If risk-free asset yields are driven low enough for long enough (and T-bill rates has been falling since October), then risk assets will gain in popularity. The equity market is booming, rather too quickly for our new Model Equity Portfolio to catch up (see page 3). On page 2 we examine the curious divergence of the current account from the trade account.

FX

The December 2019 figure for Foreign Portfolio Investment (FPI) into Nigeria has been reported at US$0.65 billion, 51% lower than the average monthly level for the year. The two-tier interest rate system puts current OMO yields 226bps above inflation. We must wait several weeks for January’s key data on FPI purchases of OMO bills to assess the health of the OMO market. Barring any significant change in policy in the near term, we believe that the Central Bank of Nigeria’s FX reserves at US$38.29 billion are sufficient to maintain the currency at close to NGN360/US$1 at least for the first half of the year.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity fell by 32bps to 11.08%, and at 3 years fell by 60bps to 9.70% last week. The yield on a near-364-day primary market OMO fell by 81bps to 14.11%, while a Nigerian T-bill with similar tenure closed at 4.55% in the secondary market.

The OMO auction held last week saw the 362-day tenor oversubscribed by 37%, a possible indication of renewed foreign demand. The bond market and T-bill market yields have consistently tapered downwards following increased purchases by local investors. It seems that at least some domestic institutional investors are buying bank stocks, whose gross dividend yields are as high as 14.20%. If taken up, this may give some competition for T-bill yields.

Oil

The price of Brent fell by 5.28% last week to US$64.98/bbl. The average price, year-to-date, is US$66.83/bbl, 4.10% higher than the average of US$64.20/bbl in 2019, but 6.78% lower than the average of US$71.69/bbl in 2018. Oil prices are now below the level prior to the US airstrike on Iran. This goes to show our view that one fundamental driver, demand, is still weak.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index rose by 6.63% last week, the year-to-date return is 9.59%. Last week Dangote Cement (+21.10%), Presco (+19.80%) and Okomu Oil Palm (+16.80%) closed positive while Unilever Nigeria (-8.21%), Forte Oil (-6.11%) and International Breweries (-3.16%) fell.

Bullish sentiment drove activity in the equity markets last week. Amidst BUA Cement’s N33.86 billion (US$ 94.06 million) listing on the exchange, buying interest was strong across various sectors. Although there was some profit-taking last week, we believe the rally may be sustained in the near term.

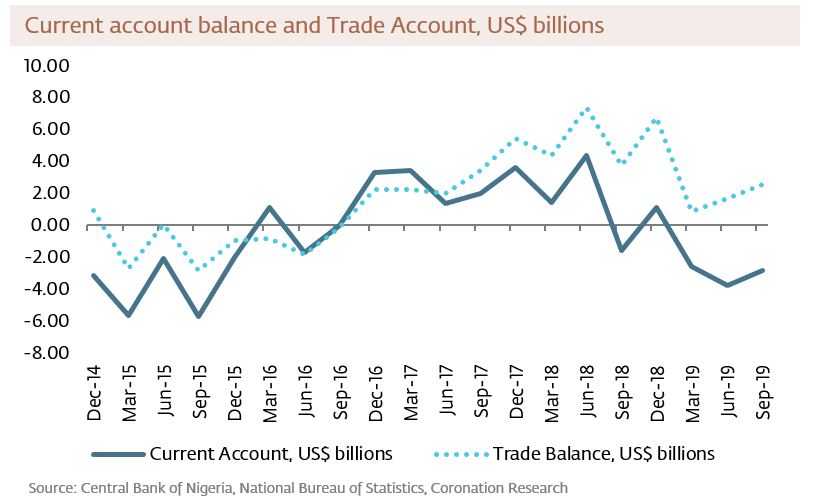

Current account deficit a function of growth

Early last December we wrote about the development of Nigeria’s current account (see Nigeria Weekly Update, 2 December 2019), while waiting for the Q3 data which subsequently has been published. We can now identify a diverging trend between the trade balance, which remains positive, and the current account, which was negative in each of the first three quarters of last year.

To begin with, the trading account. It tends to become depressed during periods of high economic growth (eg 2015) when Nigeria’s trade openness allows imports to be drawn in. Recessions (eg 2016) and the early phase of recovery (2017, 2018) tend to correct this but as growth continues (2019) it becomes depressed again, though still positive in the case of 2019.

So, what of the divergence of the current account? We offer two reasons. The first, and the most important, is that purchases of foreign services (primarily travel and technological enterprise solutions) are not covered by the trade data. These tend to rise as GDP growth continues. Purchases of services in Q3 2019 were double what they were when the economy exited recession in Q1 2017 and 318% more than the average quarterly position throughout 2016, in US dollar terms.

The other reason is that the current account includes the investment returns accruing to foreign direct equity investment (e.g. dividends payable to foreign parent companies) and the interest portion of foreign debt service obligations. As Nigeria’s debt stock increases so too do the cost of servicing it. However, it is not the case that public sector obligations account for a significant part of these outflows through the current account: private sector payments are larger.

The question then becomes how these outflows are being funded – granted, they are not fully funded because the current account is still negative. The major positive contributor is remittances from Nigerians living and working abroad, and kindly sending money home. At US$17.58bn received in the first nine months of 2019, these remittances amount to a critical level of support for FX liquidity in the economy overall.

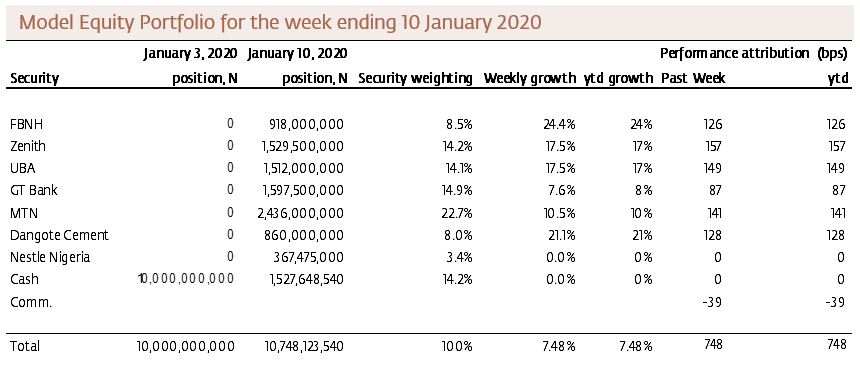

Model Equity Portfolio

Following the launch of our Model Equity Portfolio last week, we made notional purchases of Zenith Bank, UBA, GT Bank, FBN Holdings, MTN Nigeria, Dangote Cement and Nestle Nigeria, as forewarned in Coronation Research, Nigeria Weekly Update, 6 January. Notional purchases were made on Tuesday 7 and Wednesday 8 January.

The portfolio gained 748 bps (+7.48%) week-on-week, 85 bps above the Nigerian Stock Exchange All-Share Index which gained 6.63% in the same period. Year-to-date (to 10 January) the return is 7.48%, 201 bps below the NSE ASI return of 9.59%.

In other words, we are underperforming the market, year-to-date, because we have found ourselves chasing a rally (which was underway before we began our notional purchases). Never mind, we have a further 50 weeks this year to get even with the market and, we hope, out-perform it.

In the course of this week, we expect sell-offs by investors wanting to take advantage of the rally we saw last week. Although profit-taking has been initiated, prices of stocks in our portfolio at the end of the Monday 13 January trading session are still higher than what they were at the start of the year. If the prices of banks UBA, Zenith Bank and GT Bank correct more than 5% this week we intend to make further notional purchases.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.