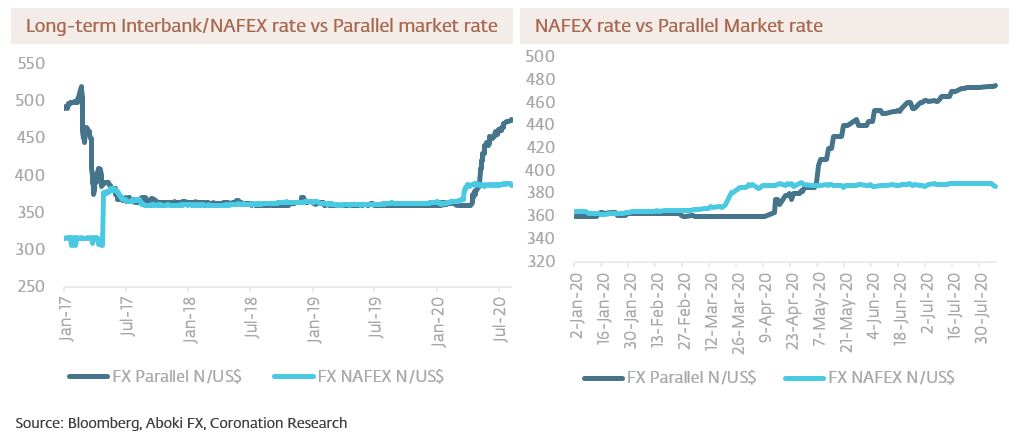

Last week we received a lot of questions about the foreign exchange markets. Was the World Bank forcing the Nigeria’s hand in demanding unification of all exchange rates? Why was the parallel market rate not weaker? We do not know the inner workings of the World Bank, nor about its dialogue with Nigeria’s monetary authorities. But we do have an explanation for what is happening in the FX markets. See details below…

FX

The foreign exchange reserves of the Central Bank of Nigeria (CBN) recorded a slight decline last week, dipping by US$198.91m to US$35.67bn (which represents a one-month moving average). The CBN, to further unify all exchange rates, moved the official rate for the second time this year from N360/US$1 N380/US$1 last week. This brings the official rate closer to the NAFEX rate (which closed at N386.23/US$1 last week) and the SMIS rate (which closed at N388.23/US$1 last week). Although it was reported that the CBN was under pressure from the World Bank (see page 2) to amend its FX management policy, the World Bank approved a loan of US$114m on Friday to help in the struggle against Covid-19. We do not see an immediate change in policy but we think the Naira will continue to come under pressure in the parallel market where it trades at N475/US$1.

Bonds & T-bills

Last week the secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity increased by 105basis point (bps) to 9.08%, and at 3 years decreased by 2bps to 3.90%. The annualised yield on 307-day T-bill decreased by 1basis point (bps) to 2.95% while the yield of a CBN Open Market Operation (OMO) bill with similar tenure increased by 1bps to 4.56%. Our sense is that some pension fund administrators (PFA) required liquidity last week and that their selling contributed to profit-taking. On the other hand, and with redemptions from open market operation (OMO) bills due to increase liquidity in September, we think the market may stabilise going forward, even though the mark-to-market risks (see Nigeria Weekly Update, last week) are rising.

Oil

The price of Brent crude increased by 2.54% last week to US$44.40/bbl. The average price, year-to-date, is US$42.36/bbl, 32.73% lower than the average of US$64.20/bbl in 2019. Last week, oil prices recorded gains as Iraq, a member of the Organisation of Petroleum Exporting Countries (OPEC), disclosed that it would pare its oil production by 400,000bpd in August and September to compensate for its overproduction in the last three months. Also, a weakening US dollar further supported the rally in oil prices. We expect prices to be firm going forward.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) increased by 1.41% last week. The year-to-date return is negative 6.71%. Last week Flour Mills (+13.20%), Seplat (+12.83%), Stanbic IBTC (+10.00%), Guinness Nigeria (+8.48%) and GT Bank (+8.22%) closed positive, while Ardova Oil (-9.67%), Unilever Nigeria (-8.57%), International Breweries(-4.55%) and Dangote Sugar (-0.42%) closed negative. The sectoral performance was positive with the exception of the insurance index (-0.53%). The Oil & Gas (+0.08%), Banking (+2.38%), Industrial (0.02%) and Consumer Goods (0.42%) indices all recorded weekly gains.

No Big Changes in FX Policy

Three weeks ago (see Coronation Research, Nigeria Weekly Update, 20 July) we wrote about the mystery of the parallel exchange rate. Why had the parallel rate not diverged more from the NAFEX rate (also known as the I&E Windows and the interbank rate)? In the absence of significant supply of US dollars from the CBN to the NAFEX market (which was designed, in any case, to be autonomous and not require CBN support), NAFEX turnover fell in mid-March and remains low. So we would expect demand for US dollars to hit the parallel market, driving down the unofficial price of the Naira. It has, indeed, but not very much. If we look back to early 2017 (see chart) the parallel rate was a long way from the interbank market (there was no NAFEX market at the time) – 50.9% weaker, to be precise. Towards the end of last week, the parallel market rate was 22.9% shy of the NAFEX rate, much less of a difference.

