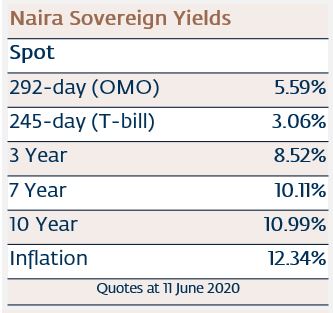

When a currency is under pressure you expect interest rates to go up, and the long-term (we mean 10-year) lesson is that this generally happens in Nigeria. But is it not happening now. A huge amount of liquidity held by investing institutions (such as pension funds and mutual funds) is seeking a home. The result is over-subscription for Naira T-bill and Naira bond issues, and a range of market interest rates (see sidebar) well below inflation. Tough times for savers, good times for issuers. See below for details of how this situation evolved.

FX

Last week, the Central Bank of Nigeria (CBN) recorded a decline in its FX reserves, which fell by US$82.09 million to US$36.50 billion; a much slower rate of attrition that we have seen for most of this year, indicating that the CBN did not supply many US dollars to the NAFEX market (also known as the I&E Window). Currency depreciation was very slight, with the Naira falling by 0.32% to N387.75/US$1 in the NAFEX market and closing largely flat at N450.00/US$1 in the parallel market. By contrast, the Naira recorded gains against the US dollar across all contracts in the forwards market. Specifically, the 1-month (+0.1% to N388.71/US$1), 3-month (+0.4% to N392.70/US$1), 6-month (+0.8% to N398.45/US$1), and 1-year (+2.3% to N416.25/US$1) contracts all appreciated. With the recent rise in its reserves we think the CBN has breathing space and can maintain a spot rate close to the current NAFEX rate for several months.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined last week by 1 basis point (bps) to 10.99%, and at 3 years increased by 5bps to 8.52%. The annualised yield on 245-day T-bill remained flat at 3.06%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 5.59%, 96bps down week-on-week. This week, the Debt Management Office (DMO) will issue bonds for the Federal Government worth N150.00 billion: 12.75% FGN APR 2023 (5-yr re-opening) worth N40 billion; 12.50% FGN APR 2035 (15-yr re-opening) worth N50 billion; and 12.98% FGN APR 2050 (30-yr re-opening) worth N60 billion. We expect increased activity in the secondary market as Nigerian institutional investors cover unsuccessful bids at the auction.

Oil

The price of Brent crude declined by 8.44% last week to US$38.73/bbl. The average price, year-to-date, is US$42.19/bbl, 34.28% lower than the average of US$64.20/bbl in 2019, and 41.19% lower than the average of US$71.69/bbl in 2018. Crude’s six-week rally came to a halt last week amid concerns that the worst of the COVID-19 pandemic isn’t over. New infections were recorded in China while there was a jump in the number of daily infections in the United States. This raised the prospect that a renewed outbreak could weigh on the recovery of fuel demand. The fact that Brent crude fell so precipitously indicates that the price had moved well ahead of fundamentals: but we suspect that underlying fundamentals are improving so we expect Brent crude to be range-bound around the US$40.00/bbl mark for a while.

Equities

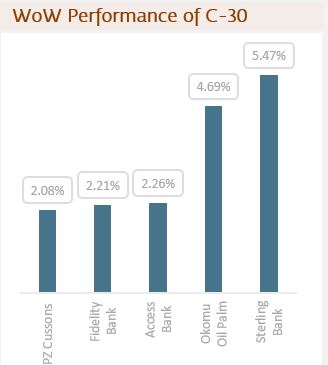

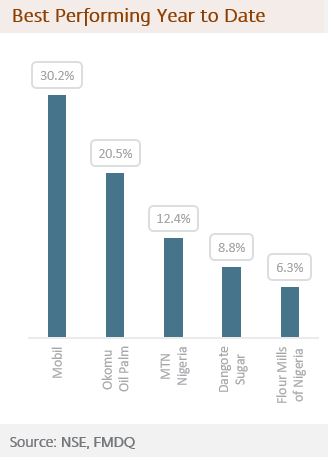

The Nigerian Stock Exchange All-Share Index (NSE-ASI) advanced by 0.65% last week. The year-to-date return is negative 6.18%. Last week Sterling Bank (+5.47%), Okomu Oil palm (+4.69%), Access Bank (+2.26%), Fidelity Bank (+2.21%) and PZ Cussons (+2.08%) closed positive, while Mobil(-9.96%), Honeywell Flour Mills (-9.80%), Guinness Nigeria (-4.37%), Cadbury Nigeria (-1.96%) and Lafarge Africa (-1.94%) closed negative. The Insurance (+3.7%), Industrial Goods (+2.2%) and Banking (+0.5%) indices closed higher while the Oil and Gas (-3.3%) and Consumer Goods (-0.2%) indices recorded declines. This week we expect a degree of profit-taking as investors react to the rise in short-term global risks.

The mystery of Naira liquidity

As we have written before, the long-term lesson of Naira interest rates is that they rise when the currency is under pressure – and when the parallel market rate is N450.00/US$1 compared with an interbank (or NAFEX) rate of N387.75/US$1 (a 16.00% difference) then it is fair to say that the Naira is under a certain amount of pressure at the moment. However, market interest rates currently are extremely low with all Naira rates under the rate of inflation.

