Bitcoin has taken the world by storm over the past year, but Nigerians were alert to the opportunities early on, and data suggests that they are among the most active Bitcoin traders in the world. At the same time, numerous central banks take a dim view of cryptocurrencies and would like to control them. What is the way forward? Read on for the answers.

FX

Last week, the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.01% to close at N410.8/US$1. However, in the parallel (or street) market, the Naira was flat at N502.00/US$1, keeping the gap between both market rates at 22.22%. Last week at the Bankers’ Committee meeting it was reiterated that the Central Bank of Nigeria (CBN) has made additional foreign exchange available to support imports by small and medium-sized enterprises (SME), aside from making it available for invisibles. The CBN also announced that it would launch the Central Bank Digital Currency (CBDC) by the end of the year, in its bid to improve remittances, enhance financial inclusion, and simplify payments. Elsewhere, the CBN’s FX reserves fell by 0.48% over the week to US$34.01bn, the lowest level since May 5, 2020. Amidst persisting FX illiquidity in the I&E Window, we expect the parallel rate and the I&E Window rates to remain under pressure over the months to come.

Bonds & T-bills

Last week, bearish sentiment returned to the secondary market for FGN Bonds. The yield of an FGN Naira-denominated bond with 10 years to maturity rose by 16bps to 13.10%. Conversely, the yield on the 7-year bond fell by 9bps to 12.78%, and the yield on a 3-year bond fell by 5bps to 11.61%. The overall average benchmark yield rose by 6bps w/w to close at 12.27%. We expect the market to take a cue from today’s report of May inflation at 17.93% y/y, down slightly from 18.12% y/y in April. We maintain our view of an upward trend in bond yields amidst still negative inflation-adjusted returns.

Activities in the Nigerian Treasury Bill (T-bill) secondary market remained bearish as system liquidity remained thin. The annualised yield on a 321-day T-bill in the secondary market rose by 27bps to 9.77%, while the yield on a 277-day OMO bill fell by 1bps to 9.78%. The average benchmark yield for T-bills rose by 10bps to close at 6.36%, while the average yield for OMO bills fell by 32bps w/w to close at 9.64%. The CBN conducted a T-bill primary market auction (PMA), offering N91.27bn in bills. The apex bank allotted a total of N179.3bn (US$437.2m) with stop rates on the 91-day (2.50%) and 182-day (3.50%) bills remaining unchanged. Conversely, the stop rate on the 364-day declined by 1bp to 9.64%. We expect secondary market yields to trend upwards over the coming weeks amidst the continued squeeze on system liquidity.

Oil

The price of Brent crude rose by 1.11% last week, closing at US$72.69/bbl, with a 40.33% increase year-to-date. The average price year-to-date is US$64.19/bbl, 48.51% higher than the average of US$43.22/bbl in 2020. Last week the oil price maintained its rally above US$70.00/bbl on the back of expectations of a recovery in demand for fuel in the United States, Europe, and China. In its latest monthly oil report, the IEA (International Energy Agency) called on the Organization of the Petroleum Exporting Countries and Russia (OPEC+) to “open its taps” to meet expected demand in 2022. The IEA’s report was received scepticism as its earlier “Net-Zero by 2050” report had called for halting oil and gas investments. However, this position had been reviewed in line with current market realities. According to the IEA’s report, demand is expected to increase by 5.36 million barrels per day (bpd) in 2021 and another 3.07 million bpd in 2022. By the end of 2022 global demand is forecast to be at 99.46 million bpd. Our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was up by 1.11% last week, moderating the year-to-date loss to 2.77%. Okomu Oil +20.73%, PZ Cussons +9.09%, and Unilever Nigeria +7.56% closed positive last week, while FCMB Group -5.45% and Sterling Bank -2.44% closed negative. Sectoral performances were broadly bullish as the NGX Industrial Goods index led the gainers, rising by +2.36%, followed by the NGX Oil and Gas index +1.37%, the NGX 30 index +1.36%, the NGX Pension index +1.14%, the NGX Consumer Goods index +1.06%, and the NGX Banking index +0.89%. Conversely, the NGX Insurance index was the sole loser, declining by 4.12%. Buying has continued following the slowdown in the upward trend of yields in the fixed income market. See Model Equity Portfolio below.

