Last week the Monetary Policy Council of the Central Bank of Nigeria (CBN) concluded its two-day meeting by leaving its key policy rate unchanged at 11.50%. After two cuts during 2020 that demonstrated the CBN’s resolve to deal with recession, last week’s announcement was not a surprise. And, as expected, the official communique had plenty to say about inflation which reached 15.75% year-on-year in December. In our minds, there is no doubt that inflation is damaging businesses and households: the key question is what is driving it and what can be done to alter its course over the coming months. See our analysis below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) strengthen by 0.06% to N393.45/US$1. In the parallel, or street market, the Naira depreciated by 0.63% to close last week at N480.00/US$1. The cash parallel market remains approximately 20% lower than the I&E Window and NAFEX rates. A recovery in crude prices to pre-pandemic levels could help the CBN keep its grip on the currency, in our view, but with the World Bank withholding a $1.5bn loan until the central bank moves ahead with currency reform, we think the current situation will persist for some time, with the currency likely to remain under pressure.

Bonds & T-bills

Last week, the secondary market yield for a Federal Government of Nigeria Naira-denominated bond with 10 years to maturity rose by 70 basis points (bps) to 9.08% and at 7 years rose by 74bps to 8.72%, while at 3 years the yield rose by 190bps to 6.25%. The annualised yield on a 272-day T-bill rose by 97bps to 1.77%, while the yield on a 270-day OMO bill rose by 93bps to 2.32%. These trends marked a continuation of the bearish trend which we have seen all year, though the market was calm towards the end of the week with demand evident for selected issues. While the coming week may be one of consolidation after such strong moves last week, we nevertheless think that the bearish trend is likely to persist this month.

Oil

The price of Brent crude remained steady last week, closing at US$55.88/bbl, a 7.88% increase year-to-date. The average price to year-to-date is US$55.31/bbl, 27.97% higher than the average of US$43.22/bbl in 2020. A Reuters poll showed late on Friday that OPEC’s (the Organization of the Petroleum Exporting Countries) crude production increased by 160,000 bpd in January. This was a bullish result, given that in December OPEC+ (i.e. OPEC plus Russia) had decided to increase production by 500,000 bpd in January, of which 300,000bpd was due to come from OPEC itself. News of vaccination programs getting underway in numerous counties (particularly in the developed world) has been countered by reports of the new Covid-19 variants, but the overall outlook for global industrial output recovering this year remains good. There is likely to be no policy change following the modest increase in January production as OPEC+ has decided to keep output unchanged in February and March. Our view is that Brent is likely to trade in the US$45.00/bbl and US$60.00/bbl range for the first half of this year, and quite likely towards the top of this range.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 3.44% last week with a gain of 5.32% year-to-date. Lafarge Africa(+15.36%), MRS (+9.82%), and Airtel Africa (+9.18%) closed positive last week while Cadbury Nigeria (-9.74%), Seplat (-9.26%) and International Breweries (-8.95%) closed negative. The equities market was bullish during the week, we expect the market to sustain the momentum as investor sentiment remains positive, despite the rapid rise in market interest rates. The Model Equity Portfolio will be back next week.

Why inflation is important

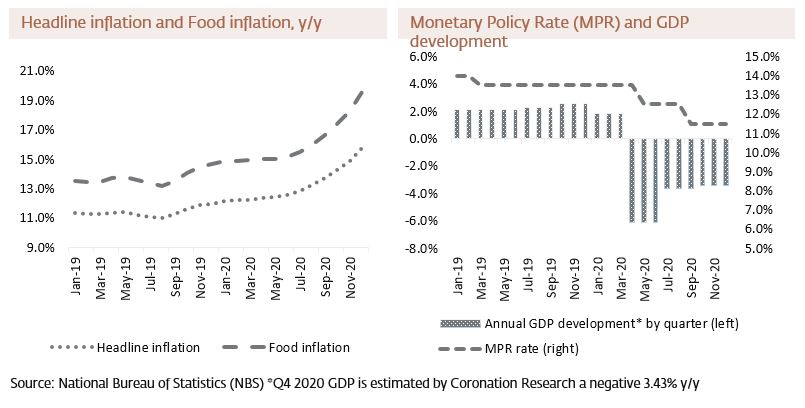

Last week, and as widely forecast, the Monetary Policy Council (MPC) of the CBN left its monetary policy rate (MPR) unchanged at 11.50%. This came against a background of uncertainty about the timing of Nigeria’s exit from the recession and against a background of headline inflation (for December 2020) of 15.75% year-on-year (y/y).

