465.00/US$1. The impact of the Central Bank of Nigeria’s (CBN) new rules on receipt of diaspora remittances is reflected in the continuing appreciation of the Naira in the parallel market from N500/US$1 at the beginning of the month. According to the latest CBN Business Expectation Survey, respondent firms expect the Naira to depreciate this month but to recover against the US dollar from February. Although we do not think that pressure on the parallel rate will be severe, we do not think it will completely go away, either. We see the parallel rate being c.20% lower than the NAFEX rate over the coming weeks.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 27 basis points (bps) to 6.58% and at 7 years rose by 72bps to 5.58% while at 3 years the yield rose by 83bps to 3.60%. The annualized yield on a 308-day T-bill declined by 2bps to 0.63%, while the yield on a 306-day OMO bill rose by 23bps to 0.92%. In the Nigerian Treasury Bills (T-bill) market, trade volumes continued to be low as local banks remain risk-off at current market levels with short- to long-dated papers. By and large, yields remained unchanged across the curve for both the T-bills. The bond market remained in a negative mood last week. And on Friday yields expanded further by an average of c.65bps across the benchmark bond curve. We do not expect a significant change in the current market sentiment over the coming weeks.

Oil

The price of Brent crude fell by 0.41% last week to US$51.29/bbl on Thursday 24 December. The average price, year-to-date, is US$43.09 /bbl, 32.81% lower than the average of US$64.14 /bbl in 2019. Brent was down last week despite earlier optimism about vaccines and a new stimulus package that was approved in the United States. Dragging on oil prices was a build-up in crude oil inventories of 2.70 million barrels for the week ending 18 December. Analysts had predicted an inventory draw of 3.14 million barrels for the week. A new strain of Covid-19 that caused border closures throughout the world created concerns that the global economic recovery would be delayed. We expect oil prices to remain close to US$50bbl for several weeks, though we await the outcome of the OPEC meeting on 4 January which may change the level of production cuts.

Equities

Last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 5.42% with a gain of 44.55% year-to-date to close at 38,800.01. Dangote Cement (+16.95%), Oando (+15.92%), and Honeywell Flour Mills (+10.81%) closed positive while International Breweries (-5.90%), Ardova Oil (-5.24%) and Lafarge Africa (-4.55%) closed negative. We are concerned by the velocity of the recent rally. See Model Equity Portfolio for details.

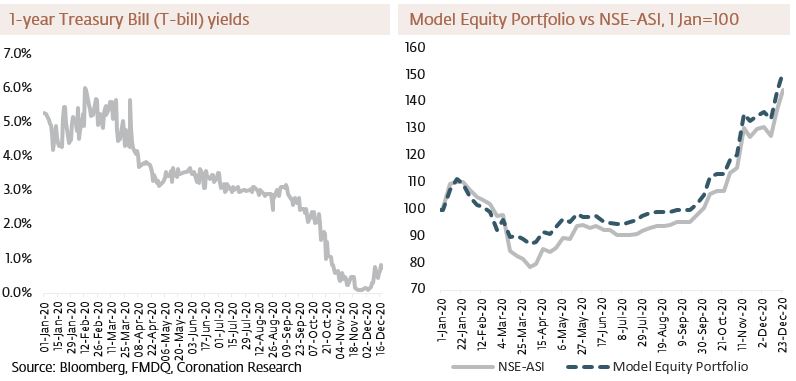

A year in two charts

For Nigeria’s financial markets 2020 was the year of crashing interest rates and of surging equities (the Nigerian Stock Exchange All-Share Index, NSE-ASI, is up 44.55%, so far). The first caused the second to happen. And the first was unprecedented, at least over the past 10 years. During the years from 2010 to 2019 inclusive Treasury bill rates exceeded the rate of inflation by 2.57 percentage points (pp), on average. Saving, whether through building up bank deposits or mutual funds, was straightforward during this period, since the risk-free Treasury bill usually offered an attractive return. All that changed in 2020 when, over a period of 11 months, 1-year T-bill rates fell from 5.40% to almost nothing.

Investors, not surprisingly, were not impressed with this; some were indignant. Many of them were unaccustomed to taking risks to obtain an adequate return. And inflation stayed in double digits during 2020, rising to 14.89% y/y for November. A guide was required for them to begin to measure the returns they should expect from different asset classes. We published Navigating the Capital Market, the Investor’s Dilemma on 24 July, our guide to fixed income and listed equity returns. 2020 was also the year when mutual funds (collective investment schemes) took off, as savers began to turn their back on banks (deposit rates were crashing) and to buy funds instead. We covered this phenomenon in Shifting the Appetite of Nigerian Investors: from Savings to Mutual Funds, in October.

