Since last July the Central Bank of Nigeria (CBN) has pursued non-conventional monetary policies (see Coronation Research, Year Ahead 2020, 16 January) which have seen credit grow and domestic risk-free rates fall well below the level of inflation. There are risks the Naira/US dollar exchange rate here (see below) but the CBN could claim that its policies are working because GDP growth rates are rising, albeit gently.

FX

Pressure on the CBN FX reserves last week led to a decline of US$380.2m to close at US$36.8bn (reported as a one-month moving average), roughly twice the average weekly outflow which we saw during January. The CBN continues to supply US dollars to the FX markets and, by alleviating pressure there, prevents excess demand building up in the parallel (or ‘street’) FX market. Here the Naira actually appreciated by N1.0 to the US dollar to close at N361.0/US$1 last week. The CBN last week extended exchange controls by restricting US dollar domiciliary accounts funded in cash – only cash withdrawals are allowed. Our view is that, with US dollars due to flow into the CBN’s reserves from Eurobond proceeds and other sources later this year, the CBN can defend a rate of N362.5/US$1, or close to it, for most, if not all, of 2020.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity fell by 16bps to 10.71%, and at 3 years fell by 107bps to 8.03% last week. The annualised yield on 328-day T-bill, the longest duration available in the secondary market, rose by 102bps to 5.34%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 13.89%, 25bps down week-on-week. This suggests continuing demand from domestic investors for bonds and from foreign investors for OMO bills (domestic corporates cannot bid in OMO auctions).

Oil

The price of Brent rose by 2.06% last week to US$58.50/bbl. The average price, year-to-date, is US$60.64/bbl, 5.54% lower than the average of US$64.20/bbl in 2019, and 15.41% lower than the average of US$71.69/bbl in 2018. A decline in US inventories supported oil prices last week, but the news over the weekend about the spread of the coronavirus in Europe quickly reversed these gains. Though we expect oil prices to continue to be under pressure we note that the forward curve for Brent is holding above US$55.00/bbl for all of 2020, suggesting a level of support at this level.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index fell by 1.32% last week, the year-to-date return is positive 2.03%. Last week FCMB Group (+14.28%) Stanbic IBTC (+1.32%) and Zenith Bank (+1.02%) closed positive while Forte Oil (-9.97%), International Breweries (-9.03%) and Nestle Nigeria (-9.02%) fell. The full year 2019 financial results have started trickling in and we think this will be a catalyst for the All-share index, especially the bellwether stock whose gross dividend yield are currently above the 364-day T-bill.

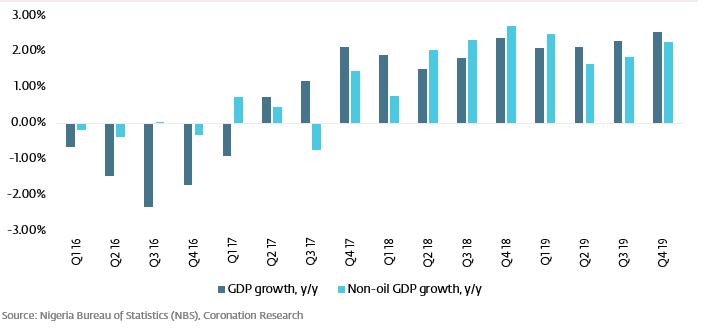

Gentle improvements in GDP growth (1)

Today we received the report on 2019 GDP growth, at 2.27% y/y, close to our published forecast of 2.25%. The annual series now reads 1.91% y/y growth for 2018 followed by 2.27% y/y growth for 2019, a slight acceleration. And for the fourth quarters, the series reads 2.38% y/y growth for Q4 2018 and 2.55% y/y growth for Q4 2019. In terms of sequential quarters, Q4 2019’s growth rate of 2.55% y/y compares with 2.28% y/y in Q3 2019. Non-oil growth in Q4 2019 was 2.26% y/y, comparing with 1.85% y/y growth in Q3 2019. In most comparisons, therefore, the headline data suggest gently-improving growth rates. Oil & gas GDP grew at 6.36% y/y in Q4 2019.

