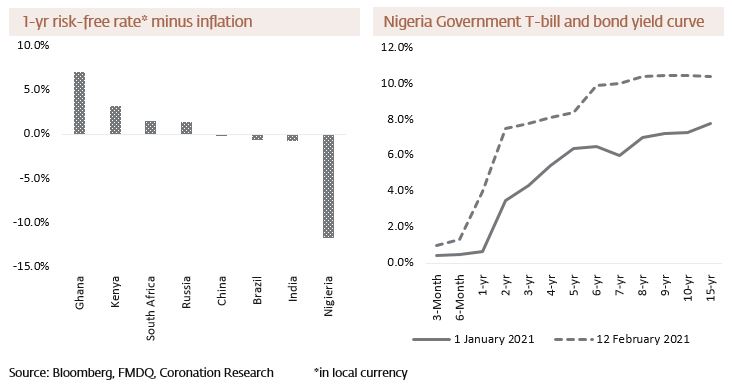

How much higher are Nigerian Treasury Bill rates going to rise this year? We think that there are several months of rising rates ahead of us and that we should not be surprised to see 1-year Treasury Bill rates of 10.0%, or more, by mid-year. If we are right, then it will mean good news for Naira-based savers and investors in money market funds in a few months from now. See details below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 3.35% to N410.50/US$1. In the parallel, or street market, the Naira appreciated by 1.46% to close last week at N480.00/US$1. The IMF released its Article IV review on Nigeria, reiterating its position on the need for the devaluation of the Naira: but the Central Bank of Nigeria (CBN) is reluctant, citing the danger posed to inflation. However, an unscheduled crawling-peg devaluation may be on the cards this year, in our view, as successive small-step devaluations – like the one we saw last week – could eventually close the gap between the NAFEX and parallel rates which are approximately 20% apart.

Bonds & T-bills

Last week, the secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity rose by 156 basis points (bps) to 10.43% and at 7 years rose by 163bps to 10.00% while at 3 years the yield rose by 168bps to 7.79%. The annualized yield on a 349-day T-bill rose by 58bps to 2.07%, while the yield on a 347-day OMO bill rose by 653bps to 9.58%.

In the primary market for Treasury Bills the story of short-term rate rises was even more dramatic. Demand was weak, with a wide range of bids. The stop rates closed higher by c.45bps for 91-day T-bills, c.70bps for 182-day T-bills, and c.200bps for 364-day T-bills. The rates closed at 1.00%, 2.00%, and 4.00% for the 91, 182 and 364-day tenors, respectively. For the auction of the CBN’s open market operation (OMO) bills, the stop rates closed at 7.00%, 8.50%, and 10.10% for the 96, 187, and 362-day tenors, respectively. Last week the Debt Management Office (DMO) of the Federal Government (FG) increased the fiscal sustainability limit (total public debt as a percentage of GDP) from 25% to 40%, implying that the government is set to significantly expand borrowing.

Oil

The price of Brent crude rose by 3.09% last week, closing at US$62.43/bbl, a 20.52% increase year-to-date. The average price to year-to-date is US$56.78/bbl, 23.88% higher than the average of US$43.22/bbl in 2020. Brent crude reached US$60.00/bbl-mark for the first time since January 2020. Oil prices have risen recently due to cuts by OPEC+ (OPEC plus Russia), prospects of a US stimulus bill, reduction in new Covid-19 cases and hospitalisations, as well as progress with vaccination. However, OPEC this week lowered expectations for global oil demand in 2021, cutting its forecast by 110,000 barrels per day (bpd) to 5.79 million bpd, due to lockdowns in major developed economies in the first half of the year. According to the International Energy Agency (IEA), oil supply is still outstripping global demand, though COVID-19 vaccines are expected to support a demand recovery. Oil prices have exceeded the range of between US$45.00/bbl and US$60.00/bbl which we pencilled in for this year, but recent prices are encouraging increases in US production and may encourage other producers, such as Russia, to turn on the taps.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 3.04% last week with a gain of 0.42% year-to-date. Guinness Nigeria (+6.32%) and MTN Nigeria (+1.11%) closed positive last week, while GT Bank (-15.69%), Ardova Oil (-12.89%) and BUA Cement (-7.13%) closed negative. The equities market is experiencing continued bearish momentum. It appears that investors are reacting to the uptrend in market interest rates which is beginning to make money market instruments attractive again. See Model Equity Portfolio below.

Interest Rates: how much higher?

Last week’s deal between the Organization of the Petroleum Exporting Countries (OPEC), Russia and the US, was heralded as a breakthrough. It ended the stand-off that had brought oil prices down from above US$50.00bbl (Brent crude traded at US$51.13/bbl as recently as 3 March) to under US$30.00/bbl (US$22.76/bbl on 30 March). Yet oil prices have not rallied much since the deal, with Brent now at US$32.12/bbl. If oil prices stay this low for six months or more, then there are far-reaching implications for Nigeria’s access to US dollars, the currency, and its budget.

