On Friday, we published our report on Nigerian Banks. We examined what has happened within the Nigerian Banking industry over the past 10 years. It is a unique 10-year study of the margins and profitability of six listed banks: Zenith Bank; Guaranty Trust; Access Bank; FBN Holdings; UBA, and Stanbic IBTC. Read below for details and read the full report here.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) weakened by 0.16% to close at N411.67/US$1. In the parallel (or street) market, the naira weakened by 0.40% to close at N500.00/US$1. Last week, the CBN Governor stated in a webinar for foreign investors that he expects the true value of the naira to be between N430-440/US$1. This is in line with our view that there will be further small-step devaluations in the exchange rate over the rest of the year. Elsewhere, the CBN’s FX reserves fell by 0.73% over the week to US$33.54bn, the lowest level since April 2020. Amidst persisting FX illiquidity in the I&E Window, we expect the parallel rate and the I&E Window rate to remain under pressure over the months to come.

Bonds & T-bills

Last week, trading in the secondary market for FGN bonds continued to be bullish. The yield of an FGN Naira-denominated bond with 10 years to maturity fell by 4bps to 12.47%, the yield on a 7-year bond fell by 23bps to 12.55%, while the yield on a 3-year bond rose by 2bps to 11.85%. The overall average benchmark yield fell by 7bps w/w to close at 11.94%. The Debt Management Office (DMO) held the June bond PMA on Wednesday and offered N150bn (US$365m) across three tenors. The auction was significantly oversubscribed (bid-to-offer: 2.8x), with the DMO eventually allotting a total of N326bn in bonds to investors. Compared with the previous action, stop rates contracted across all the instruments offered: March 2027 (-36bps to 12.74%); March 2035 (-50bps to 13.50%); March 2050 (-50bps to 13.70%). There is clearly a bull market in bonds at the moment. However, we question how long it can last, given that bond yields fall so far short of inflation. It is a question, in our view, of when the authorities will tackle this question, and this likely depends on how quickly (and when) economic activity picks up.

Conversely, activity in the Nigerian Treasury Bill (T-bill) secondary market was bearish last week. The annualised yield on a 307-day T-bill in the secondary market fell by 2bps to 9.74%, while the yield on a 263-day OMO bill rose by 42bps to 10.18%. The average benchmark yield for T-bills rose by 38bps to close at 6.75%, and the average yield for OMO bills rose by 8bps w/w to close at 9.74%. At the T-bill auction scheduled for June 30, 2021, CBN plans to offer N81.74bn in instruments, comprising N2.87bn of 91-day bills, N20.00bn of 182-day bills, and N58.85bn of 364-day bills. We expect the auction stop rates, especially on 364-day bills, to fall due to the small size on offer and expected oversubscription.

Oil

The price of Brent crude rose by 3.63% last week, closing at US$76.18/bbl, showing a 47.07% increase year-to-date. The average price year-to-date is US$64.58/bbl, 50.44% higher than the average of US$43.22/bbl in 2020. Last week, Brent closed with another week of gains, hitting a new high of US$76.18/bbl on Friday despite worries over the expansion of Iranian production, a day after an interim agreement for the UN nuclear watchdog to monitor Tehran’s atomic activities expired on 24 June. Key to the market’s confidence is the orderly way in which OPEC+ is preparing to increase output. Our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was down by 2.56% last week, with selloffs of market heavyweights Airtel Africa, Dangote Cement, BUA Cement and MTN Nigeria pulling down the index. Consequently, the year-to-date loss rose to 6.49%. Honeywell Flour Mills +10.71%, Stanbic IBTC +2.69% and Fidelity Bank +2.20% closed positive last week, while Airtel Africa -10.00%, FCMB Group -5.96% and Dangote Cement -3.91% closed negative. Sectoral performances were mixed. The NGX Banking index led the gainers, rising by +0.92%, followed by the NGX Consumer Goods index +0.57%, the NGX Oil and Gas index +0.12%, and the NGX Pension index +0.02%. Conversely, the NGX Industrial Goods index led the losers, declining by -3.33%, followed by the NGX 30 index -1.32%, and the NGX Insurance index -0.83%. See Model Equity Portfolio below.

