From one perspective, it could not be better. As we outline on page 2, foreign exchange reserves are high, the foreign exchange markets need no official support and the Naira has appreciated against the US dollar this year. Yet nothing stays still for long. Oil prices are weak and some investors are taking long-duration Naira fixed-income positions off the table. It all suggests rising risk.

FX

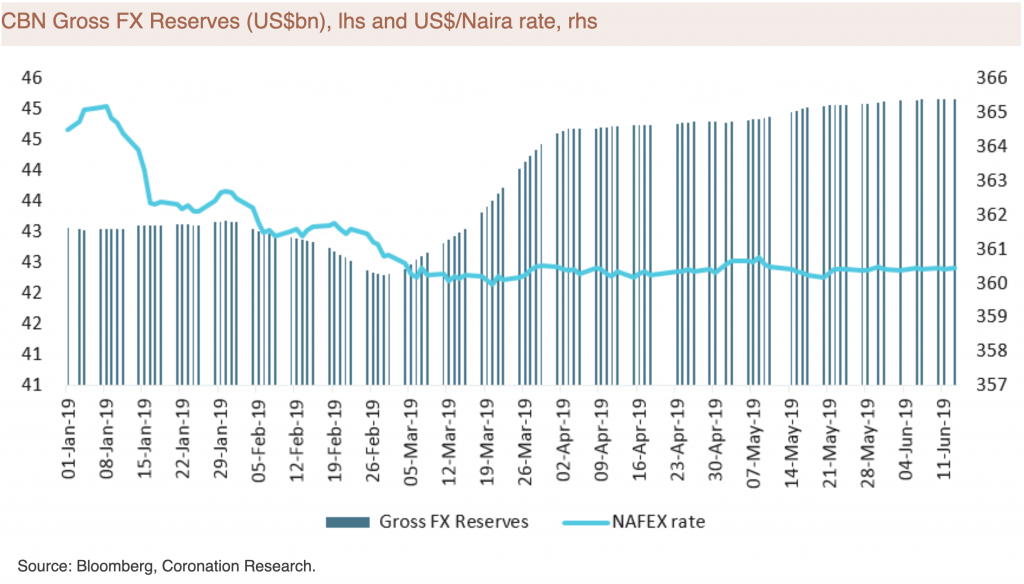

The Central Bank of Nigeria’s (CBN) supply of US dollars to the NAFEX market has significantly reduced this year, from US$484.0m in January to zero in May and June month-to-date. The CBN’s FX reserves currently stand at US$45.2bn. We reiterate our view in Coronation Research: Year Ahead 2019, A tale of two halves, 15 January, that FX reserves are sufficient to ensure Naira exchange rate stability in 2019.

Bonds & T-bills

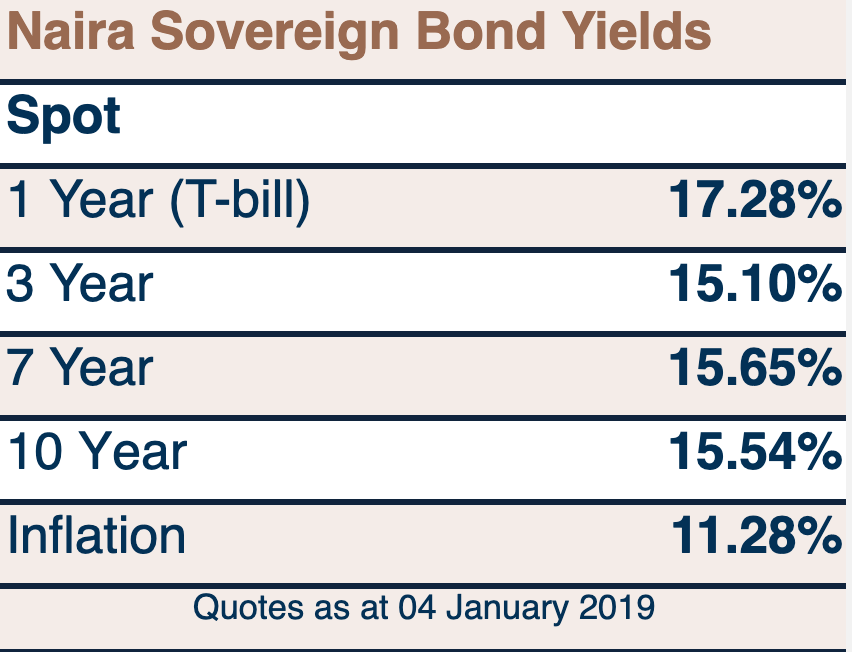

The yield on a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity increased by 8bps to 14.68%, and at 3 years declined by 8bps to 14.54% last week. The yield on a 364-day T-bill declined by 37bps to 13.72%. The yield on a T-bill with 3 months to maturity declined by 159bps to 10.96%.