Bitcoin and Nigeria

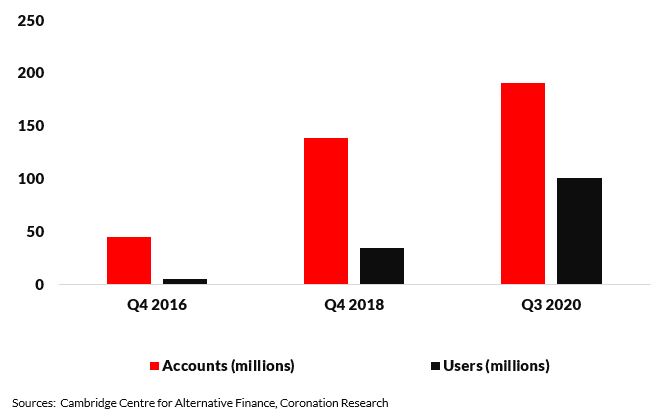

Bitcoin is the most commonly traded cryptocurrency in the world, accounting for about 60% of the global cryptocurrency market. It is created as a reward for a process known as mining, which uses software that requires solving cryptographic problems and which in turn creates and stores records of transactions on a public digital ledger called the blockchain. From Q4 2016 to Q3 2020 the number of users rose by 324%, becoming a social and economic phenomenon that has created big winners and losers as its popularity has grown among retail and institutional investors. There were 191 million accounts as of Q3 2020.

Accounts and users between Q4 2016 and Q3 2020

At the time of writing, Bitcoin is worth US$681.8billion in market capitalisation, which is more than seven times the size of the NGX-ASI (US$95.31bn). However, the decentralised nature of cryptocurrencies skews them towards high volatility. In addition, the anonymity of cryptocurrencies exposes them to use for money laundering, fraud and even financing of terrorism. This has led the Central Bank of Nigeria to ban banks from dealing in cryptocurrency-related transactions and to close the accounts of individuals or entities dealing in cryptocurrencies. Data from recent months after the ban showed that, despite regulators’ attempts to dampen demand, Nigerians moved to peer-to-peer transactions in which bitcoin can be transferred directly from seller to buyer, bypassing the need for a registered financial intermediary.

Other emerging market regulators, like the People’s Bank of China, have followed the CBN in trying to curtail demand for cryptocurrencies and have reminded financial institutions that they should not conduct business in cryptocurrencies. The People’s Bank of China is test-running its cryptocurrency, the digital Yuan. Turkey has also banned the use of cryptocurrencies for payments. Other countries implementing regulatory prohibitions include Egypt, Pakistan, Argentina, India and Bangladesh. All these raise questions about the tolerance of global central banks for private cryptocurrencies within their jurisdictions as many have plans to develop, or are already developing, their own cryptocurrencies.

What makes Bitcoin so volatile? The value of Bitcoin has taken wild swings based on tweets or comments from powerful individuals. For instance, in recent months, Elon Musk, CEO of Tesla, played a critical role in influencing its value. Last month he released a statement stating that Tesla would no longer accept Bitcoin for payments due to the adverse effects on the environment of the large amounts of energy it takes to mine it. By recent estimates, it has dwarfed the energy usage of some small European countries. However, in a recent tweet, Elon Musk has said that if the energy issues improve, he would consider accepting it as a means of payment for Tesla. This tweet led to a 9.08% jump to $39,035.47 in Bitcoin’s price from the day before to the time he made this tweet.

Bitcoin price from 1 November 2013 to 9 June 2021

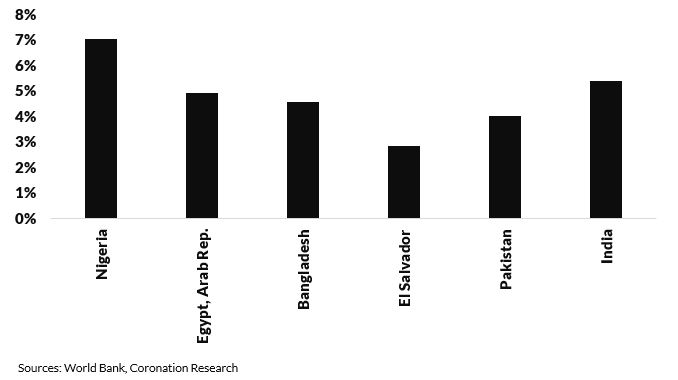

Last week, El Salvador took a bold decision and laid out plans to make Bitcoin legal tender. A new bill mandates all businesses to accept bitcoin for goods and services. The primarily cash-based country is one of the poorest in Latin America, with remittances making up 24% of GDP amid low levels of financial inclusion.

As of 8 June, Bitcoin’s value had fallen by 47.11% from a year-high of US$63,346 per coin. To keep bitcoin scarce and help maintain its value, the number of bitcoins that can be mined is capped at 21 million. To date, almost 19 million bitcoins have been mined.

The arguments for and against Bitcoin continue as, in technical terms, we gradually move towards mining the last Bitcoin. Its potential as a currency presented by its proponents is still debatable, and its high volatility puts it in the highly speculative category of asset classes.

