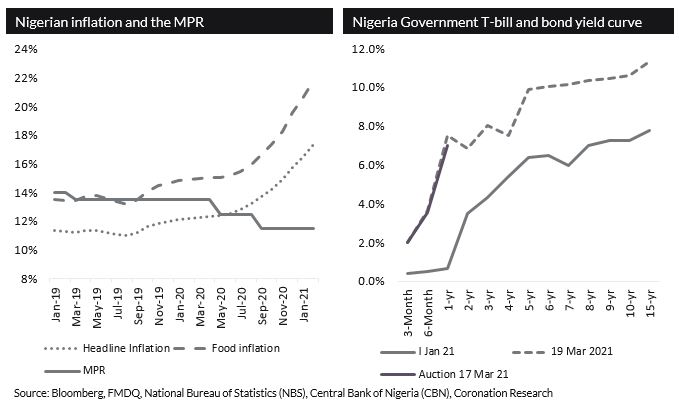

The Monetary Policy Committee (MPC) of the CBN meets today and tomorrow to decide upon its Monetary Policy Rate (MPR). We estimate that it will keep the MPR on hold at 11.50%, but amplify its commentary on inflation, singling it out as the next economic threat to be dealt with. This would leave the way open for rate rises later in the year. See details below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) closed at N410.00/US$1 with no changes from the previous week. In the parallel, or street market, the Naira also closed flat at N485.00/US$1. Although the reported level of CBN gross foreign exchange reserves has fallen from US$35.4bn at the beginning of the year to US$34.4bn recently, having reached a peak (for the year) of US$35.5bn in late January, we think that the current level remains comfortable. Indeed, reserves may well improve over the coming months as elevated oil prices improve receipts. However, we think that it will be difficult to restore FX liquidity to the levels achieved before the crisis (i.e. prior to March 2020) and therefore believe that exchange rates will continue to come under pressure.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity increased by 25bps to 10.59%, the 7-year bond yield increased by 3bps to 10.13%, and the 3-year bond yield increased by 62bps to 8.00%. The annualised yield on a 342-day T-bill remained unchanged at 4.16% in the secondary market while the yield on a 347-day OMO bill fell by 20bps to 8.57%. The Primary Market Auction held on Wednesday closed with a 1-year T-bill stop-rate of 7.00%, up from 6.50% the week before, and well above the rates found for equivalent durations in the secondary market. The result of a 1-year OMO-bill sale was a stop-rate of 10.10%. We continue to think that T-bill rates are on an upward trend, with1-year T-bill auction rates heading towards 10.00% by mid-year. We await the results of this week’s bond auctions to see how this trend continues

Oil

The price of Brent crude fell by 6.78% last week, closing at US$64.53/bbl, a 24.58% increase year-to-date. The average price to year-to-date is US$60.98/bbl, 41.11% higher than the average of US$43.22/bbl in 2020. The market is becoming increasingly nervous about some European countries imposing Covid-19 related restrictions again, as well as the suspended use of a major coronavirus vaccine, raising concerns for the demand outlook. This medium-term bad news was coupled with short-term news concerning increasing US crude inventories. In addition, the rise in US 10-year US interest rates was seen as unfavourable for risk assets generally. On the bullish side, OPEC plus Russia (OPEC+) agreed to hold oil production steady in April, as opposed to increasing production as the market earlier had anticipated. We think that Brent crude prices will likely be supported above US$60.00/bbl over the coming weeks.

Last week, Nigeria’s Federal Executive Council approved $1.5bn for the rehabilitation of the Port Harcourt refinery which is said to have a crude processing capacity of 210,000 barrels per day (bpd). If completed, it is expected to increase the availability of crude by-products and help reduce domestic petrol and diesel prices.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 0.69% last week with a loss of 4.69% year-to-date. Guinness Nigeria (+7.66%), Zenith Bank (+5.39%), and Oando (+3.39%) closed positive last week, while BUA Cement (-6.42%), Nigerian Breweries (-5.34%), and Dangote Sugar (-5.29%) closed negative. Despite the bullish performance of the Banking sub-index (+2.80%), there was still a plunge in the overall performance of the NSE-ASI driven largely by BUA Cement and Dangote Cement (-3.42%). Our view is that overall investor sentiment continues to be weak amid improvements in T-bill and bond yields. See Pages 3 & 4 for our Model Equity Portfolio for last week (15-19 March) and the week prior to that (8-12 March).