Last week Business Day ran a story that hinted that the World Bank might withhold a US$1.5bn tranche of lending unless Nigeria unifies its exchange rates, and this article prompted much debate. It remains unclear to us whether this was – or is – the World Bank’s stance since there is no ‘smoking gun’, i.e. a direct quotation of a World Bank official, nor a statement from a Nigeria official to the same effect. On the other hand, there is credence in the idea that international development agencies such as the IMF and the World Bank oppose developing countries having multiple exchange rates, and they generally prefer a free float to a managed exchange rate.

Another explanation for the state of the parallel market is that it is not a case of low demand for US dollars (as we argued on 20 July – we put it down to the weak economy) but a steady supply of US dollars flowing into the parallel market. This thesis is impossible to test because there is no data for a turnover on the parallel market. It might be revealing to find a website offering the parallel market rate as opposed to the NAFEX rate, but both those of Western Union and of Azimo, for example, are offering rates that essentially are the same as the NAFEX rate.

The mystery can probably be explained this way: demand for US dollars is unusually low; the parallel market is meeting a higher proportion of US dollar demand than it did in 2017.

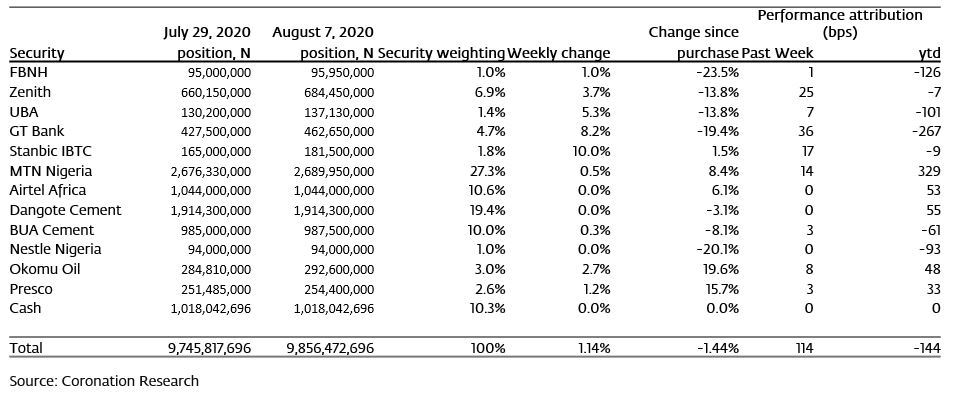

Model Equity Portfolio

Last week the Model Equity Portfolio rose by 1.14%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.41%, therefore underperforming it by 27 basis points. Year-to-date it has lost 1.44%, against a loss of 6.71% in the NSE-ASI, outperforming it by 527bps.

Last week we wrote that we had outperformed the index for five consecutive weeks and that we found this odd, given a number of nearly market-neutral positions (e.g. Airtel Africa, Dangote Cement and BUA Cement) in our portfolio. We were almost inviting some underperformance.

In the event we underperformed on two separate counts. First, two stocks which we generally do not favour rallied hard. These were Seplat (1.58% of the index) which rallied by 12.83% and Flour Mills of Nigeria (0.61% of the index) which rallied by 13.20% over the week. Given our investment approach, which is to hold stocks that we like (unless they are unavoidably a large part of the index), we must be content to suffer the opportunity cost of not holding them.

Model Equity Portfolio for the week ending 07 August 2020

The second problem was our underweight position in banks, which wrote up as a downside risk two weeks ago. We tried to avoid underperformance by making (as forewarned) a notional purchase in Zenith Bank last week, but we did not go far enough in building up the notional position in banks. Our performance attribution tells us that our decision to underweight them back in June was a mistake. Is it too late to rectify it?

We think is worth taking the risk of increasing our notional position in banks. Results are due soon and it seems to us that the market has oversold at least some of these stocks (see their year-to-date performance) when they are likely to have preserved spreads and proved to be fairly resilient earners. It is understood that their earnings will be weak, on a year-on-year comparison, but perhaps not as weak as the market expects. We intend to increase our notional positions in FBN Holdings, UBA, GT Bank and Stanbic IBTC (liquidity permitting) this week.

We also intend to increase our notional positions palm oil and rubber producers Okomu Oil and Presco. Although the catalyst of devaluation has not arrived (certainly not in the NAFEX market and only slowly in the parallel market) we note that their base prices – international palm oil prices were up 2.7% and rubber prices were up 7.1% last week – are trending upwards.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.