Now that we are almost three-quarters through the year, Nigeria stock market investors might want to take a look at what factors and sectors have driven the market’s performance and why. See details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) weakened by 0.49% to a record low of N414.90/US$1, following a 17.34% fall in turnover in the space. Elsewhere, the Central Bank of Nigeria’s FX reserves rose by 2.04% to US$36.09bn – its highest level in over six months. We maintain our view that the FGNs US$4.0bn Eurobond issuance and the US$3.3bn allocation from the International Monetary Fund’s (IMF) Special Drawing Right (SDR) will help shore up the external reserves and provide some respite to the exchange rate pressure. Amidst these developments, we expect the I&E Window rate to trade range-bound in the near term.

Bonds & T-bills

Last week, the Federal Government of Nigeria (FGN) bond market saw renewed bullish sentiments as market players sought to cover lost auction bids in the secondary market. Additionally, expectations of reduced local currency bond supply, and a consequent decline in bond yields following the FGN’s US$4.00bn Eurobond issuance, led to increased activity in the bond space. Consequently, the average benchmark yield for bonds fell by 7bps w/w to close at 11.23%. The yield of an FGN Naira-denominated bond with 10-years to maturity rose by 8bps to 12.02%, the yield on the 7-year bond closed flat at 11.60%, while the yield on the 3-year bond fell by 12bps to 9.15%. At the FGN Bond primary auction, the Debt Management Office (DMO) allotted a total of N277bn (US$647m) to investors, the highest total issuance since the June 2021 auction. This brings the total bond issuance in 2021 so far to a record N2.19trn (FY2020: N1.88trn). Stop rates were unchanged on the February 2028 (11.60%) and March 2036 (12.75%) bonds. However, the stop rate on the March 2050 bond expanded by 20bps to 13.00%. Demand at the auction was relatively strong, with a recorded total subscription of N334.32bn and a bid-to-offer ratio of 2.2x. The auction outcome supports our view that a future rise in bond yields, if any, is unlikely to be sharp over the coming months due to unaggressive borrowing as the DMO manages its debt service costs.

Trading in the Treasury Bill (T-Bill) secondary market was bearish, given the sustained liquidity squeeze and the shift in investor attention to the FGN bond PMA. As a result, the average benchmark yield for T-bills rose by 4bps in the week to close at 5.61%. Elsewhere, the average yield for OMO bills rose by 8bps in the week to close at 6.43%. Specifically, the annualised yield on a 349-day T-bill fell by 1bp to 8.30%, and the yield on a 326-day OMO bill shed 10bps to 7.41%. At this week’s T-bill PMA, we expect the DMO to roll over maturing bills worth N111.87bn across all tenors.

Oil

The price of Brent crude rose by 3.65% last week to close at a US$78.09/bbl, the highest since September 2018. Year-to-date, Brent is up 50.75% and has traded at an average price of US$67.76/bbl, 56.78% higher than the average of US$43.22/bbl in 2020. Over the week, the price rallied as the Hurricane Ida induced output disruptions continued to support the market. By the week’s close, reports from the Bureau of Safety and Environmental Enforcement (BSEE) showed that 31 production platforms in the Gulf of Mexico are still evacuated. As a result, approximately 16.18% (300,000 bpd) of the crude oil production in the Gulf is still shut-in. Elsewhere, supply from the Organization of the Petroleum Exporting Countries and its allies (OPEC+) remains below target as some of its members, e.g., Nigeria and Angola, have been unable to increase production in line with their increased quotas as under-investment or maintenance delays persist from the pandemic. Consequently, we maintain our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) edged higher by 0.05% last week. Consequently, the year-to-date return rose to -3.25%. MRS +9.75%, Oando +6.70%, Okomu Oil Palm +5.77% and Lafarge Africa +4.19% closed positive last week, while Presco -8.18%, Honeywell Flour Mills -5.00%, Unilever Nigeria -2.22% and PZ Cussons -1.71% closed negative. Sectoral performances were mainly positive: the NGX Insurance +1.75%, NGX Oil & Gas +1.38% and NGX Industrial Goods +0.23% indices gained, while the NGX Banking -0.79% and NGX Consumer Goods -0.04% indices declined. The Model Equity Portfolio will resume next week.

