In 2019, the Central Bank of Nigeria decided to introduce a policy that, in its view, would stimulate the economy while keeping monetary policy tight. A little over two years after its implementation, we examine the impact of the LDR policy on the banks and the overall economy. See page details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) weakened to a record low of N413.07/US$1 on Thursday before retracing slightly to end the week at N412.88/US$1. Week-on-week, the rate weakened by 0.21%. Similarly, the Naira further weakened by 4.59% in the parallel (or street) market to close at N570.00/US$1 – a record low. At the Monetary Policy Committee (MPC) meeting last week, the CBN Governor alleged that the management of AbokiFX, a website that publishes parallel market rates, illegally manipulates the exchange rate. The website has since suspended its parallel rate updates. Elsewhere, the Central Bank of Nigeria’s FX reserves rose by 1.69% to US$35.37bn – its highest level in six months. We maintain our view that the FGNs potential Eurobond issuance and the US$3.4bn allocation from the International Monetary Fund’s (IMF) Special Drawing Right (SDR) are likely to help shore up the external reserves. Amidst these developments, we expect the I&E Window rate to trade range-bound in the near term.

Bonds & T-bills

Last week, the Federal Government of Nigeria (FGN) bond market activities were bearish for most of the week following the uncertainty around the yield direction. However, the results of the Treasury Bill (T-Bill) Primary Market Auction (PMA) doused the bearish sentiments towards the end of the week. Overall, the average benchmark yield for bonds rose by 22bps w/w to close at 11.31%. The yield of an FGN Naira-denominated bond with 10-years to maturity rose by 38bps to 11.94%, the yield on the 7-year bond rose by 39bps to 11.60%; on the other hand, the yield on the 3-year bond fell by 40bps to 9.27%. In this week’s FGN Bond PMA, the Debt Management Office (DMO) will be offering instruments worth N150bn (US$365m) through re-openings of the February 2028, March 2036 and March 2050 bonds. While we expect the auction to clarify the direction of rates, our view remains that a future rise in bond yields, if any, is unlikely to be sharp over the coming three months due to unaggressive borrowing as the DMO manages its debt service costs.

Trading in the Treasury Bill (T-Bill) secondary market was bearish, given the liquidity squeeze and the shift in investor attention to the PMA. As a result, the average benchmark yield for T-bills rose by 66bps in the week to close at 5.57%, while the average yield for OMO bills was up by 12bps on the week to close at 6.34%. On the other hand, the annualised yield on a 342-day T-bill in the secondary market closed at 8.16%, while the yield on a 333-day OMO bill closed at 7.51%. At the T-bill PMA, the DMO allotted N155.88 billion (US$379.27m) worth of bills across all tenors. Stop rates remained unchanged on the 91-day (2.50%), 181-day (3.50%), and 364-day (7.76%) bills. Demand at the auction was relatively weak – the total subscription (N244.57bn) fell to the lowest since May 2021, while the bid-to-offer ratio was the lowest since February 2021.

Oil

The price of Brent crude rose by 3.23% last week to close at a US$75.34/bbl, showing a 45.44% increase year-to-date. The average price year-to-date is US$67.54/bbl, 56.27% higher than the average of US$43.22/bbl in 2020. Over the week, the price rallied as Hurricane Ida induced output disruptions and sustained high demand expectations continued to support the market. However, by the week’s close, prices dropped slightly as energy companies in the U.S. Gulf of Mexico restarted production. Elsewhere, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) pegged global oil demand for 2021 at 96.68mbpd and 2022 at 100.83mbpd. Nonetheless, we maintain our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) edged higher by 0.06% last week. Consequently, the year-to-date return rose to -3.29%. Fidelity Bank +5.65%, Honeywell Flour Mills +5.26%, Guaranty Trust Holdco +3.51% and MTN Nigeria +1.45% closed positive last week, while Seplat -6.54%, Okomu Oil Palm -5.45%, Lafarge Africa -4.02% and Guinness Nigeria -3.23% closed negative. Sectoral performances were broadly negative: the NGX Oil & Gas -3.35%, NGX Banking -0.79%, NGX Insurance -0.58%, NGX Industrial Goods -0.24% and NGX Consumer Goods -0.21% indices declined. The Model Equity Portfolio will resume next week.

