Global equity markets have been trending up this month. Markets are showing confidence in a global economic rebound, despite significant setbacks from the rising number of recorded Covid-19 cases in the US, the European Union, India and Brazil. Commodity prices have also been rising, but the behaviour of oil prices and copper prices have been very different, with oil prices seemingly held back recently. This could have important implications for Nigeria. Learn more below…

FX

Month-to-date the FX reserves of the Central Bank of Nigeria (CBN) have declined by US$171.95m to US$36.00bn (a data point that represents a one-month moving average). There was a meagre inflow of US$45.62m month-to-date into the NAFEX market (also known as the I&E Window, where the rate is the one quoted by Bloomberg). It appears that the CBN is not meeting the demand for FX, and this is indicated by the significant gap between exchange rates in the NAFEX market at N389.52/US$1 and the parallel market at N472.00/US$1. We may see further weakness in the parallel market if the bulk of FX demand remains unmet.

Bonds & T-bills

Last week the secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 100 basis point (bps) to 7.84%, and at 3 years increased by 33bps to 4.36%. The annualised yield on 321-day T-bill remained flat at 2.96% while a CBN Open Market Operation (OMO) bill with similar tenure increased by 7bps to 5.87%. Last week, strong demand for the longer-dated bonds in the primary market auction led to a decline in yields. A total subscription of N470.13bn (US$1.23bn) was recorded while the Debt Management Office (DMO) sold N177.00bn (US$465.79m) worth of instruments across different maturities.

Oil

The price of Brent crude increased by 0.46% last week to US$43.34/bbl. The average price, year-to-date, is US$42.24/bbl, 34.20% lower than the average of US$64.20/bbl in 2019. Oil demand has improved from the deep trough of the second quarter, although the recovery is uneven as the resumption of lockdowns in the United States and other parts of the world is capping consumption. As we have been saying for a month now, oil look supported at US$40.00/bbl but a sharp rally to US$50.00/bbl seems unlikely at this stage.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) increased by 0.58% last week. The year-to-date return is negative 8.99%. Last week Honeywell Flour Mills (+8.33%), Ardova Oil (+7.17%), Dangote Cement (+6.51%) and Stanbic IBTC (+3.45%) closed positive, while International Breweries (-10.53%), Seplat (-10.00%), Sterling Bank (-5.60%) and Unilever Nigeria (-4.67%) closed negative. The sectoral performance was mixed, with the Banking (+0.01%), and Insurance (+0.29%) indices recording weekly gains, while the Industrial Goods (-1.01%), Oil & Gas (-4.98%), Consumer Goods (-0.08%) index closing lower.

The commodity price conundrum

Commodity prices indicate the state of the global economy, and recent rises show that the world is getting back to normal, or something close to it. Both oil and copper respond to global industrial demand. However, their performances this year have been very different.

The price of copper is up 3.9% year-to-date (YTD) and up 38.6% from its low point which it reached in March. The price of Brent Crude is down 34.3% YTD but is up 103.2% from its low point which it reached in April. What is going on?

The copper price is the easier of the two to explain. It fell in line with the spread of the Covid-19 pandemic early in the year but has rebounded as industrial countries have headed out of recession (the Chinese economy was already growing in Q2). Oil also fell as the pandemic spread, but then was depressed by two of the largest producers, Russia and Saudi Arabia, announcing that they would ramp up production. Then they reached a truce in April.

Why has oil not rallied more? One explanation is that Russia and Saudi Arabia could increase production if they see the price rally much higher. Russia has stated that it wishes to regain global market share, implying that the high-cost part of the US shale industry must close. Indeed, one US oil industry CEO has been keen to point out that he does not expect US oil production to reach 13 million barrels per day again: he thinks 11mbpd is realistic.

In other words, if oil prices recover too much, then Russia and Saudi Arabia might respond by producing more oil (indeed, an easing of production cuts is planned by the OPEC+ group of oil producers, which is dominated by Saudi Arabia and Russia). For Nigeria, whose public finances work well when oil is trading over US$50.00/bbl, this could imply that adjustments will have to be made. US$50.00bbl may be desirable but may not be reached until a sizeable part of U.S. shale production has shut down.

Model Equity Portfolio

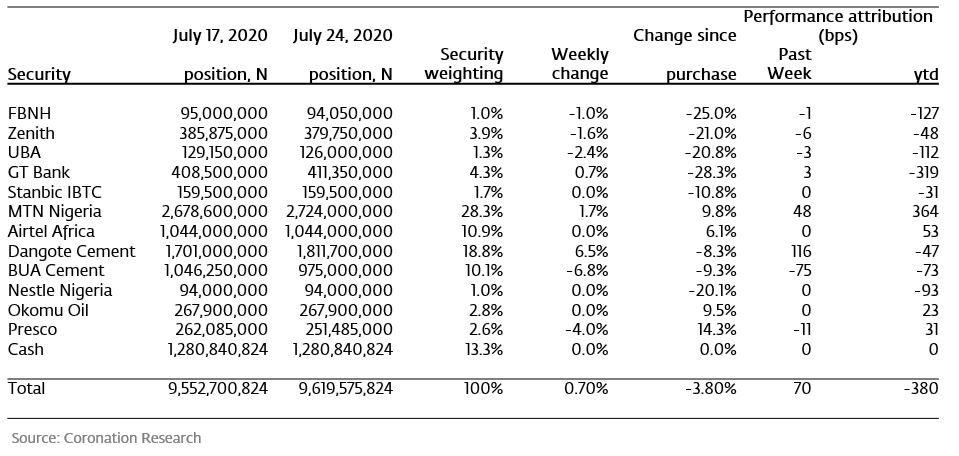

Last week the Model Equity Portfolio rose by 0.70%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.58%, therefore outperforming it by 12 basis points. Year-to-date it has lost 3.80%, against a loss of 8.99% in the NSE-ASI, outperforming it by 519bps.

Our slight outperformance last week was due in large measure to our overweight position in MTN Nigeria, which rose by 1.7% over the week. The market’s star performer, however, was Dangote Cement, which rose by 6.5%, but we only have a neutral position in it. Dangote Cement’s results, released on Friday, were a pleasant surprise to the market. Much of its growth came from African countries other than Nigeria, but trading conditions in Nigeria itself indicated that economic conditions during Q2 were perhaps not as bad as some people had expected. This, therefore, gives a degree of positive read-through to the market overall, which gives us added impetus to think about our underweight positions.

Model Equity Portfolio for the week ending 24 July 2020

Our notional underweight position in the banks has saved us 27bps since we made notional sales four weeks ago. This is not a very impressive result for the risk of being so underweight and, as indicated last week, we have been reviewing this tactic. We intend to take our notional position in Zenith Bank from 3.9% to close to 7.0% this week.

We will continue to review our combined 5.4% position in palm oil and rubber producers Presco and Okomu Oil, which have earned us a combined 54 basis points this year, with a view to increasing exposure. We understand that their US dollar commodity-related revenues are likely to be strong in the event of currency adjustment, but currency adjustment is happening slowly rather than precipitously, so we may have time to build larger positions if we wish to.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.