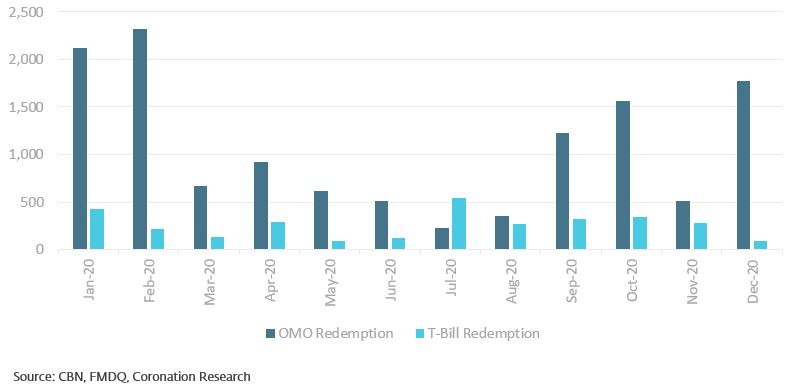

The origin of this situation goes back to the pension funds and mutual funds, which used to the beholder of the CBN’s open market operation (OMO) bills which they treated as much the same at government-issued T-bills. This was the case until 23 October 2019 when all Nigerian corporates (with the exception of banks trading for themselves) were barred from investing in new issues of OMO bills. The OMO market was six times the size of the T-bill market at the time, so a lot of money was due to rotate, as OMO bills matured, to the relatively small T-bill market.

OMO bill, T-bill and bond redemption schedule, Naira billions

However, why does this effect persist now, in mid-June, when the large redemptions of OMO bills were in the early part of this year? The answer may be that there is simply so much cash that investing institutions are having problems deploying it, and that other investors are heading down the same route.

It is often pointed out that the cash reserve ratio (CRR) of 27.5% imposed on the commercial banks is designed to manage, if not restrict, liquidity. But this is a restriction on banks, not their depositing clients. So a pension fund administrator (PFA) depositing several billion of Naira of funds from an OMO redemption still believes those Naira belong to the PFA (they do) even if they have been debited for the CRR. The PFA is then at liberty to bid for the same volume of T-bills and bonds.

Another clue is given by the declining rate on OMO bills. At the beginning of the year these kept up close to the 14.00% per annum mark even when T-bill rates were declining swiftly, but later they declined, suggesting that some foreign portfolio investors (FPI) are keeping funds in Naira and buying the highest-yielding short-term funds available – OMO bills. And if the required tenors are not available in the OMO market then T-bills could be their target.

The banks themselves are encouraged, by the Loan-to-deposit Ratio (LDR) of 65.0%, to make loans. But, given the sluggish economy (non-oil GDP growth was just 1.55% y/y in Q1 2020) and a contraction in the trade sector of the economy (a significant source of demand for corporate loans), they too could have excess liquidity, which makes them natural buyers of T-bills. All in all, there seems no let-up, in the short-term, in this volume of market liquidity. Despite the long-term lesson, we expect such rates to persist for several weeks, if not months, yet.

Model Equity Portfolio

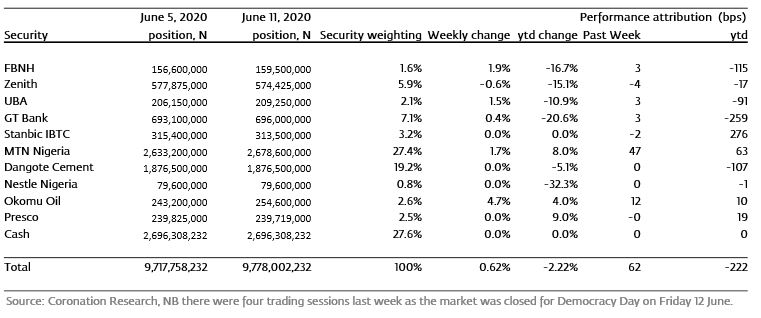

Last week the Model Equity Portfolio rose by 0.62% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.65%, therefore underperforming it by 3 basis points. Year-to-date it has lost 2.22%, against a loss of 6.18% in the NSE-ASI, outperforming it by 396bps.

In running the Model Equity Portfolio we set ourselves the task of selecting good stocks, more so than attempting to predict which way the market will go. Nevertheless, we sense that sentiment was changing in the market at the end of last week and we are concerned about this. Looking at the detail of trading in Lagos, we noticed investors cashing in on certain stocks at the end of the trading week (and this also happened the previous week), which suggests a desire to take profits.

Looking at the global picture, investors have been spooked by the appearance of what some commentators call the second wave of COVID-19 infections (though it looks like part of the first – and hopefully only – wave to us). This led to steep falls in global markets last week and took roughly US4.00/bbl of the price of Brent crude oil. This could encourage some investors to take money out of the market in Lagos, their only problem being where to invest it when market interest rates (e.g. T-bill rates) are so low.

Model Equity Portfolio for the week ending 11 June 2020

We have a notional position in banks at 20.0% of the Model Equity Portfolio, which is close to their weight in the NSE-ASI. Yet we will look at our bank positions closely because bank stocks are much more volatile than the market as a whole. For example, when the NSE-ASI rallied by 22.25% between 4 April and 29 May, the sub-index of banks rallied by 34.50%. Conversely, any correction in the market now would likely means a deep correction in banks stocks. We need to be prepared for that and perhaps navigate through some stormy weather.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.