Nigerian Stocks: Worth a second look

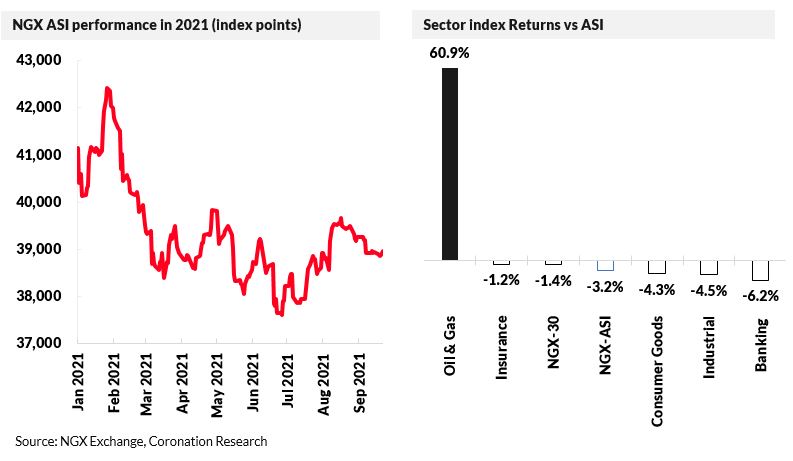

The domestic recovery has continued in 2021 as various sectors of the economy have largely reopened following the pandemic. However, Nigerian stocks are lagging – they are down 3.2% year-to-date. The benchmark All-Share Index (ASI) fell by 3.0% in Q1 2021 and 2.9% in Q2 2021 as local currency T-bill and bond yields began trending upwards and as stocks began to look relatively expensive in valuation terms.

The YTD losses are primarily thanks to a 16.1% fall in telco and index heavyweight, Airtel Africa. As a reminder, Airtel Africa was one of the best performing names of 2020 as foreign investors took advantage of the stock’s fungibility as an alternative means to repatriate funds. However, the spread between the stock’s Lagos and London listings rose to as high as 145.6% (N551.34) in April 2021, leading to a selloff and sharp correction in the share price in Lagos.

On sectors, the banking stocks, led by Guaranty Trust Holdco (-14.2%) and Zenith Bank (-5.4%), were the primary contributor to the markets poor performance, with the banking index down 6.2% YTD. This is because banks earnings have remained under pressure amidst the low-yield environment, and investors have largely ignored the fact that they are trading at significant discounts to their Sub-Saharan African peers and their own historical valuations. In addition, the Industrial (-4.5%) and Consumer Goods (-4.3%) sectors, led by Nestle Nigeria (-7.0%) and BUA Cement (-12.1%), also lent a hand as investors sold down companies whose margins have come under the most pressure from the high-inflationary environment and FX weakness. In the case of BUA Cement, the stock was trading at an incredibly expensive valuation.

The Oil & Gas (O&G) sector has been the bright spot this year – the O&G index is up 60.9% YTD. Upstream Oil & Gas companies such as Seplat Energy (+74.0%) have benefitted from the strong rally in oil prices this year. In comparison, the downstream players such as TotalEnergies Marketing Nigeria (+47.7%) have seen product volumes surge following the reopening of the economy.

Where do we go from here? The second quarter was the first time since Q1-20 that Nigerian equities have lost in two successive quarters. However, Q3-20 is set to buck the trend. The market has seen renewed interest as local currency yields have begun falling again in recent months and H1-2021 earnings impressed across the major non-bank stocks. As a result, the ASI is up 2.5% quarter-to-date with less than a week to go in the quarter.

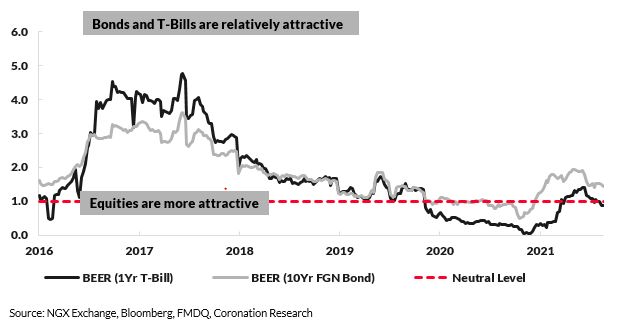

Like we mentioned in our series on Total Returns (see Coronation Research, “Why you need to study Total Equity Returns”, 9 August 2021 & “The role of dividends in total return” 17 August 2021), current market yields still do compensate for the level of domestic inflation. The monetary authorities also seem to be happy with yields at this level. As a result, fixed income remains not an easy sell unless under the heading ‘You have nowhere else to go’. Consequently, equities look more attractive going forwards, with some select stocks generating yields higher than the 1-year T-bill. Our study on the Bond Equity Earnings yield Ratio (BEER) buttresses this point. The bond equity earnings yield ratio (BEER) is a metric that is often used to evaluate the relationship between the earnings yield of a stock market (the inverse of the price-to-earnings ratio) relative to bonds. A number above one indicates that bonds offer more value than equities.

Nigerian Stocks: Worth a second look

Bond Equity Earnings Yield Ratio

Stocks likely to attract the most attention as we round off the year include Zenith Bank, Guaranty Trust Holdco, UBA and MTN Nigeria – these stocks have expected dividend yields of between 6% and 14% (consensus estimates).

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.