Monetary Policy Rate decision

The MPC of the CBN is due to decide the Monetary Policy Rate (MPR) on Tuesday afternoon. As we consider what its decision will be, it is as well to look at what is happening to rates in other emerging economies.

The current trend in emerging markets is for policy rates to move up towards the level of inflation. In other words, is it broadly understood that sub-inflation interest rates were necessary to soften the impact of recession last year, but that an orthodox relationship between rates and inflation needs to be restored now. Last week the Bank of Russia raised its official rate by 25 basis points to 4.50%, thereby approaching the rate of inflation at 5.80% year-on-year. The Brazilian Central Bank raised its overnight rate (the Selic rate) by 75bps to 2.75% last week and indicated that it would raise it again to 3.50% in May. Inflation in Brazil runs at 5.20% y/y.

However, raising policy rates is not a straightforward task. Last week Naci Agbal, the Governor of the Central Bank of the Republic of Turkey, raised its policy rate by 200bps, bringing it to 19.0%. At this point, he had raised it by 875bps since November of last year. This prompted the President of Turkey, Recep Erdogan, to dismiss Mr Agbal from his post on Saturday morning. The lesson here, perhaps, is that some central banks would be wise to move towards monetary orthodoxy with caution, even if this means delaying what is necessary.

The interest rate system in Nigeria gives the CBN a lot of flexibility as to when to change rates. The MPR is a practical rate inasmuch as banks borrow and lend to the CBN around this rate (with a corridor of +100bps/-700bps) but it does not set market interest rates. (And it is not the rate at which banks make the bulk of their deposits with the CBN under the cash reserve ratio, CRR, which is between 0.0% and 0.5%.) Inflation is influenced by market interest rates because these are the benchmarks used for commercial lending and therefore influence the flow of credit. Market interest rates, in particular the 1-year T-bill rate achieved at the Primary Market Auctions, have been moving up sharply this year with the stop rates rising, for example, from 4.0% in mid-February to 7.0% last week.

So, T-bill rates are catching up with the current MPR at 11.50%. The MPR itself functions as a signalling device and was used effectively twice last year, in May and September, to show the CBN’s satisfaction with the fact that market interest rates were falling. (Both last year’s MPR cuts were largely unexpected by the market.) Therefore, the question we need to answer is whether the CBN wishes to send a signal to the markets that rates need to rise. Of course, the markets are doing this already (T-bill rates are going up at successive auctions) which lessens the need for a signal. And the economy has only just returned to growth (Q4 2020 GDP was up 0.11% y/y, with the non-oil economy up 1.69% y/y) so the CBN may not want to be seen pouring cold water on it yet. This leaves the question of inflation.

Last year the MPC opined that inflation is largely a structural issue, and also expressed the view that inflation could come down during the first quarter of this year. So far, this quarter, this has not happened, with February inflation running at 17.33% y/y and food inflation at 21.79% y/y. Structural issues are critical in determining inflation but so too are other factors: commodity prices; foreign exchange rates; government spending and funding; and interest rates. Therefore, a compromise must be reached between growth and inflation and this is likely to involve interest rates.

Our sense is that the MPC will want to send a signal to the markets about inflation but will use its communique to say this rather than raising the headline MPR itself. It may want to see evidence that the economy is continuing to grow before actually raising rates, and therefore wait for evidence of growth during Q1 2021. Therefore, we expect the MPC to keep rates on hold at 11.50% for now.

Model Equity Portfolio – 19 March 2021

Last week the Model Equity Portfolio lost 0.19% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.69%, thereby outperforming it by 50bps. Year-to-date it has lost 3.57%, compared with a loss in the NSE-ASI of 4.69%, outperforming it by 111bps.

We benefited from the recovery in bank stocks last week, with our notional position in Zenith Bank (which we had reduced from 7.9% to 5.4% the previous week) giving back 29bps of performance. As advertised last week, we made notional sales of stocks to bring our notional cash position to slightly above 30.0%.

Model Equity Portfolio for the week ending 19 March 2021

This week we intend to continue to make notional sales of bank and industrial stocks to bring our notional cash position to over 35.0% with an upper target of 40.0% if liquidity is exceptionally good.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.