To have both high inflation and a recession is a painful combination, and the MPC’s official communique acknowledged this with the statement that “the economy is currently in a stagflationary environment.” To the question as to which to prioritize, price stability or growth, the communique’s answer was, unequivocally, to “continue pursuing price stability in growing the economy,” i.e. growth.

But what is the cost? When we look at inflation we notice that not only is it trending up, but that the rate of increase is also climbing. More importantly for the consumer, food inflation rose from 14.85% y/y in January 2020 to 19.56% y/y in December. To put this in context, our 2019 study of a low-income household (see Coronation Research: Power to the Price Point, May 2019) estimated that 50% of its income was spent on food and of this 70% (35% of total income) was spent on unbranded goods such as beans, yam and eggs. This suggests that low-income households are feeling the squeeze.

According to the MPC’s communique food inflation is largely a structural issue: “Members reiterated the adverse impact of insecurity on food production, stressing that the current uptick in inflationary pressure could not be solely associated to monetary factors, but due mainly to legacy structural factors across the economy, including major supply bottlenecks across the country.” But notice, in this sentence, that monetary factors are acknowledged as part of the inflationary problem. (The CBN long-term target of inflation is a range between 6.0% and 9.0%.)

The MPC cut its policy rate as the economy went into recession. But its work in reducing market interest rates both preceded the recession (and the onset of the COVID-19 pandemic) and was much more dramatic. The yield on a 1-year T-bill fell from 5.40% in January 2020 to 0.15% in early December (and the dramatic downtrend started in October 2019). Bank credit grew strongly in 2020, having flatlined during the first half of 2019. This suggests a large flow of liquidity into a contracting economy.

The MPC’s communique, to be fair, includes some optimistic statements about inflation, notably that it expects it to decline in the near term “as the economy’s negative output gap closes.” Nevertheless, in our view, there has already been considerable damage done to company balance sheets (erosion of equity through inflation) and household finances. A resumption of GDP growth cannot come too soon.

Why inflation is important

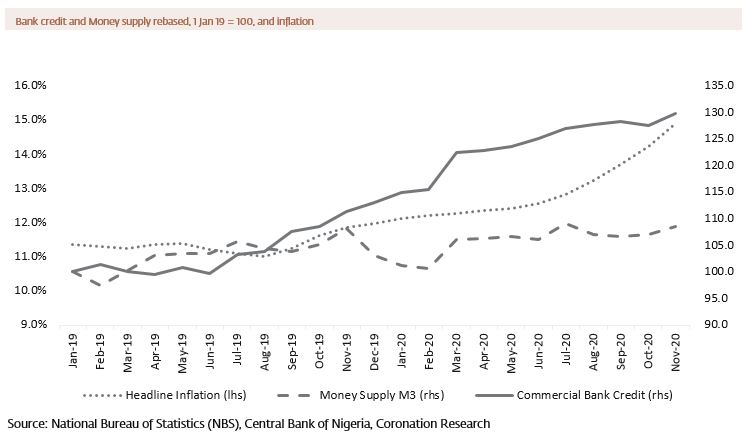

On the subject of managing inflation, the MPC is undoubtedly right to include monetary factors among its causes, and most people would agree that structural factors are critical, too, especially during times of insecurity. Depreciation of exchange rates is also an important factor. Another argument against putting a lot of emphasis on monetary factors is that the financial sector in Nigeria is small relative to the economy as a whole, with outstanding commercial bank credit at around 10.0% of GDP. Therefore, an expansion in credit may not have the same inflationary effect in Nigeria as it would in an economy where credit is much more widespread, to begin with.

Bank credit and Money supply rebased, 1 Jan 19 = 100, and inflation

On the other hand, bank credit to the private sector has been rising at the same time as inflation has been going up. Commercial bank credit to the private sector did not grow in the first half of 2019, then rose as the loan-to-deposit ratio (which stipulates the percentage of customer deposits that banks must reach in terms of loans) was imposed from mid-2019 onwards. The LDR was originally set at 60.0% and was later raised to 65.0%. As market interest rates fell during 2020 it became easier to expand credit and companies that were hit by the recession were eager to take it.

It is true to say that the LDR policy has worked, and fair to argue that a combination of the LDR policy and falling interest rates likely prevented the recession from being worse than it has been. However, it would also be reasonable to think that credit expansion has been a contributory factor in inflation. If this is the case, then the current environment of rising market interest rates may slow the growth of credit over the coming months and, possibly, inflation may then moderate with a lag of between two to three months.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.