As we argued in Coronation Research, Year Ahead 2020, 16 January, Nigeria’s comfort zone for Brent crude prices is above US$50.00/bbl and preferably above US$60.00/bbl (which they have not touched since the US$60.69/bbl recorded on 24 January). Foreign portfolio investors (FPI), in our view, feel comfortable with oil prices in this range (and above US$60.00/bbl), but tend to withdraw money when prices fall below US$50.00/bbl. And, for the Central Bank of Nigeria (CBN), oil is the primary source of its US dollars from the Nigerian National Petroleum Corporation (NNPC), with the secondary (but larger) sources of FPI, bilateral loans and Eurobond sales depending on oil prices being in or above the comfort zone.

Does this mean that Nigerian 1-year Treasury Bill rates need to go all the way up to – and even beyond – the rate of inflation? Inflation stood at 15.75% y/y in December. It would be a remarkable adjustment for banks and their customers to make. It would be difficult for borrowers but good for holders of savings accounts and money market mutual funds. It seems likely that the authorities might want to phase in the changes over several months, in order to give time for the financial system to adjust. In this case, we would not be surprised to see 1-year T-bills rates of 10.0%, or more, by the middle of this year.

Another way to interpret the CBN’s OMO auctions is to see them as the creation of a two-tier interest rate market: a class of OMO bills for foreigners; ordinary T-bill rates for domestic investors. However, such a strategy would face two hurdles, in our view. First, it would require incoming foreign portfolio investors to purchase OMO bills when the issue of foreign exchange liquidity is still not fully resolved (NAFEX volumes remain lower than a year ago). Second, it would encourage Nigerian domestic investors to become foreign portfolio investors, moving offshore (however difficult that is) to benefit from superior rates.

The bond market clearly thinks that rates are on the rise, with the yield curve in Federal Government of Nigeria T-bills and bonds shifting rapidly upwards so far this year, even though investors are liquid and there is plenty of cash around. T-bill rates and FGN bond rates look poised to continue trending upwards for several months, in our view.

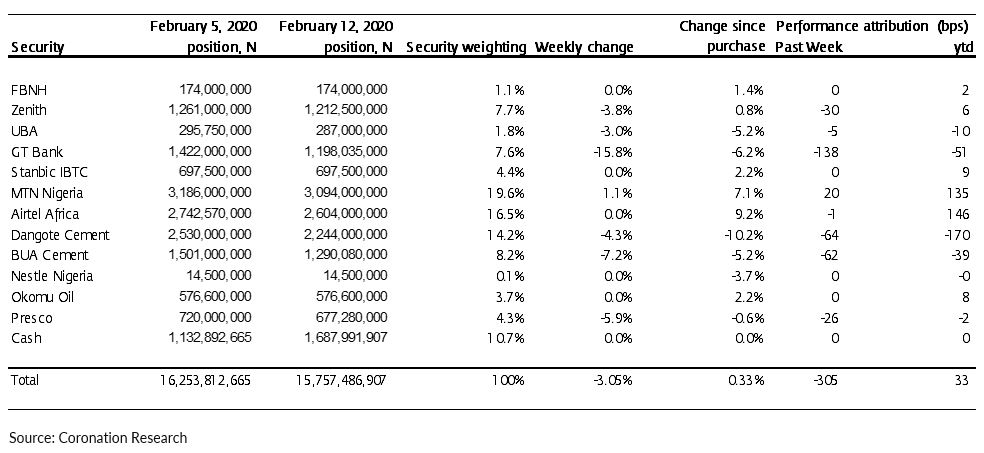

Model Equity Portfolio – 12 February 2021

Last week the Model Equity Portfolio fell by 3.05% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 3.04%, therefore underperforming it by 1 basis point. Year to date it has gained 0.33% against again in the NSE-ASI of 0.42%, underperforming it by 9bps.

Last week we wrote that it was fortunate that the price of GT Bank had held up when most other bank stocks were correcting, and we did not expect to be so fortunate again. Indeed, GT Bank corrected 15.8% last week and our notional position cost us 138bps. There were few rallies, last week, in the mid-cap stocks where we have few notional positions, and this deficit remains a weakness that we intend to redress.

Model Equity Portfolio for the week ending 12 February 2021

As forewarned in this publication last week, we made notional sales in Airtel Africa, MTN Nigeria, Dangote Cement and BUA Cement last week with a view to raising our notional cash position by between one and three percentage points. We actually took advantage of reasonable liquidity and raised the notional cash position by three percentage points, with the decline of the market bringing the notional cash position up to 10.7%.

We will continue with these tactics this week in order to raise the notional cash position by up to a further five percentage points but will broaden the scope of our notional sales to include sales in Nestle Nigeria, Okomu Oil and Presco if necessary. Note that we do not intend to reduce our notional positions in banks, whose results for the full-year 2020 are due to be reported soon. We think that the results will be received well by the market.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.