Agriculture continued to grow but slower than its long term growth rate of 3% in Q4’19. We had expected stronger growth in agriculture as a result of positive externalities from the border closure, particularly the crop and livestock sub-sectors. We premised our expectations on marginal benefits from improved supply chain management locally and net additions to cultivated areas for import substitution. These factors appear to be more sticky than we projected.

Manufacturing, however, grew by 1.24% y/y in Q4’19, it strongest performance in 2019. One of the enablers for this growth was credit expansion. The CBN reports that new credit in Q4’19 was in the region of N1.0tn (US$2.8bn).

GDP growth vs non-oil GDP growth

The upward trend in Non-oil GDP throughout 2019 correlates well with the trend in Telecoms. Telecoms delivered another quarter of double-digit growth at 10.26% y/y. Subscriber additions in 2019 continued to be net positive. Structurally, demand is projected to remain strong for telecom services as no viable alternatives exist for end-user migration and higher average revenue per user (ARPU) continue to be achieved. Trade fell by 0.58% y/y in Q4’19. Negative shocks from the border closure remain the major risk to the downside, though recent exchange controls further dampens its outlook.

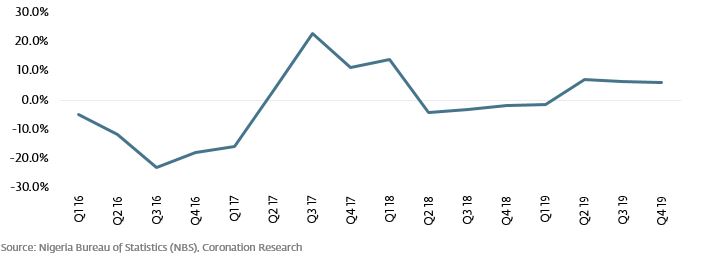

Gentle improvements in GDP growth (2)

Oil GDP growth, y/y

Oil GDP advanced for the third consecutive quarter in Q4’19, growing by 6.36% y/y. Much of the growth in the Oil sector was volume driven rather than through price gains. Crude output was on average 90,000bpd higher than in 2019, corroborating a 73.6% decline in NPL ratios attributable to the oil and gas sector as at 9M’19.

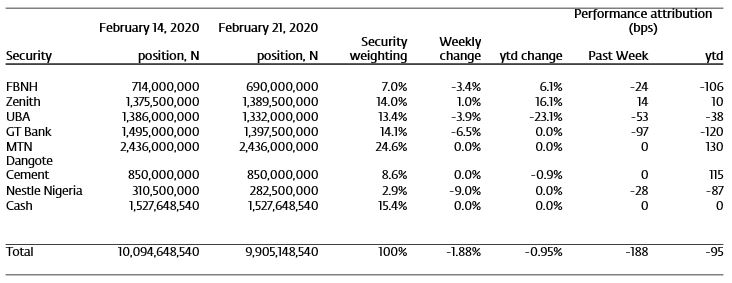

Model Equity Portfolio

Our Model Equity Portfolio contracted by 1.88% last week compared with a decline of 1.32% in the NSE-ASI broad index. Last week’s trading activity saw declines in GT Bank, FBNH and UBA. The biggest weekly loss in the portfolio last week was from Nestle Nigeria (3% of our holdings) which fell by 9.02% w/w. The NSE-ASI broad index is in the lead with 2.03% y-t-d, outperforming by 298bps the Model Equity Portfolio at negative 0.95% y-t-d. However, we still have 10 months to redress the balance this year.

Our large exposure to banks, collectively 48.6% of the portfolio, highlights an area of risk concentration when the market has a few reservations over banks. Zenith Bank’s FY 2019 results were broadly flat, year-on-year. MTN (24.6% portfolio weight), Dangote Cement (8.6% portfolio weight) and Nestle Nigeria (2.9% portfolio weight) complete the Model Equity Portfolio’s current equity allocation with a cash position of 15.4%.

We made no change to the Model Equity Portfolio last week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.

Model Equity Portfolio for the week ending 21 February 2020