What is the investment case for Nigerian banks? 2021 is proving to be a year of volatile Naira market interest rates (rising sharply), as was 2020 (when they crashed). It is important to understand the drivers of these interest rate changes, and how the monetary authorities control liquidity and influence interest rates. It is also important to set market interest rates next to inflation.

Under these circumstances, it is understandable to be concerned about banks’ Net Interest Margins, spreads, growth and overall profitability, which we have looked at in the context of a 10-year study.

First, we looked at the banks’ Net Interest Margins and spreads over the long term and found a remarkable degree of resilience through several interest rate cycles. This suggests that investors have little to fear when it comes to current fluctuations in interest rates, while the banks themselves state that they are confident they can re-price deposits and loans advantageously this year.

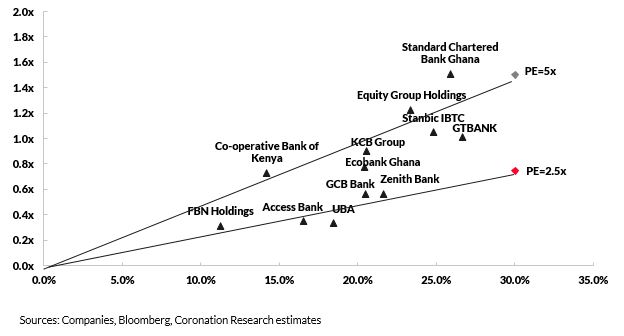

In terms of valuations, and despite a significant rally in share prices over the past year, Nigerian bank stocks look remarkably cheap, both in relation to other Sub-Saharan African banks and in relation to their own valuation history. Five years ago, the median prospective price-to-earnings (PE) ratio was around 5.0x. Now it is 2.5x. This downward shift in ratings has exposed meaningful value for today’s investors, in our view.

We have bank-specific sections, and 3-year financial forecasts, and recommendations for six listed banks: Zenith Bank; Guaranty Trust Bank; Access Bank; FBN Holdings; UBA; Stanbic IBTC.

On our BUY list, we feature Zenith Bank; Guaranty Trust Bank; Access Bank; UBA; and Stanbic IBTC.

On our HOLD list, we feature FBN Holdings.

Click here for the full report.

Second, we looked at the growth record of the banks and found that, with one notable exception, balance sheet growth has been elusive, something that became clear when we re-stated key metrics for the effects of inflation over time.

Third, we looked at the Return on Average Equity (RoAE, or more simply RoE) and the Return on Average Assets (RoAA, or RoA) of the banks over 10 years, and made note of the gradual improvement and convergence in RoAEs over this period.

Finally, we looked at the challenge posed by Fintech in general and by digital banks in particular.

Return on Average Equity (RoAE) (horizontal scale) versus Price-to-Book Value (P/BV) of Nigerian and selected African banks, 2021E

Model Equity Portfolio

Last week the Model Equity Portfolio fell by 2.32% compared with a fall in the NGX Exchange All-Share Index (NGX-ASI) of 2.56%, therefore outperforming it by 24 basis points. Year to date it has lost 5.06% against a loss in the NGX-ASI of 6.49%, outperforming it by 143bps.

Model Equity Portfolio for the week ending 25 June 2021

While it is nice to outperform the market, it is not so nice to be losing money (albeit notional money the case of this portfolio). We judged, at the beginning of the month, that the equity market might receive support, given the fact that interest rates were stabilising, but this support did not last for long. It appears that institutional money is rotating into the bond market, even though there is little hope of obtaining a positive inflation-adjusted return there (all bond yields are well below the rate of inflation). And retail investors appear to be less keen about equities than they were.

We often write that we do not wish to make calls on the market as a whole: we prefer to buy and hold stocks that we like when they offer good value. However, now seems like a good moment to take some notional money out of stocks and into cash. We will make notional sales in industrials in order to do this, notably Dangote Cement, BUA Cement, Okomu Oil and Presco, with the intention of raising our notional cash position by approximately 5.0 percentage points this week.

We note that Guaranty Trust Bank was only suspended for four trading sessions and returned as Guaranty Trust Holdco last week. And it went up 5.1%. We also observe that the market is treating bank shares fairly gently at the moment. As we argue in our publication, ‘Nigerian Banks: Resilience priced in’ (25 June) the earnings of the banks look robust in the face of interest rate changes. We are warming to the sector again.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.