Last week saw the Central Bank of Nigeria (CBN) announce changes in the foreign exchange (FX) market and in its Cash Reserve Ratio (CRR) regime. The changes in the FX market are already increasing liquidity, which is good. The changes in the CRR, though they look purely like banking supervision, could allow the CBN to control short-term market interest rates directly. We discuss the possibilities below.

FX

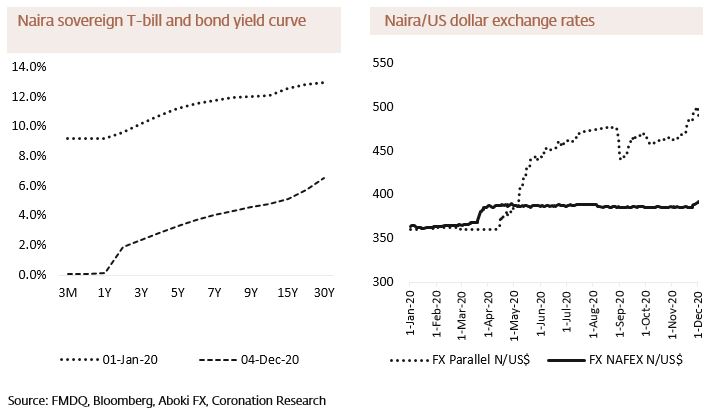

Last week the exchange rate in the NAFEX market (also known as the I&E Window and the interbank market) weakened by 0.76 % to N391.5/US$1. In the parallel, or street market, the Naira appreciated by 4.04% to close the week at an offer rate of N475.00/US$1. Following the 1.5% depreciation of the Naira by the CBN to 390/US$1 for Bureaux de change (BDC), the CBN introduced a policy that grants unfettered access to forex from diaspora and other electronic money transfer remittances. The World Bank recently predicted that diaspora remittances into Nigeria would decline by $2.0 billion in 2020 versus the $23.8 billion recorded in 2019. Although the NAFEX rate and the Parallel rate are now only 21% apart, we think the gap will remain difficult to close.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 52 basis points (bps) to 4.96% and at 7 years dropped by 13bps to 3.90% while at 3 years the yield rose by 5bps to 1.82%. The annualized yield on 328-day T-bill remained flat 0.15%, while the yield on a 326-day OMO bill also remained flat at 0.14%. The T-bill market started the week on a quiet note as the average benchmark yield remained unchanged at 0.10%. During the week, the CBN announced the forthcoming issue of Special Bills for excess Cash Reserve Requirement (CRR). Markets reaction was mixed as investors were unsure how to price in the effects of the new instruments. In the bond market, the week started on a slow note as average benchmark yields rose to 4.20% this week from 4.06% in the previous week. We expect to vary a lot this week as investors second guess the soon-to-be-announced yields on Special Bills.

Oil

The price of Brent crude rose by 2.22%% last week to US$49.25/bbl. The average price, year-to-date, is US$42.66/bbl, 33.43% lower than the average of US$64.08 /bbl in 2019. Last week OPEC+ finally managed to reach a production cut agreement after several days of tough negotiations. Members have decided to adjust January production by 0.5 million bpd from 7.7 million bpd to 7.2 million bpd. Hopes that Covid-19 vaccines will be hitting the market and driving a major recovery seems to be fueling the price. But it doesn’t seem like we are out of the woods yet as internal OPEC dissent still exists, the resurgence of Libyan, Iranian and Iraqi production is resurgent. Plus, an increase in US shale production could still weigh in prices.

Equities

Last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 0.72% with a gain of 30.91% year-to-date to close at 35,137.99. Airtel Africa (+19.63%), Mobil (+9.20%) and Ardova Oil (+5.09%) closed positive while Cadbury Nigeria (-9.38%), FCMB Group (-8.92%) and Nigerian Breweries (-7.05%) closed negative. The prevailing state of the NSE may be attributed to continued profit-taking by investors. However, despite the profit-taking, the stock market has sustained the growth recorded in the previous week. See Model Equity Portfolio on page 3.

Saving Interest rates?