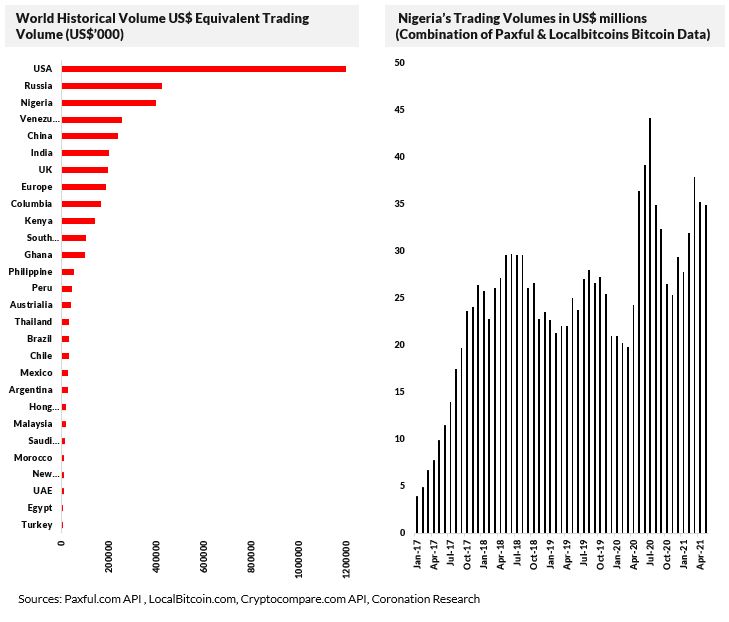

Narrowing it down to Nigeria, Bitcoin’s popularity witnessed massive growth as the country grappled with the Covid-19-induced recession in 2020 and while the Naira was afflicted by inflation. As a result, some Nigerian retail investors saw Bitcoin as a means to make quick returns (compared with traditional investments) and a hedge against inflation and Naira devaluation. According to figures from two cryptocurrency online trading platforms, Paxful and Localbitcoins, monthly average trades of Bitcoin (combined) reached US$24.6 million. These data suggest that Nigeria is the country with the most Bitcoin trades in Africa and number three in the world (after the US and Russia).

Remittance costs for selected countries

Cryptocurrency poses numerous opportunities for Nigeria and this article aims to show that there may be untapped capital from certain retail investors. The data from the number of trading volumes has revealed that Nigerian retail investors are willing to take on risky assets as long as there are promising returns and the market is liquid. We also wish to show that the flow of remittances can be aided significantly through Bitcoin as it erases the need for middlemen in carrying out transactions. Data shows that it is expensive to remit funds through Money Transfer Organizations. Finally, it can be argued that it boosts digital financial inclusion. We hope that these features will characterise the cryptocurrencies currently being created by central banks.

Model Equity Portfolio

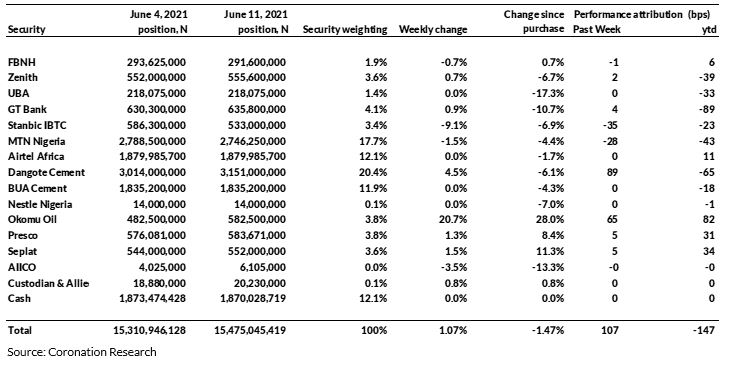

Last week the Model Equity Portfolio rose by 1.07% compared with a rise in the NGX Exchange All-Share Index (NSE-ASI) of 1.11%, therefore underperforming it by 4 basis points. Year to date it has lost 1.47% against a loss in the NSE-ASI of 2.76%, outperforming it by 130bps.

Model Equity Portfolio for the week ending 11 June 2021

Stanbic IBTC’s 1-for-6 bonus issue made things complicated last week. Stanbic IBTC’s historic and current share price has been re-stated for the bonus shares. However, these have not yet been delivered and with this small degree of settlement risk, our approach is to mark the position for the published share price. Following this cautious approach, we have marked our notional position (13.0 million shares) in Stanbic IBTC down by 9.1%, though if we accounted for our (or soon-to-be-our) bonus shares (2.2 million shares) the position would have gained 4.0%. In effect, we have made a provision whereby we stand to gain 2.2m free notional Stanbic IBTC shares when the bonus is delivered.

(Had we recorded the bonus shares, rather than making an arrangement to record them later, the Model Equity Portfolio would have gained 1.65% last week as opposed to 1.07%.)

Elsewhere, the Model Equity Portfolio gained 89bps from its nearly index-neutral notional position in Dangote Cement and 65bps from its notional position in Okomu Oil. The biggest loss came from the Model Equity Portfolio’s nearly index-neutral notional position in MTN Nigeria.

Last week we continued to make notional purchases in insurance companies AIICO and Custodian & Allied, respecting the very low liquidity in these two. We will continue to do so.

Going forward, we intend to make notional sales of Airtel Africa when the opportunities arise (but liquidity is scarce). We are content with our notional 12.1% cash position for the time being but will be scouting around for new ideas to take the Model Equity Portfolio forward.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.