We observed rotation out of long-dated bonds and into short-dated bonds and T-bills last week. This, we believe, reflects investors’ belief that Nigeria’s risk outlook is worsening, hence the need to capture long-dated gains, where possible, and reinvest them in short-dated securities. Nigerian risk is signaled by weak oil prices, as we described last week. So, while the US dollar yield curve is inverted out to three years’ duration, the Naira yield curve out to 10 years’ duration is taking on a positive slope.

The result is crowding at the 364-day maturity, and here we find the spread over inflation, which is 232bps over May’s print of 11.40% y/y, somewhat low in relation to our expectation of a 250 – 300bps spread over inflation. Investors are becoming more risk-averse and in time this could mean higher rates across the curve, in our view.

Oil

The price of Brent decreased by 2.02% last week to US$62.01/bbl. The average price, year-to-date, is US$66.36/bbl, 7.43% lower than the average of US$71.69/bbl in 2018, but 21.22% higher than the US$54.75/bbl average seen in 2017.

Last week, the organization of the petroleum exporting countries (OPEC) released its monthly oil market report for June which showed a downward revision to its global oil demand forecast for 2019 to 1.14 million barrels per day (mbpd) – 70,000bpd lower than its previous forecast, citing signs of an economic slowdown due to international trade disputes. The strain in trade ties was worsened last week by India’s increase of tariffs on 28 US products.

