January started so well: February is another matter. Nigeria’s stock market was the world’s best-performing in January, foreign money flowed into its fixed-income instruments. Then came the coronavirus, fears over global growth and a sharp drop in oil prices. There is no reason to panic, in our view, but it is necessary to keep a close watch on key indicators this month to see how our forecasts (see Coronation Research, Year Ahead 2020) will work out. Meanwhile, the Lagos State Government has rid the streets of motorcycle-taxis and trikes. See page 2 for details.

FX

The rate of depletion of the Central Bank of Nigeria’s (CBN) reserves has reduced since the beginning of the year. The average monthly outflow in the second half of last year was US$1.1bn while in January the outflow was just US$0.6bn, a position helped by a gross inflow of foreign portfolio investment (FPI) of US$1.7bn. However, concerns over the global economic impact of the coronavirus have taken oil prices (Brent) down to US$54.47/bbl which, in our view, may negatively impact investor sentiment towards Nigerian assets. We still believe the CBN can maintain an exchange rate of close to N362.50/US$1 for most, if not all, of 2020 but the recent slump in oil prices poses a risk to this prospect. January’s data for reserves and FPI was good, but February’s measures will be critical to our outlook.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity rose by 11bps to 10.95%, and at 3 years rose by 22bps to 9.16% last week. The annualised yield on 342-day T-bill, the longest duration available in the secondary market, was at 4.32%, while an OMO bill with similar tenure closed at 14.31%, 63bps up week-on-week. This week, inflows from T-bills (N147.38bn, US$409.39mn), OMO (N440.90bn, US$1,224.22mn) and FGN bond (N606.43bn, US$1,684.53mn) maturities on 13 February 2020 will increase market liquidity. This is likely to put downward pressure on T-bill rates.

Oil

The price of Brent fell by 6.34% last week to US$54.47/bbl. The average price, year-to-date, is US$62.03/bbl, 3.38% lower than the average of US$64.20/bbl in 2019, and 13.48% lower than the average of US$71.69/bbl in 2018. Although there appears to be no end in sight to the coronavirus epidemic and its threat to global growth, we note that the futures curve in Brent now points slightly upwards, suggesting a degree of price support in the short term.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index fell by 2.69% last week, the year-to-date return is positive 4.56%. Last week Honeywell Flour Mills (+13.40%) Flour Mills of Nigeria (+3.64%) and Fidelity Bank (+0.93%) closed positive while Cadbury Nigeria (-16.38%), Forte Oil (-9.95%) and Mobil (-9.94%) fell. The gains that were recorded by the Nigerian Stock Exchange All-Share Index (NSE-ASI) are gradually being eroded, ending its brief reign as the best-performing stock market in the world in January.

Okada and Keke ban

Commuting within Lagos, Nigeria’s mega-city often entails several hours of traffic jams due to poorly-linked and poorly-maintained road networks. In a bid to manoeuvre the jams and efficiently reduce the long-hours of traffic, commercial motorcycles (popularly known as “Okada”) and tricycles (popularly known as “Keke”) ply the streets of Lagos.

The Lagos State Government on 27 January 2020 announced the ban of Okada and Keke effective 1 February 2020, citing safety concerns and crime as reasons for its decision. Of the 20 local governments in the state 15 of them, including Victoria Island, Ikeja and Lagos Island, which are some of the major residential and business hubs, are affected by the ban. The state has also banned the operations of motorcycle-hailing startups which earlier amassed a strong following and provided stiff competition for car-hailing companies like Uber and Bolt. Commuters who depended heavily on these transport alternatives have been left stranded. The Lagos State Government has, however, stated that additional buses will be put on the roads, as well as additional boats to aid freight transport across the lagoon.

The transport system in Lagos is weak. Commercial buses alone are not sufficient to cater to several million citizens, and there are no commuter railways. More so, some of these motorcycle-hailing startups recently injected fresh capital for expansion and the outright ban not only frustrates these companies, mostly foreign-owned, but also Nigeria’s ability to attract, and retain, foreign direct investments (FDI). Collectively, Max.ng and Gokada raised over US$12 million in funding last year alone. OPay, a payments service which founded Oride, a motorcycle taxi platform, received US$170 million in funding, mainly from Chinese investors, last year.

The operating environment for businesses in Nigeria is already challenging. Nigeria is ranked 131 out of 190 countries on the World Bank’s 2020 Ease of Doing Business report. Prior to the ban, motorcycle-hailing start-ups were in agreement with the Lagos State Government and transport unions to pay a daily fee of N500 (US$1.38) per motorcycle per day by buying tickets. Assuming all start-ups have a total of 5,000 motorcycles, they were looking to collectively pay N500,000 (US$ 1,388) per day. This fee was separate from company tax paid to the government.

Two major ripple effects of this ban will likely be a higher unemployment rate and increased pressure on already thin disposable incomes. While the safety and crime concerns cited by the Lagos government are valid, it is not likely that the banning of Okada, Keke and motorcycle-hailing operations will solve the problem.

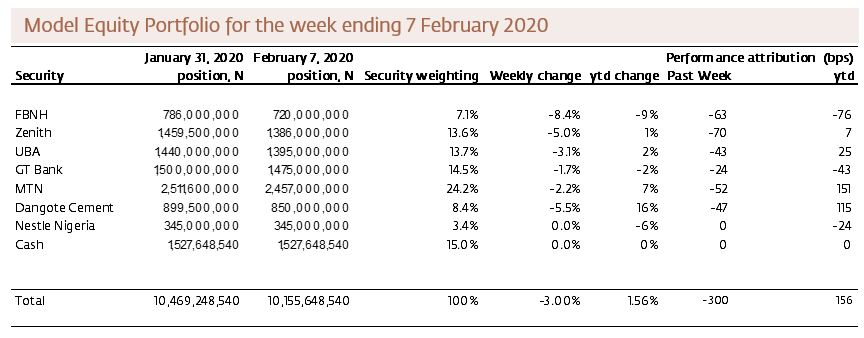

Model Equity Portfolio

Our Model Equity Portfolio contracted by 3.00% last week compared with a decline of 2.69% in the NSE-ASI broad index. Last week’s trading activity consisted of sell-offs across banks, oil and gas and the industrial sector. The NSE-ASI broad index is therefore in the lead with 4.56% y-t-d, 300bps outperforming by 300bps the Model Equity Portfolio at 1.56% y-t-d.

Our large exposure to banks, collectively 49.0% of the portfolio, highlights an area of risk concentration to a lively regulator and other banking sector systemic shocks. However, it is also a reflection of the lack of depth in the market for quality names with fundamentally reasonable upsides at the moment, in our view. MTN (24.2% portfolio weight), Dangote Cement (8.4% portfolio weight) and Nestle Nigeria (3.4% portfolio weight) complete the Model Equity Portfolio’s current equity allocation with a cash position of 15.0%.

We persist with our strategy to be underweight brewers, food and fast-moving consumer goods companies on weak medium to long-term real growth and stiff competition from unlisted brands. Having taken the punishment for our bank-heavy orientation we are minded to await FY 2019 results, at least, before considering a change in strategy.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.