What are the open market operation (OMO) bills of the Central Bank of Nigeria (CBN) for? And who are they for? We received some new answers last week. The OMO market is much larger than a liquidity management system might require, and serves as a means for foreign investors to enjoy Naira interest rates. Last week we saw foreign interest in OMO bills pick up, an early indication of foreign inflows and support for the Naira. On the other hand, the CBN further squeezed domestic banks’ participation in the OMO market by raising its formal Cash Reserve Requirement from 22.5% to 27.5% of customer deposits. See page 2 for details.

FX

There are signs of confidence in the FX market. Last week subscription levels for long-dated OMO bills stood at 103.0% above the total offer, an indication that foreign institutional investors are still bullish on the Naira-denominated securities. The last three auctions have attracted bids of N1.36 trillion (US$3.8bn) compared with N1.29 trillion for the whole of December 2019. We also observed that month-on-month, the rate of depletion of CBN reserves is on the decline. In the parallel market, the Naira firmed by N1.0 against the dollar week-on-week to close at N361/US$. Our view is that stability in the FX market will persist for the coming nine months at least.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity fell by 43bps to 10.96%, and at 3 years fell by 139bps to 8.39% last week. The annualised yield on 272-day T-bill, the longest duration available in the secondary market, remained unchanged at 4.46%, while an OMO bill with similar tenure closed at 13.77%, 11bps down week on week.

Oil

The price of Brent fell by 6.41% last week to US$60.69/bbl. The average price, year-to-date, is US$65.04/bbl, 1.32% higher than the average of US$64.20/bbl in 2019, but 9.28% lower than the average of US$71.69/bbl in 2018. Oil fell to its lowest level in 12 weeks as the coronavirus outbreak continues to affect sentiment. In our view, we may see a further decline in oil prices, as the spread of the virus is yet to be contained thereby restricting the movement of people within China and putting economic pressure on the worlds’ largest consumer of crude oil.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index rose by 0.03% last week, the year-to-date return is 10.38%. Last week Honeywell Flour Mills (+14.56%), Lafarge Africa (+10.76%) and Cadbury Nigeria (+8.50%) closed positive while Nestle Nigeria (-6.12%), Unilever Nigeria (-5.14%) and Dangote Sugar (-5.12%) fell.

Bullish sentiment drove activity in the equity markets last week. Although there was some profit-taking, we think there remains significant headroom for a further rally as cash maturing from fixed income instruments hunts for investments.

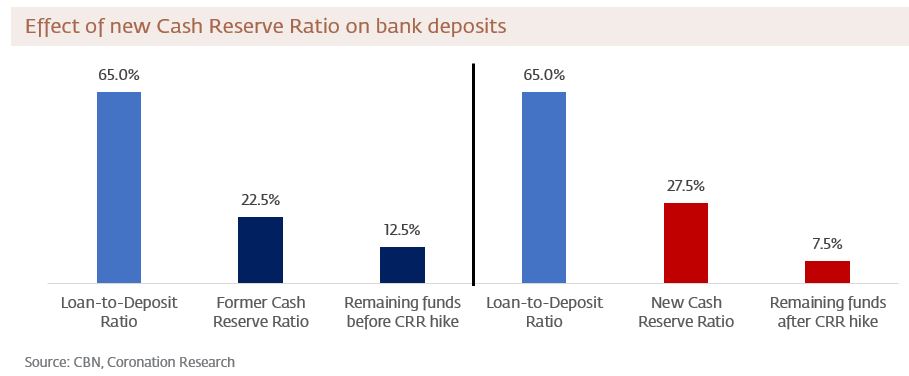

On Friday the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) surprised the market by raising its Cash Reserve Requirement (CRR) from 22.5% to 27.5%. While the headline Monetary Policy Rate (MPR) was kept at 13.5%, the CBN decided to flex the CRR in order to withdraw liquidity from the banks. The CRR is the percentage of customer deposits which banks must hold at the CBN with zero percent interest, and in Nigeria it is generally much higher than in other jurisdictions.

Why was the market – including us – surprised? One explanation is that the thrust of recent CBN policy towards banks has been to encourage them to increase flows, rather that restrict them. In July last year banks were required to lend a minimum of 60.0% of their deposits to customers by 30 September 2019, and this percentage was increased to 65.0% for a deadline of 31 December 2019. Commercial bank credit grew as a result.

However, there remained a small proportion of deposit funds which the banks could still invest in securities, and these securities included (for banks but not for other Nigerian corporate investors) the open market operation (OMO) bills of the CBN itself. Another key CBN policy was to prevent Nigerian corporates (including mutual and pension funds, but excluding banks) from investing in new OMO issues, and this policy was introduced in October. The result was that money rotated from the OMO market into the T-bill market, crashing T-bill rates. (See Coronation Research, Year Ahead 2020, 16 January, for details). OMO rates were kept high in order to maintain the interest of foreign portfolio investment (FPI) in Naira-denominated securities.

Seen from this perspective, banks were benefitting from the crash in T-bill rates (from example, from 14.30% in mid-October to 4.46% last Friday) because T-bill yields are reflected in their own cost of funds; but OMO bill rates held up close to the 14.00% level. This gave them a high return on a small proportion of their funds, with a corresponding expense for the CBN. By raising the CRR from 22.5% to 27.5% the CBN aims to reduce that cost, in our view, while removing just over Naira1.0 trillion (US$3.6bn) of liquidity from the system.

How large a blow is this to banks? Some banks report that their effective CRR was much higher than 22.5% prior to the hike (apparently CRR debits tend not to follow deposit levels down). Therefore, the hike in the CRR from 22.5% to 27.5% could formalize an existing arrangement, or signal further tightening. On the other hand, it is well to remember that banks benefit during periods of declining market interest rates, receiving high levels of interest income on legacy loans and security holdings while their cost of funds falls. Spreads tend to be maintained.

Model Equity Portfolio

Our Model Equity Portfolio contracted by 1.59% last week compared with a slight appreciation of 0.03% in the NSE broad index. Last week’s result means the NSE broad index is back in the lead with 10.38% y-t-d, 85bps outperforming the Model Equity Portfolio at 9.54% y-t-d. The distribution of last week’s losses was largely skewed to our four constituent bank names, whose sub-index was down 2.6% week-on-week.

Our large exposure to banks, collectively 51% of the portfolio, highlights an area of risk concentration from a lively regulator and other banking sector systemic shocks. However, it is also a reflection of the lack of depth in the market for quality names with fundamentally reasonable upsides at the moment, in our view. MTN (24% portfolio weight), Dangote Cement (8.2% portfolio weight) and Nestle Nigeria (3.1% portfolio weight) complete the Model Equity Portfolio’s current equity allocation with a cash position of 13.9%.

We persist with our strategy to be underweight brewers, food and fast-moving consumer goods companies on weak medium to long-term real growth and stiff competition from unlisted brands. Also, last week’s correction in the bank sub-index creates some positive adjustments to the dividend yields on the four Model Equity Portfolio’s constituent banks. But as we guided last week, we expect to make further notional purchases in banks if prices regress up to 5% from closing levels the previous week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.