Taking stock of the LDR policy

In July 2019, the Central Bank of Nigeria (CBN) mandated banks to attain a minimum loan-to-deposit ratio (LDR) of 60.0% by 30 September 2019. The apex bank further raised this limit by another 5.0ppts to 65.0% and set a compliance deadline of 31 December 2019. The CBN’s goal here was to stimulate the economy while keeping monetary policy tight. A little over two years after its implementation, we examine the impact of the policy on the banks and the overall economy.

Since the initial deadline of 30 September 2019, only one of the banks in our coverage has met the regulatory minimum of 65.0% over the last two years. However, efforts to comply with the directive has seen banking sector credit to the economy grow from N15.5trn (US$37.7bn) at the end of Q2 19 to an impressive N22.04trn (US$53.6bn) at the end of Q2 21. In the six quarters before the directive, aggregate loans were declining by an average of 0.5% every quarter. However, post-directive, aggregate loan growth has accelerated to an average of 4.5% per quarter. Of course, we cannot rule out that the low yield environment, following the segregation of the Treasury bills market, has given banks more of an incentive to create risk assets to increase profits. Overall, on the credit growth front, it can be said that this was an easy policy win.

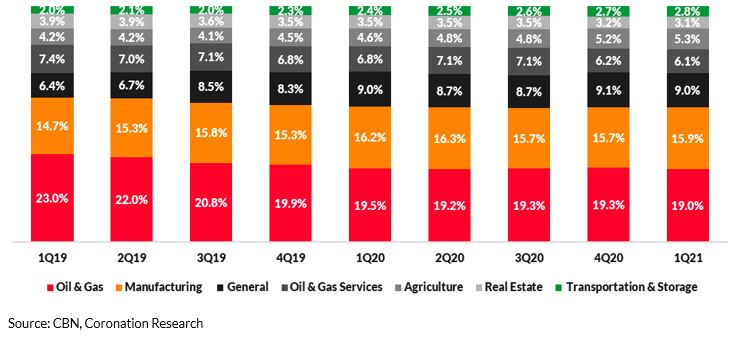

Sectoral Allocation of Credit

Additionally, we find that there has been a structural change in the economy’s loan composition. Oil & Gas sector loans now make up much less as a share of total loans than before the directive, as do Real Estate sector loans. The decline is justified as both sectors tend to be highly susceptible to economic shocks. Also, we note that the apex bank gave commercial banks an incentive to boost lending to SMEs, Retail, Mortgage and Consumer credit. The growth in these segments, in our view, are reflected under the “General” sector, which made up about 9.0% of total loans in Q1 21 compared to 6.7% in Q2 19.

Taking stock of the LDR policy

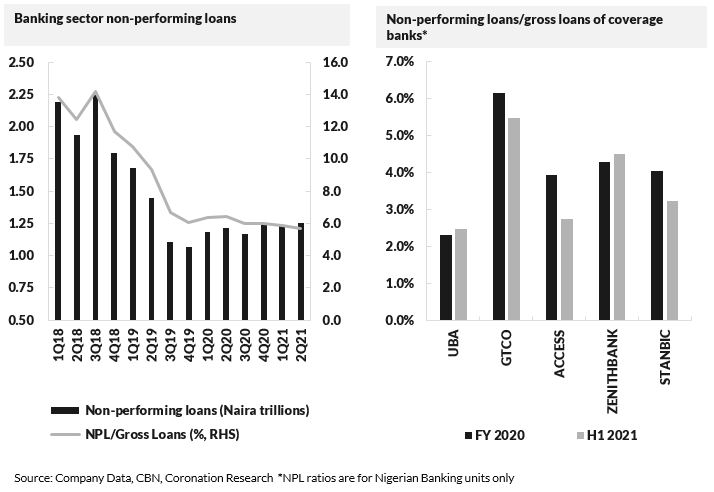

Post-2016 recession, banks have taken prudential actions together with restructuring to pare the level of non-performing loans (NPLs) in the industry. The banks within our coverage achieved this without suspending dividend payments to shareholders. However, the recent pandemic has led to asset quality pressures. As a result, non-performing loans are bottoming out around 5.5% – 6.0% as a percentage of gross loans. Additionally, the absolute value of NPLs rose by 18.1% from Q4 2019 to Q2 2021. (Gross loans rose by 25.5% in the period).

Looking ahead, we believe banks will remain cautious in creating loans, given the elevated risks to asset quality due to the fragile macro conditions. As a result, the rapid loan growth we have seen in recent quarters could be running out of steam in the medium term. Further credit creation over the long term will depend on how quickly and efficiently the government resolves the structural issues in the economy and, ultimately, the pace and pattern of economic recovery.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.