Exogenous factors were important in 2020: the first wave of Covid-19 infections spread around the world in February; the associated loss of confidence destroyed global growth. The crash in commodities, with oil being particularly badly hit, took income away from the Federal Government of Nigeria (FGN) and upset Nigeria’s trade balance. Shortage of US dollar inflows prompted the CBN to be parsimonious with its foreign exchange reserves (from March onwards). Foreign exchange turnover on the NAFEX market (the I&E market) fell and the parallel rate re-emerged. Nigeria went into recession, though we think that it will prove to be not as severe as the 4.30% y/y full-year recession which the IMF forecast back in June.

In some ways Nigeria’s 2020 actually started in October 2019, when the CBN decided to bar most domestic institutions from buying new issues of its open market operation (OMO) bills. This caused institutional liquidity to flow from the OMO market into the T-bill and bond markets, and it was this flow of liquidity that crashed rates. The CBN achieved one of its desired effects, with commercial bank lending rising significantly, having been stagnant during 2019. Through its cash reserve ratio (CRR), and the excess CRR, it was possible to provide a high level of liquidity to the public sector.

Towards the end of the CBN aided banks with their liquidity by issuing them with N4.1 trillion (US$10.5bn) of Special Bills in respect of their excess CRR. These bills carry a yield of 0.50% pa, and the market has interpreted this as putting a floor under short-term interest rates. Indeed, the flow of liquidity from the OMO market into the T-bill market and the bond market is a one-off event and cannot be repeated. Therefore, 2021 will be very different from 2020, in our view. This is not to say that 2021 will be reverse of 2020, but market interest rates are already moving up. Our current base case is for a gentle rise in interest rates in 2021.

Model Equity Portfolio

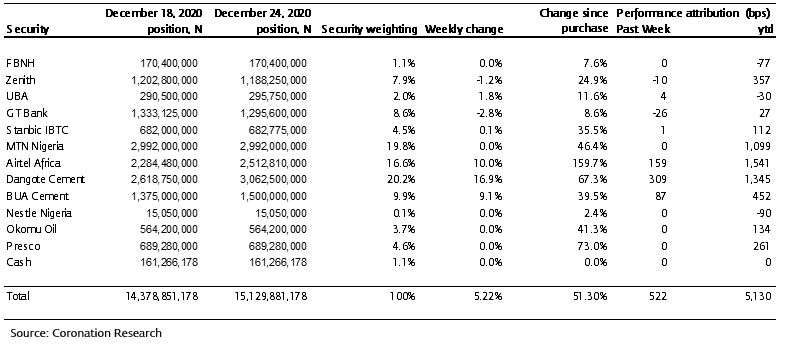

Last week the Model Equity Portfolio rose by 5.22% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 5.42%, therefore underperforming it by 20 basis points. Year-to-date it has gained 51.30% against a gain of 44.55% in the NSE-ASI, outperforming it by 675bps.

For some weeks we have become concerned about the market’s rally. It is one thing for Dangote Cement to rally on the back of an announced share buy-back: quite another thing for Airtel Africa to rise by 66.91% in three weeks. If we take the four largest weights in the NSE-ASI, they have rallied a lot since the beginning of November: MTN Nigeria by 11.11%; Airtel Africa by 107.65%; Dangote Cement by 53.13%; BUA Cement by 31.87%.

Shares in Airtel Africa are usually much less liquid than many other NSE-listed stocks (for example, much less liquid than the principal bank stocks in which we hold notional positions). So, in the real world, it possible for a relatively small amount of buying make the stock move a lot. True, the telecom sector does benefit from current consumption trends and data usage – there is some fundamental underpinning to the rally – but this seems to be overdone.

Model Equity Portfolio for the week ending 24 December 2020

We have protected ourselves during this rally by holding notional neutral positions in the four principal index weights mentioned above. However, we are concerned that the rally will last until the end of the year (in two days) and not much further. We will therefore begin to reduce our notional positions in these stocks over the coming two days, raise the level of cash, and review the situation early next week.

As we often write, we do not like to guess the market’s direction because we simplify our job to buying stocks we like when they are cheap: but (as was the case in early March), exceptional circumstances require an exceptional response.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.