Equities

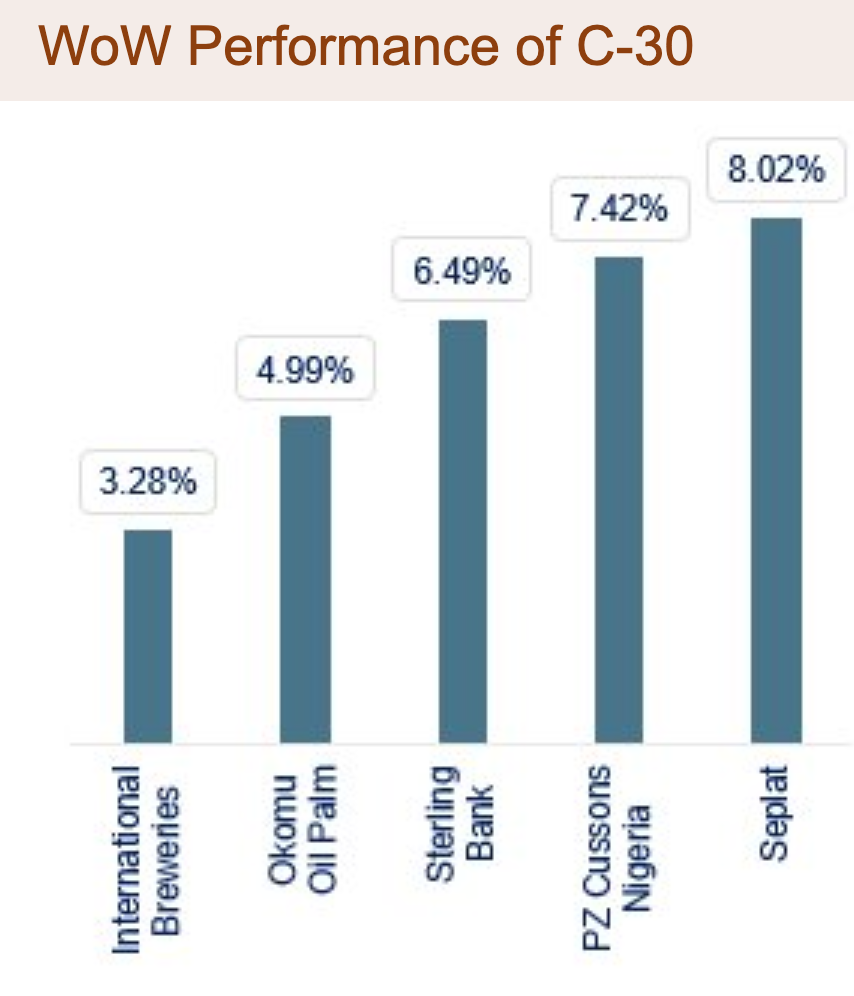

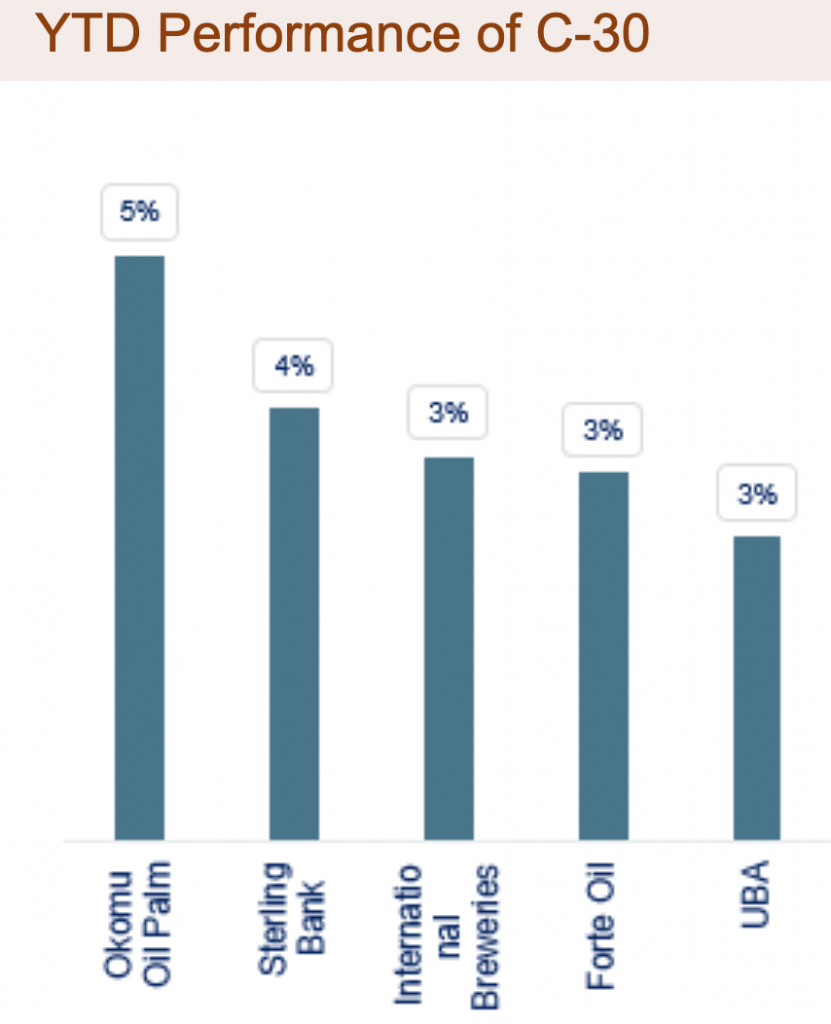

The Nigerian Stock Exchange (NSE) All-Share Index recorded a loss of 0.36% last week, resulting in a year-to-date return of negative 3.53%. Last week Forte oil (+14.2%), GT Bank (+2.0%) and Access Bank (+1.6%) closed positive while CCNN (-10.0%), Dangote sugar (-7.8%) and International breweries (-7.3%) fell.

Naira staying strong

At the beginning of this year we wrote that the Naira/US dollar exchange rate would hold at close to N365.00/US$1 for the entire year. In fact, so far, it has slightly appreciated. The Naira’s value in the most widely-traded market, the Nigerian Autonomous Foreign Exchange (NAFEX) market, has risen 1.11% year-to-date. It has maintained an average rate of N360.99/US$ during the second quarter of the year so far, with a daily average deviation of less than a kobo.

Clearly, this has had a lot to do with the volume of foreign portfolio investment (FPI). Gross FPI has more than doubled with US$11.06bn coming into the Nigerian market year-to-date compared with US$3.67bn in the last six months of 2018.

This has taken the pressure off the CBN when it comes to supporting the NAFEX market (also called the I&E window). There has been a 92.5% decline in the CBN’s participation in the NAFEX market year-to-date – US$0.54m compared with US$7.54bn during the last six months of 2018. The CBN’s gross foreign exchange reserves were reported last week at US$45.2bn, a US$2.08bn increase since the beginning of the year.

Less appetite for duration

As a result, one-year government treasuries now trade at 232bps above May’s inflation print of 11.40% y/y. However, as we note on page 1, the rotation from long-dated to short-dated risk-free Naira paper likely signifies a de-risking of Naira fixed-income security portfolios by taking off long-duration investments. Although this pushes short-term yields down in the short term it may signify that, if oil prices continue to trend down, rates overall need to rise again.