Last week the Central Bank of Nigeria (CBN) decided that it would substantially adjust its Cash Reserve Ratio (CRR) regime. Under the CRR commercial banks must leave 27.5% (but in practice, much more) of their customer deposits with the CBN with zero interest: but last week they were informed that the CBN would issue them with ‘Special Bills’ in respect of some or all of their CRR positions. The interest rate on these bills is yet to be announced.

At one level this is pure banking supervision. Sums debited for the CRR do not count towards liquidity calculations, with the result that a high level of CRR means that some banks struggle with the CBN’s 30.0% liquidity requirement. So, the change in the CRR regime is designed to help them from a regulatory perspective.

The CRR regime also causes practical issues. Take the example of a bank which receives a large sum of cash from a pension fund in respect of redeemed securities. Part of that cash is now removed for the CRR, but if the pension fund now asks for all its money back (e.g.to fund new purchases), the bank may be short of cash. Banks have become adept at creating liquidity when it is lacking. They may now use the new Special Bills as collateral to raise cash.

However, the effects of last week’s move probably go, beyond managing bank liquidity. For over a year the CBN has overseen a dramatic fall in market interest rates so that Treasury bills now yield 0.15% pa, versus inflation at 14.23% pa (see last week’s Nigeria Weekly Update: Where is the money going?). Nigeria’s inflation-adjusted risk-free one-year rates are among the lowest in the world. There is a danger that, with a high level of the CBN’s open market operation (OMO) bills to be redeemed this month, T-bill rates could move into negative territory.

In our view, the CBN, having allowed the flow of OMO redemptions to crash T-bill and bond rates this year, may want to stop short of negative rates. Setting a rate on these new Special Bills gives it a tool for adjusting market interest rates. We must wait to find out what rates it wants to see. Last week there were some upwards moves in FGN bond yields, suggesting that some market participants expect the CBN to set a floor under short-term rates.

The CBN also allowed, last week, unrestricted access to US dollars in domiciliary (i.e. onshore) accounts where these have been paid in electronically. The result was that customers could remove their US dollars and buy Naira. The Naira duly strengthened in the parallel market. Nobody knows how large or liquid the parallel market is, but it probably comforted the CBN that it could influence the rate so effectively. Nevertheless, we do not think that this is the end of the parallel market.

Model Equity Portfolio

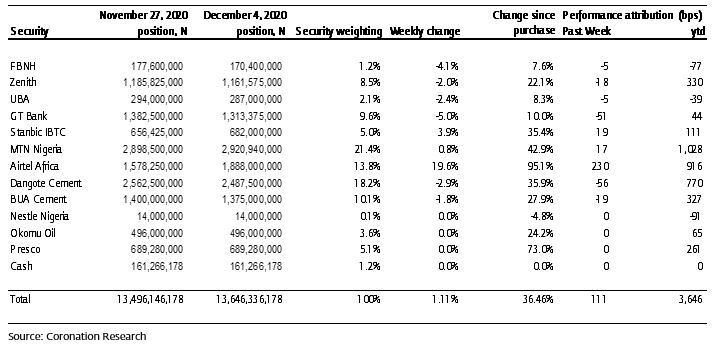

Last week the equity market continued its advance, with large gains by Airtel Africa, up 19.63% on the week, among the largest weights in the Nigerian Stock Exchange All-Share Index (NSE-ASI). By contrast, Nigerian Breweries fell by 7.05% and it accounts for 2.40% of the NSE-ASI. We hold a notional neutral weight in Airtel Africa and no notional position in Nigerian Breweries. Therefore, we could reasonably hope for some outperformance, so long as the profit-taking in the banking sector was not too big. The sub-index of 10 bank stocks was down 3.22% on the week.

Last week the Model Equity Portfolio rose by 1.11% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.72%, therefore outperforming it by 72 basis points. Year-to-date it has gained 36.46% against a gain of 30.91% in the NSE-ASI, outperforming it by 556bps.

Model Equity Portfolio for the week ending 04 December 2020

We have written recently about Flour Mills of Nigeria and about Dangote Sugar, and whether we should take notional positions in them. Both these stocks fell last week, and we sense that there is no hurry to make up our minds. We plan no changes in the Model Equity Portfolio this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.